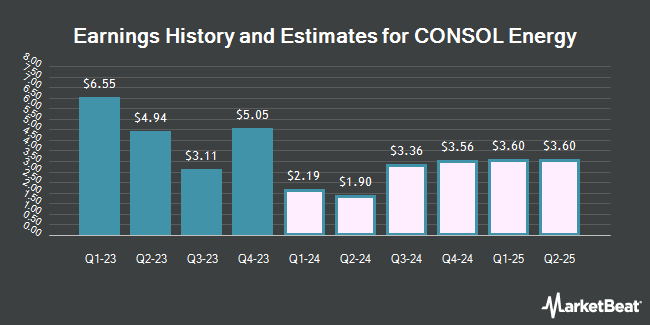

CONSOL Energy Inc. (NYSE:CEIX - Free Report) - Research analysts at B. Riley raised their FY2024 EPS estimates for CONSOL Energy in a report issued on Wednesday, November 6th. B. Riley analyst L. Pipes now forecasts that the company will post earnings of $11.57 per share for the year, up from their previous estimate of $11.50. B. Riley has a "Buy" rating and a $138.00 price target on the stock. The consensus estimate for CONSOL Energy's current full-year earnings is $11.50 per share. B. Riley also issued estimates for CONSOL Energy's Q4 2024 earnings at $3.00 EPS and FY2025 earnings at $15.99 EPS.

CONSOL Energy Trading Up 0.4 %

Shares of CONSOL Energy stock traded up $0.48 during trading on Friday, reaching $128.14. The company's stock had a trading volume of 517,723 shares, compared to its average volume of 485,025. The company has a quick ratio of 1.31, a current ratio of 1.55 and a debt-to-equity ratio of 0.13. The company has a market cap of $3.77 billion, a price-to-earnings ratio of 9.45 and a beta of 1.73. The firm's 50-day moving average is $103.86 and its two-hundred day moving average is $98.32. CONSOL Energy has a 52-week low of $75.43 and a 52-week high of $129.97.

CONSOL Energy (NYSE:CEIX - Get Free Report) last announced its earnings results on Tuesday, November 5th. The company reported $3.22 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.17 by $0.05. CONSOL Energy had a net margin of 18.28% and a return on equity of 30.50%. The company had revenue of $574.90 million for the quarter, compared to analyst estimates of $554.00 million. During the same period in the prior year, the business earned $3.11 earnings per share. CONSOL Energy's quarterly revenue was up .9% on a year-over-year basis.

CONSOL Energy Cuts Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, November 26th. Investors of record on Friday, November 15th will be given a dividend of $0.25 per share. The ex-dividend date is Friday, November 15th. This represents a $1.00 dividend on an annualized basis and a yield of 0.78%. CONSOL Energy's dividend payout ratio (DPR) is 1.85%.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of the company. Vanguard Group Inc. grew its holdings in CONSOL Energy by 5.1% during the 1st quarter. Vanguard Group Inc. now owns 2,562,110 shares of the company's stock worth $214,602,000 after acquiring an additional 125,087 shares during the period. American Century Companies Inc. boosted its holdings in shares of CONSOL Energy by 6.8% during the 2nd quarter. American Century Companies Inc. now owns 611,291 shares of the company's stock valued at $62,370,000 after purchasing an additional 38,669 shares during the last quarter. Samlyn Capital LLC purchased a new stake in shares of CONSOL Energy in the 2nd quarter worth $36,033,000. Hennessy Advisors Inc. raised its stake in shares of CONSOL Energy by 18.1% in the second quarter. Hennessy Advisors Inc. now owns 279,000 shares of the company's stock worth $28,466,000 after purchasing an additional 42,800 shares during the last quarter. Finally, Victory Capital Management Inc. increased its position in shares of CONSOL Energy by 578.7% during the third quarter. Victory Capital Management Inc. now owns 265,133 shares of the company's stock worth $27,746,000 after purchasing an additional 226,069 shares in the last quarter. 86.54% of the stock is currently owned by institutional investors and hedge funds.

CONSOL Energy Company Profile

(

Get Free Report)

CONSOL Energy Inc, together with its subsidiaries, produces and sells bituminous coal in the United States and internationally. It operates through two segments, Pennsylvania Mining Complex (PAMC) and CONSOL Marine Terminal. The company's PAMC segment engages in the mining, preparing, and marketing of bituminous coal to power generators, industrial end-users, and metallurgical end-users.

Featured Stories

Before you consider CONSOL Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CONSOL Energy wasn't on the list.

While CONSOL Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.