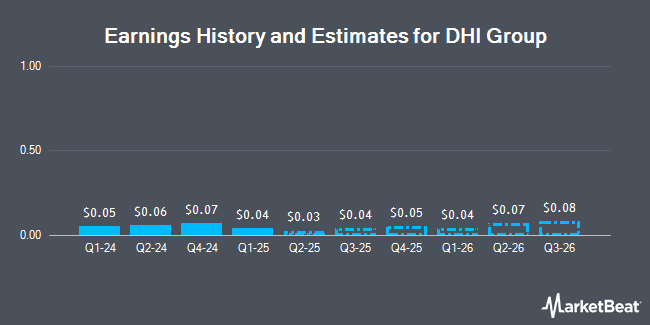

DHI Group, Inc. (NYSE:DHX - Free Report) - Analysts at B. Riley raised their FY2024 earnings per share (EPS) estimates for DHI Group in a report issued on Tuesday, November 12th. B. Riley analyst Z. Cummins now expects that the technology company will post earnings of $0.16 per share for the year, up from their previous estimate of $0.13. B. Riley has a "Buy" rating and a $3.50 price target on the stock. The consensus estimate for DHI Group's current full-year earnings is $0.19 per share. B. Riley also issued estimates for DHI Group's Q4 2024 earnings at $0.00 EPS.

Other analysts have also issued reports about the company. StockNews.com lowered DHI Group from a "strong-buy" rating to a "buy" rating in a report on Friday, August 16th. Barrington Research reaffirmed an "outperform" rating and set a $7.00 price target on shares of DHI Group in a research note on Monday.

Get Our Latest Research Report on DHI Group

DHI Group Stock Up 1.2 %

Shares of NYSE:DHX traded up $0.02 during trading on Thursday, reaching $1.65. 155,450 shares of the company traded hands, compared to its average volume of 212,881. The firm has a fifty day simple moving average of $1.73 and a 200 day simple moving average of $1.99. The company has a quick ratio of 0.45, a current ratio of 0.45 and a debt-to-equity ratio of 0.32. DHI Group has a 1-year low of $1.45 and a 1-year high of $2.98. The firm has a market cap of $79.86 million, a P/E ratio of 40.26 and a beta of 1.04.

DHI Group (NYSE:DHX - Get Free Report) last posted its quarterly earnings results on Tuesday, November 12th. The technology company reported $0.05 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.04 by $0.01. DHI Group had a net margin of 0.95% and a return on equity of 7.93%. The business had revenue of $35.28 million during the quarter, compared to analyst estimates of $35.24 million.

Institutional Inflows and Outflows

Several institutional investors have recently bought and sold shares of the company. Pacific Ridge Capital Partners LLC increased its position in DHI Group by 50.9% in the 2nd quarter. Pacific Ridge Capital Partners LLC now owns 2,495,095 shares of the technology company's stock worth $5,215,000 after buying an additional 841,350 shares during the period. Tieton Capital Management LLC increased its position in DHI Group by 25.1% during the second quarter. Tieton Capital Management LLC now owns 2,441,485 shares of the technology company's stock worth $5,103,000 after acquiring an additional 490,035 shares during the period. First Eagle Investment Management LLC increased its position in DHI Group by 72.2% during the second quarter. First Eagle Investment Management LLC now owns 668,928 shares of the technology company's stock worth $1,398,000 after acquiring an additional 280,479 shares during the period. CWC Advisors LLC. acquired a new position in DHI Group during the 3rd quarter valued at $327,000. Finally, Royce & Associates LP boosted its holdings in DHI Group by 5.5% in the 3rd quarter. Royce & Associates LP now owns 3,359,148 shares of the technology company's stock valued at $6,181,000 after purchasing an additional 174,010 shares during the period. Institutional investors own 69.26% of the company's stock.

About DHI Group

(

Get Free Report)

DHI Group, Inc provides data, insights, and employment connections through specialized services for technology professionals and other select online communities in the United States. Its solutions include talent profiles; job postings; employer branding; and other services comprising virtual and live career events, sourcing services, and content and data services that provides tailored content to help professionals manage their careers and provide employers insight into recruiting strategies and trends.

See Also

Before you consider DHI Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DHI Group wasn't on the list.

While DHI Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.