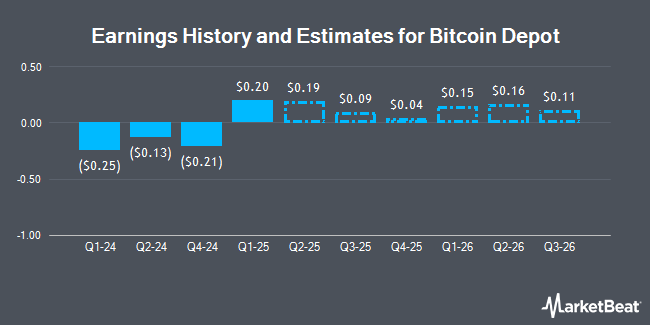

Bitcoin Depot Inc. (NASDAQ:BTM - Free Report) - Stock analysts at B. Riley dropped their Q3 2024 earnings per share (EPS) estimates for Bitcoin Depot in a note issued to investors on Monday, November 11th. B. Riley analyst H. Goetsch now forecasts that the company will post earnings of ($0.01) per share for the quarter, down from their prior forecast of $0.01. The consensus estimate for Bitcoin Depot's current full-year earnings is ($0.09) per share.

A number of other analysts have also commented on BTM. HC Wainwright cut their price target on Bitcoin Depot from $4.00 to $3.50 and set a "buy" rating on the stock in a research note on Thursday, August 15th. Noble Financial upgraded shares of Bitcoin Depot to a "strong-buy" rating in a research report on Thursday, October 17th.

Get Our Latest Stock Report on Bitcoin Depot

Bitcoin Depot Price Performance

Shares of NASDAQ BTM traded down $0.03 during mid-day trading on Wednesday, hitting $2.48. 9,943,876 shares of the stock traded hands, compared to its average volume of 386,469. Bitcoin Depot has a twelve month low of $1.33 and a twelve month high of $3.70. The company has a current ratio of 1.16, a quick ratio of 1.16 and a debt-to-equity ratio of 9.33. The firm has a 50 day simple moving average of $1.58 and a two-hundred day simple moving average of $1.71.

Bitcoin Depot (NASDAQ:BTM - Get Free Report) last posted its earnings results on Thursday, August 15th. The company reported ($0.13) EPS for the quarter, missing analysts' consensus estimates of $0.03 by ($0.16). The company had revenue of $163.07 million during the quarter, compared to the consensus estimate of $148.49 million. Bitcoin Depot had a negative return on equity of 307.37% and a negative net margin of 3.10%.

Institutional Trading of Bitcoin Depot

A hedge fund recently raised its stake in Bitcoin Depot stock. Renaissance Technologies LLC grew its holdings in shares of Bitcoin Depot Inc. (NASDAQ:BTM - Free Report) by 122.1% in the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 47,300 shares of the company's stock after purchasing an additional 26,000 shares during the quarter. Renaissance Technologies LLC owned approximately 0.08% of Bitcoin Depot worth $85,000 at the end of the most recent reporting period. Institutional investors and hedge funds own 9.18% of the company's stock.

Insiders Place Their Bets

In other news, COO Christopher Scott Buchanan sold 20,000 shares of the business's stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $1.56, for a total transaction of $31,200.00. Following the completion of the sale, the chief operating officer now directly owns 241,276 shares of the company's stock, valued at $376,390.56. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Over the last 90 days, insiders have sold 50,100 shares of company stock worth $77,051. Insiders own 70.23% of the company's stock.

Bitcoin Depot Company Profile

(

Get Free Report)

Bitcoin Depot Inc owns and operates a network of cryptocurrency kiosks in North America. Its customers can buy and sell bitcoin, litecoin, and ethereum cryptocurrencies using the BTM kiosk network and other services. The company also engages in the sale of cryptocurrency to consumers at a network of retail locations through its BDCheckout product offering, as well as its website through over-the-counter trade.

Featured Articles

Before you consider Bitcoin Depot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bitcoin Depot wasn't on the list.

While Bitcoin Depot currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.