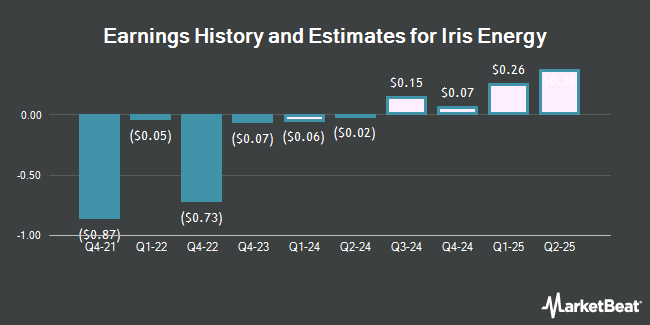

Iris Energy Limited (NASDAQ:IREN - Free Report) - B. Riley lifted their Q3 2025 earnings per share (EPS) estimates for shares of Iris Energy in a research note issued to investors on Wednesday, December 18th. B. Riley analyst L. Pipes now forecasts that the company will post earnings per share of $0.09 for the quarter, up from their previous forecast of $0.07. B. Riley currently has a "Buy" rating and a $16.00 target price on the stock. The consensus estimate for Iris Energy's current full-year earnings is $0.01 per share.

Several other research analysts also recently weighed in on the stock. BTIG Research started coverage on shares of Iris Energy in a research report on Friday. They issued a "buy" rating and a $33.00 target price on the stock. Compass Point lowered their price objective on shares of Iris Energy from $18.50 to $16.00 and set a "buy" rating on the stock in a research report on Friday, August 30th. Roth Capital raised shares of Iris Energy to a "strong-buy" rating in a research note on Tuesday, October 1st. Macquarie raised their target price on Iris Energy from $13.50 to $19.00 and gave the stock an "outperform" rating in a research report on Wednesday, December 4th. Finally, Roth Mkm initiated coverage on Iris Energy in a research report on Wednesday, October 2nd. They set a "buy" rating and a $14.00 price target on the stock. Two research analysts have rated the stock with a hold rating, nine have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $19.50.

Get Our Latest Stock Analysis on Iris Energy

Iris Energy Trading Up 3.5 %

IREN traded up $0.40 during trading on Friday, reaching $11.81. The company had a trading volume of 14,204,444 shares, compared to its average volume of 13,826,229. Iris Energy has a 12-month low of $3.56 and a 12-month high of $15.92. The firm's 50-day simple moving average is $11.09 and its 200 day simple moving average is $10.20.

Hedge Funds Weigh In On Iris Energy

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. D1 Capital Partners L.P. acquired a new position in shares of Iris Energy during the 2nd quarter worth $17,319,000. Hood River Capital Management LLC bought a new stake in Iris Energy in the second quarter worth $13,618,000. Marshall Wace LLP increased its position in Iris Energy by 33.6% during the second quarter. Marshall Wace LLP now owns 3,811,780 shares of the company's stock worth $43,035,000 after buying an additional 958,494 shares during the last quarter. Bank of Montreal Can bought a new position in Iris Energy during the second quarter valued at about $9,969,000. Finally, Van ECK Associates Corp lifted its position in shares of Iris Energy by 56.1% in the third quarter. Van ECK Associates Corp now owns 1,605,671 shares of the company's stock worth $13,938,000 after buying an additional 576,726 shares during the last quarter. Institutional investors own 41.08% of the company's stock.

Iris Energy Company Profile

(

Get Free Report)

Iris Energy Limited owns and operates bitcoin mining data centers. The company was incorporated in 2018 and is headquartered in Sydney, Australia.

Read More

Before you consider Iris Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iris Energy wasn't on the list.

While Iris Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.