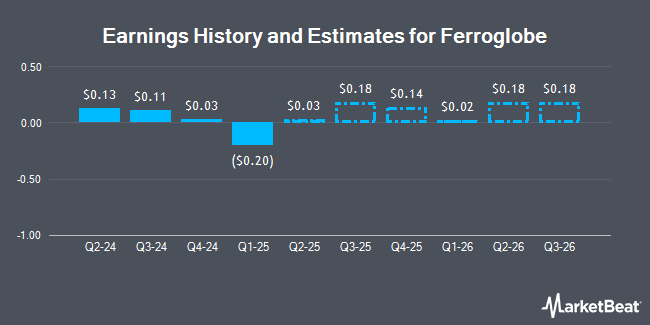

Ferroglobe PLC (NASDAQ:GSM - Free Report) - Equities researchers at B. Riley decreased their Q4 2024 earnings estimates for Ferroglobe in a research report issued to clients and investors on Friday, November 8th. B. Riley analyst L. Pipes now forecasts that the basic materials company will earn ($0.01) per share for the quarter, down from their previous forecast of $0.02. The consensus estimate for Ferroglobe's current full-year earnings is $0.28 per share. B. Riley also issued estimates for Ferroglobe's Q1 2025 earnings at ($0.01) EPS, FY2025 earnings at $0.50 EPS and FY2026 earnings at $0.62 EPS.

Ferroglobe (NASDAQ:GSM - Get Free Report) last released its earnings results on Wednesday, November 6th. The basic materials company reported $0.11 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.16 by ($0.05). Ferroglobe had a net margin of 2.74% and a return on equity of 7.55%. The company had revenue of $433.53 million for the quarter, compared to analyst estimates of $443.50 million. During the same quarter in the previous year, the firm earned $0.27 EPS.

Separately, StockNews.com raised shares of Ferroglobe from a "hold" rating to a "buy" rating in a research report on Wednesday, August 7th.

Get Our Latest Research Report on Ferroglobe

Ferroglobe Stock Down 0.2 %

Shares of NASDAQ GSM traded down $0.01 during midday trading on Monday, hitting $4.17. 1,198,163 shares of the stock traded hands, compared to its average volume of 1,363,039. The company has a debt-to-equity ratio of 0.02, a quick ratio of 0.91 and a current ratio of 1.83. Ferroglobe has a one year low of $4.07 and a one year high of $6.78. The business has a 50 day moving average price of $4.36 and a two-hundred day moving average price of $5.00. The company has a market cap of $781.58 million, a PE ratio of 17.08 and a beta of 1.88.

Ferroglobe Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, December 27th. Investors of record on Friday, December 20th will be issued a $0.013 dividend. This represents a $0.05 dividend on an annualized basis and a dividend yield of 1.25%. The ex-dividend date is Friday, December 20th. Ferroglobe's dividend payout ratio (DPR) is currently 20.83%.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently modified their holdings of the stock. Covestor Ltd increased its holdings in Ferroglobe by 266.1% in the 1st quarter. Covestor Ltd now owns 5,316 shares of the basic materials company's stock worth $26,000 after acquiring an additional 3,864 shares during the last quarter. Virtu Financial LLC bought a new stake in shares of Ferroglobe in the first quarter valued at approximately $53,000. Legacy Capital Group California Inc. purchased a new stake in shares of Ferroglobe during the 2nd quarter valued at approximately $60,000. Hood River Capital Management LLC bought a new position in Ferroglobe in the 1st quarter worth approximately $73,000. Finally, Banco Santander S.A. bought a new stake in Ferroglobe during the 2nd quarter valued at $80,000. 89.64% of the stock is owned by institutional investors.

Ferroglobe Company Profile

(

Get Free Report)

Ferroglobe PLC produces and sells silicon metal, and silicon and manganese-based ferroalloys in the United States, Europe, and internationally. It provides silicone chemicals that are used in a range of applications, including personal care items, construction-related products, health care products, and electronics; and silicon metal for primary and secondary aluminum producers.

Read More

Before you consider Ferroglobe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ferroglobe wasn't on the list.

While Ferroglobe currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.