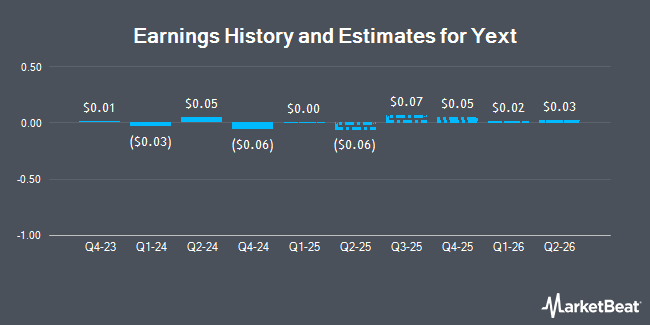

Yext, Inc. (NYSE:YEXT - Free Report) - Equities researchers at B. Riley cut their FY2025 earnings estimates for Yext in a research note issued to investors on Tuesday, December 10th. B. Riley analyst N. Khan now expects that the company will earn ($0.11) per share for the year, down from their previous estimate of $0.10. The consensus estimate for Yext's current full-year earnings is $0.08 per share. B. Riley also issued estimates for Yext's Q4 2025 earnings at $0.05 EPS, Q1 2026 earnings at $0.06 EPS, Q2 2026 earnings at $0.05 EPS, Q3 2026 earnings at $0.06 EPS, Q4 2026 earnings at $0.06 EPS, FY2026 earnings at $0.23 EPS, FY2027 earnings at $0.29 EPS, FY2028 earnings at $0.36 EPS and FY2029 earnings at $0.41 EPS.

Several other brokerages have also issued reports on YEXT. Needham & Company LLC upped their target price on Yext from $8.00 to $10.00 and gave the stock a "buy" rating in a research note on Tuesday. DA Davidson upped their target price on Yext from $5.75 to $7.50 and gave the stock a "neutral" rating in a research note on Tuesday. Finally, Roth Mkm reaffirmed a "buy" rating and issued a $10.50 target price (up previously from $7.50) on shares of Yext in a research note on Tuesday.

Read Our Latest Stock Report on YEXT

Yext Stock Down 3.6 %

Shares of YEXT stock traded down $0.24 during trading on Friday, hitting $6.47. The company had a trading volume of 721,901 shares, compared to its average volume of 893,539. The stock's 50-day moving average is $7.53 and its two-hundred day moving average is $6.17. The stock has a market capitalization of $825.70 million, a price-to-earnings ratio of -44.70 and a beta of 1.20. Yext has a 52 week low of $4.29 and a 52 week high of $8.75.

Insider Activity

In other Yext news, Director Seth H. Waugh purchased 32,600 shares of the company's stock in a transaction that occurred on Thursday, September 19th. The stock was bought at an average price of $6.65 per share, with a total value of $216,790.00. Following the completion of the purchase, the director now directly owns 153,350 shares of the company's stock, valued at $1,019,777.50. The trade was a 27.00 % increase in their position. The purchase was disclosed in a filing with the SEC, which is available at this hyperlink. Insiders own 8.40% of the company's stock.

Institutional Trading of Yext

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the business. Wilmington Savings Fund Society FSB bought a new position in Yext in the third quarter worth $38,000. Canada Pension Plan Investment Board bought a new position in Yext in the second quarter worth $62,000. Quantinno Capital Management LP bought a new position in Yext in the third quarter worth $76,000. Dynamic Advisor Solutions LLC raised its holdings in Yext by 27.8% in the second quarter. Dynamic Advisor Solutions LLC now owns 15,545 shares of the company's stock worth $83,000 after purchasing an additional 3,385 shares in the last quarter. Finally, Balboa Wealth Partners bought a new position in Yext in the third quarter worth $114,000. Hedge funds and other institutional investors own 70.98% of the company's stock.

About Yext

(

Get Free Report)

Yext, Inc organizes business facts to provide answers to consumer questions in North America and internationally. It operates Yext platform, a cloud-based platform that allows its customers to offer answers to consumer questions, to control the facts about their businesses and the content of their landing pages, and to manage their consumer reviews; and provides customers to update their information and content through its publisher network of maps, apps, search engines, intelligent GPS systems, digital assistants, vertical directories, and social networks, as well as professional services.

Further Reading

Before you consider Yext, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yext wasn't on the list.

While Yext currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.