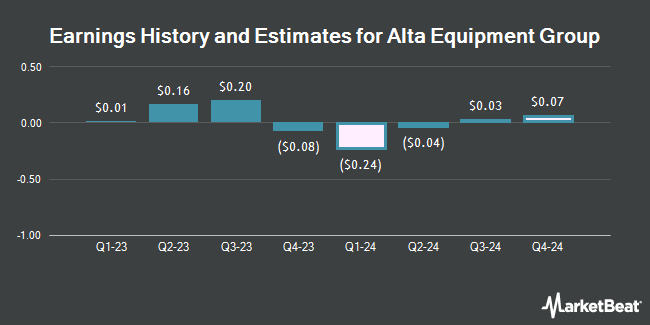

Alta Equipment Group Inc. (NYSE:ALTG - Free Report) - Research analysts at B. Riley reduced their FY2024 EPS estimates for Alta Equipment Group in a research note issued to investors on Thursday, November 14th. B. Riley analyst A. Rygiel now forecasts that the company will earn ($1.99) per share for the year, down from their previous estimate of ($0.98). The consensus estimate for Alta Equipment Group's current full-year earnings is ($1.71) per share. B. Riley also issued estimates for Alta Equipment Group's Q4 2024 earnings at ($0.38) EPS and FY2025 earnings at ($0.52) EPS.

A number of other research analysts also recently commented on ALTG. Northland Capmk downgraded Alta Equipment Group from a "strong-buy" rating to a "hold" rating in a report on Wednesday, November 13th. Raymond James cut their target price on Alta Equipment Group from $10.00 to $9.00 and set a "market perform" rating on the stock in a research report on Thursday. Northland Securities reissued a "market perform" rating and set a $20.00 price target (down previously from $30.00) on shares of Alta Equipment Group in a research report on Wednesday, November 13th. Finally, DA Davidson cut their price target on shares of Alta Equipment Group from $20.00 to $12.00 and set a "buy" rating on the stock in a report on Tuesday, August 13th. Three research analysts have rated the stock with a hold rating and two have issued a buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $15.75.

View Our Latest Stock Report on ALTG

Alta Equipment Group Stock Down 1.4 %

NYSE:ALTG traded down $0.10 on Monday, reaching $6.89. The stock had a trading volume of 401,907 shares, compared to its average volume of 361,924. Alta Equipment Group has a 12-month low of $5.40 and a 12-month high of $13.67. The stock has a market cap of $228.01 million, a P/E ratio of -4.05 and a beta of 1.67. The company has a current ratio of 1.35, a quick ratio of 0.47 and a debt-to-equity ratio of 7.45. The company has a 50-day moving average of $6.56 and a 200 day moving average of $7.77.

Institutional Trading of Alta Equipment Group

Hedge funds have recently added to or reduced their stakes in the business. SG Americas Securities LLC acquired a new stake in Alta Equipment Group in the third quarter worth about $77,000. Quest Partners LLC acquired a new stake in Alta Equipment Group in the second quarter worth approximately $80,000. The Manufacturers Life Insurance Company bought a new position in Alta Equipment Group during the 2nd quarter valued at $89,000. Zurcher Kantonalbank Zurich Cantonalbank increased its position in shares of Alta Equipment Group by 37.5% during the 2nd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 11,795 shares of the company's stock valued at $95,000 after purchasing an additional 3,218 shares during the period. Finally, EntryPoint Capital LLC lifted its holdings in shares of Alta Equipment Group by 88.0% in the first quarter. EntryPoint Capital LLC now owns 8,419 shares of the company's stock valued at $109,000 after buying an additional 3,940 shares during the period. Institutional investors own 73.58% of the company's stock.

Insider Buying and Selling

In other Alta Equipment Group news, major shareholder Voss Capital, Lp sold 11,311 shares of the firm's stock in a transaction that occurred on Wednesday, October 2nd. The shares were sold at an average price of $6.31, for a total value of $71,372.41. Following the sale, the insider now owns 963,689 shares in the company, valued at approximately $6,080,877.59. This trade represents a 1.16 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 19.90% of the stock is owned by company insiders.

Alta Equipment Group Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, November 29th. Investors of record on Friday, November 15th will be issued a $0.057 dividend. This represents a $0.23 annualized dividend and a dividend yield of 3.31%. The ex-dividend date of this dividend is Friday, November 15th. Alta Equipment Group's dividend payout ratio (DPR) is -12.94%.

Alta Equipment Group Company Profile

(

Get Free Report)

Alta Equipment Group Inc owns and operates integrated equipment dealership platforms in the United States. It operates through three segments: Material Handling, Construction Equipment, and Master Distribution. The company operates a branch network that sells, rents, and provides parts and service support for various categories of specialized equipment, including lift trucks and other material handling equipment, heavy and compact earthmoving equipment, crushing and screening equipment, environmental processing equipment, cranes and aerial work platforms, paving and asphalt equipment, and other construction equipment and related products.

Further Reading

Before you consider Alta Equipment Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alta Equipment Group wasn't on the list.

While Alta Equipment Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.