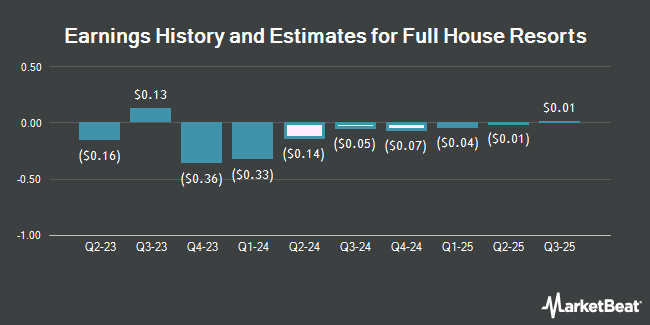

Full House Resorts, Inc. (NASDAQ:FLL - Free Report) - Stock analysts at B. Riley cut their FY2024 earnings per share estimates for Full House Resorts in a report released on Thursday, November 7th. B. Riley analyst D. Bain now forecasts that the company will earn ($1.07) per share for the year, down from their previous estimate of ($0.74). B. Riley currently has a "Buy" rating and a $8.00 target price on the stock. The consensus estimate for Full House Resorts' current full-year earnings is ($1.07) per share. B. Riley also issued estimates for Full House Resorts' Q4 2024 earnings at ($0.19) EPS, Q1 2025 earnings at ($0.12) EPS, Q2 2025 earnings at ($0.06) EPS, Q3 2025 earnings at ($0.03) EPS, Q4 2025 earnings at ($0.08) EPS and FY2025 earnings at ($0.30) EPS.

Other equities analysts have also issued reports about the company. Craig Hallum raised Full House Resorts to a "strong-buy" rating in a report on Wednesday, September 4th. JMP Securities decreased their price objective on Full House Resorts from $7.00 to $6.00 and set a "market outperform" rating for the company in a report on Thursday. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating, two have given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $6.67.

Check Out Our Latest Report on Full House Resorts

Full House Resorts Price Performance

Shares of NASDAQ:FLL remained flat at $5.02 during trading on Monday. The stock had a trading volume of 120,760 shares, compared to its average volume of 95,092. Full House Resorts has a 52 week low of $4.40 and a 52 week high of $5.98. The company has a market capitalization of $178.71 million, a PE ratio of -4.25 and a beta of 1.99. The stock has a 50 day simple moving average of $5.00 and a two-hundred day simple moving average of $5.05. The company has a quick ratio of 0.78, a current ratio of 0.81 and a debt-to-equity ratio of 7.88.

Institutional Trading of Full House Resorts

Hedge funds have recently modified their holdings of the business. Gabelli Funds LLC increased its position in Full House Resorts by 0.3% during the second quarter. Gabelli Funds LLC now owns 600,000 shares of the company's stock worth $3,000,000 after buying an additional 2,000 shares during the last quarter. Rhumbline Advisers increased its position in Full House Resorts by 14.6% during the second quarter. Rhumbline Advisers now owns 59,333 shares of the company's stock worth $297,000 after buying an additional 7,551 shares during the last quarter. B. Riley Wealth Advisors Inc. acquired a new position in Full House Resorts during the second quarter worth $50,000. KG&L Capital Management LLC acquired a new position in Full House Resorts during the third quarter worth $50,000. Finally, Price T Rowe Associates Inc. MD acquired a new position in Full House Resorts during the first quarter worth $57,000. Hedge funds and other institutional investors own 37.68% of the company's stock.

Insider Buying and Selling at Full House Resorts

In other Full House Resorts news, CEO Daniel R. Lee sold 35,000 shares of the stock in a transaction on Tuesday, August 13th. The stock was sold at an average price of $5.02, for a total transaction of $175,700.00. Following the completion of the transaction, the chief executive officer now directly owns 1,116,249 shares of the company's stock, valued at approximately $5,603,569.98. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In other news, CEO Daniel R. Lee sold 35,000 shares of the stock in a transaction on Tuesday, August 13th. The stock was sold at an average price of $5.02, for a total transaction of $175,700.00. Following the completion of the sale, the chief executive officer now owns 1,116,249 shares in the company, valued at approximately $5,603,569.98. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Daniel R. Lee sold 13,188 shares of the stock in a transaction on Wednesday, October 16th. The shares were sold at an average price of $4.99, for a total value of $65,808.12. Following the sale, the chief executive officer now owns 1,588,880 shares of the company's stock, valued at $7,928,511.20. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 185,041 shares of company stock valued at $924,473. 12.70% of the stock is owned by corporate insiders.

About Full House Resorts

(

Get Free Report)

Full House Resorts, Inc owns, leases, operates, develops, manages, and invests in casinos, and related hospitality and entertainment facilities in the United States. It operates through Midwest & South, West, and Contracted Sports Wagering segments. The company's properties include American Place in Waukegan, Illinois; Silver Slipper Casino and Hotel in Hancock County, Mississippi; Rising Star Casino Resort in Rising Sun, Indiana; Bronco Billy's Casino and Chamonix Casino Hotel in Cripple Creek, Colorado; Stockman's Casino in Fallon, Nevada; and Grand Lodge Casino, located within the Hyatt Regency Lake Tahoe Resort, Spa and Casino in Incline Village, Nevada.

Recommended Stories

Before you consider Full House Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Full House Resorts wasn't on the list.

While Full House Resorts currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.