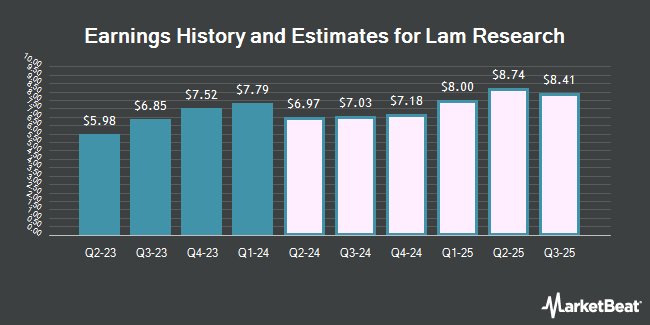

Lam Research Co. (NASDAQ:LRCX - Free Report) - B. Riley upped their Q3 2025 earnings per share estimates for shares of Lam Research in a research note issued to investors on Thursday, January 30th. B. Riley analyst C. Ellis now expects that the semiconductor company will earn $0.98 per share for the quarter, up from their prior estimate of $0.85. B. Riley has a "Buy" rating and a $105.00 price target on the stock. The consensus estimate for Lam Research's current full-year earnings is $3.51 per share. B. Riley also issued estimates for Lam Research's Q2 2026 earnings at $0.80 EPS, Q3 2026 earnings at $0.80 EPS, Q4 2026 earnings at $0.87 EPS and FY2026 earnings at $3.30 EPS.

Lam Research (NASDAQ:LRCX - Get Free Report) last announced its earnings results on Wednesday, January 29th. The semiconductor company reported $0.91 EPS for the quarter, beating analysts' consensus estimates of $0.87 by $0.04. Lam Research had a return on equity of 52.58% and a net margin of 26.49%.

Other analysts have also recently issued reports about the company. Barclays cut their price target on Lam Research from $90.00 to $75.00 and set an "equal weight" rating on the stock in a research note on Friday, January 17th. Mizuho cut their target price on Lam Research from $95.00 to $90.00 and set an "outperform" rating on the stock in a research report on Friday, January 10th. Sanford C. Bernstein upgraded Lam Research from a "market perform" rating to an "outperform" rating and lifted their target price for the stock from $85.00 to $91.00 in a research report on Thursday. Wolfe Research cut Lam Research from an "outperform" rating to a "peer perform" rating in a research report on Wednesday, January 15th. Finally, The Goldman Sachs Group cut their target price on Lam Research from $96.00 to $85.00 and set a "buy" rating on the stock in a research report on Friday, January 10th. Seven analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $95.72.

View Our Latest Report on LRCX

Lam Research Trading Up 0.4 %

Shares of Lam Research stock opened at $81.05 on Monday. Lam Research has a fifty-two week low of $68.87 and a fifty-two week high of $113.00. The stock has a 50 day moving average of $76.05 and a 200 day moving average of $78.76. The firm has a market capitalization of $104.29 billion, a price-to-earnings ratio of 24.62, a PEG ratio of 1.38 and a beta of 1.45. The company has a debt-to-equity ratio of 0.53, a quick ratio of 1.74 and a current ratio of 2.53.

Institutional Investors Weigh In On Lam Research

Institutional investors and hedge funds have recently bought and sold shares of the stock. Migdal Insurance & Financial Holdings Ltd. raised its position in shares of Lam Research by 2,400.0% in the 3rd quarter. Migdal Insurance & Financial Holdings Ltd. now owns 200 shares of the semiconductor company's stock worth $163,000 after buying an additional 192 shares during the period. Sunflower Bank N.A. acquired a new position in Lam Research in the third quarter worth approximately $202,000. Insight Wealth Partners LLC purchased a new position in Lam Research during the 3rd quarter worth approximately $202,000. B&L Asset Management LLC purchased a new position in Lam Research during the 3rd quarter worth approximately $204,000. Finally, CWC Advisors LLC. acquired a new stake in shares of Lam Research during the 3rd quarter valued at $220,000. Hedge funds and other institutional investors own 84.61% of the company's stock.

Lam Research Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, January 8th. Investors of record on Wednesday, December 11th were issued a $0.23 dividend. This represents a $0.92 dividend on an annualized basis and a dividend yield of 1.14%. The ex-dividend date of this dividend was Wednesday, December 11th. Lam Research's dividend payout ratio is currently 27.95%.

About Lam Research

(

Get Free Report)

Lam Research Corporation designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits. The company offers ALTUS systems to deposit conformal films for tungsten metallization applications; SABRE electrochemical deposition products for copper interconnect transition that offers copper damascene manufacturing; SOLA ultraviolet thermal processing products for film treatments; and VECTOR plasma-enhanced CVD ALD products.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lam Research, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lam Research wasn't on the list.

While Lam Research currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.