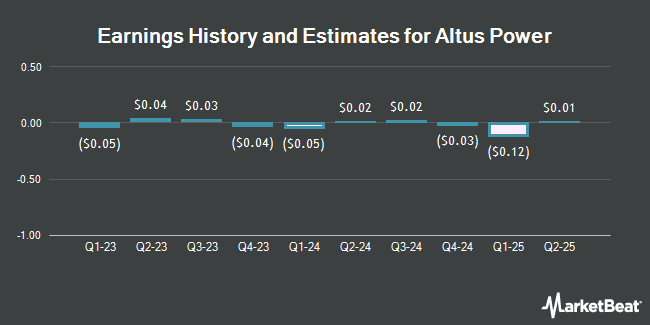

Altus Power, Inc. (NYSE:AMPS - Free Report) - Research analysts at B. Riley upped their FY2024 earnings estimates for shares of Altus Power in a report issued on Wednesday, November 13th. B. Riley analyst R. Pfingst now anticipates that the company will post earnings per share of $0.14 for the year, up from their prior forecast of $0.08. The consensus estimate for Altus Power's current full-year earnings is $0.14 per share. B. Riley also issued estimates for Altus Power's FY2025 earnings at ($0.13) EPS and FY2026 earnings at ($0.15) EPS.

AMPS has been the subject of several other research reports. UBS Group lowered their target price on shares of Altus Power from $5.50 to $5.00 and set a "buy" rating for the company in a research note on Friday, August 9th. Morgan Stanley downgraded shares of Altus Power from an "overweight" rating to an "equal weight" rating and dropped their target price for the company from $8.00 to $4.00 in a report on Wednesday, August 21st. Maxim Group decreased their price target on Altus Power from $5.50 to $4.50 and set a "buy" rating on the stock in a research note on Monday, August 12th. Citigroup dropped their price objective on Altus Power from $7.00 to $5.50 and set a "buy" rating for the company in a research note on Tuesday, October 22nd. Finally, Roth Mkm reissued a "buy" rating and set a $4.50 target price on shares of Altus Power in a research note on Wednesday, October 16th. Two analysts have rated the stock with a hold rating, six have assigned a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Buy" and an average target price of $5.81.

Check Out Our Latest Analysis on Altus Power

Altus Power Trading Down 0.4 %

Shares of NYSE AMPS traded down $0.02 during mid-day trading on Monday, reaching $3.84. 688,365 shares of the company's stock were exchanged, compared to its average volume of 1,087,813. The company's 50-day moving average is $3.36 and its 200-day moving average is $3.70. The company has a debt-to-equity ratio of 2.10, a quick ratio of 0.91 and a current ratio of 0.60. The firm has a market capitalization of $616.63 million, a price-to-earnings ratio of 17.43 and a beta of 0.94. Altus Power has a 52-week low of $2.71 and a 52-week high of $7.28.

Institutional Trading of Altus Power

Large investors have recently made changes to their positions in the company. Healthcare of Ontario Pension Plan Trust Fund increased its position in Altus Power by 15.2% in the 1st quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 259,441 shares of the company's stock valued at $1,240,000 after acquiring an additional 34,244 shares during the period. Price T Rowe Associates Inc. MD raised its stake in shares of Altus Power by 7.6% during the first quarter. Price T Rowe Associates Inc. MD now owns 44,257 shares of the company's stock worth $212,000 after purchasing an additional 3,116 shares during the last quarter. Janus Henderson Group PLC lifted its holdings in shares of Altus Power by 196.6% during the first quarter. Janus Henderson Group PLC now owns 68,309 shares of the company's stock worth $326,000 after purchasing an additional 45,276 shares during the period. Jacobs Levy Equity Management Inc. purchased a new position in Altus Power in the 1st quarter valued at $88,000. Finally, Levin Capital Strategies L.P. acquired a new position in Altus Power in the 1st quarter valued at $143,000. 46.55% of the stock is owned by institutional investors and hedge funds.

Altus Power Company Profile

(

Get Free Report)

Altus Power, Inc, a clean electrification company, develops, owns, constructs, and operates roof, ground, and carport-based photovoltaic solar energy generation and storage systems. It serves commercial, industrial, public sector, and community solar customers. Altus Power, Inc was founded in 2013 and is headquartered in Stamford, Connecticut.

Further Reading

Before you consider Altus Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altus Power wasn't on the list.

While Altus Power currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.