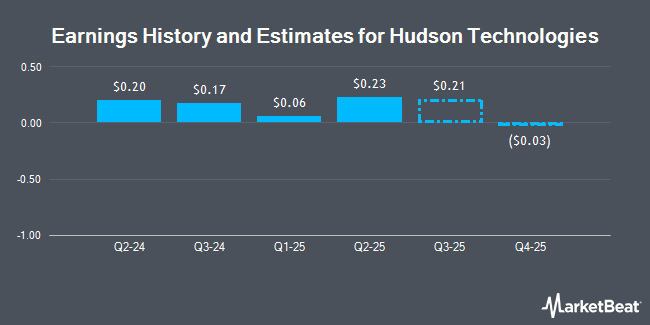

Hudson Technologies, Inc. (NASDAQ:HDSN - Free Report) - Equities research analysts at B. Riley cut their FY2024 EPS estimates for Hudson Technologies in a research report issued to clients and investors on Tuesday, November 5th. B. Riley analyst J. Nichols now forecasts that the industrial products company will post earnings of $0.57 per share for the year, down from their prior estimate of $0.59. B. Riley currently has a "Neutral" rating and a $7.25 target price on the stock. The consensus estimate for Hudson Technologies' current full-year earnings is $0.58 per share. B. Riley also issued estimates for Hudson Technologies' Q4 2024 earnings at $0.00 EPS.

Hudson Technologies (NASDAQ:HDSN - Get Free Report) last posted its quarterly earnings data on Monday, November 4th. The industrial products company reported $0.17 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.16 by $0.01. Hudson Technologies had a net margin of 14.00% and a return on equity of 16.65%. The firm had revenue of $61.94 million during the quarter, compared to the consensus estimate of $64.92 million. During the same quarter in the previous year, the firm posted $0.34 EPS.

Other analysts also recently issued reports about the company. Craig Hallum downgraded Hudson Technologies from a "buy" rating to a "hold" rating and cut their target price for the company from $10.00 to $7.00 in a research report on Tuesday. Roth Mkm downgraded Hudson Technologies from a "buy" rating to a "neutral" rating and dropped their price target for the company from $12.00 to $7.00 in a research note on Tuesday. Canaccord Genuity Group reduced their price objective on shares of Hudson Technologies from $8.75 to $8.00 and set a "hold" rating on the stock in a research note on Tuesday. Finally, Roth Capital cut shares of Hudson Technologies from a "strong-buy" rating to a "hold" rating in a research report on Tuesday. Six analysts have rated the stock with a hold rating, According to MarketBeat, Hudson Technologies has an average rating of "Hold" and an average price target of $7.85.

Read Our Latest Analysis on Hudson Technologies

Hudson Technologies Price Performance

NASDAQ:HDSN traded down $0.04 during trading hours on Wednesday, reaching $5.88. 1,788,245 shares of the company were exchanged, compared to its average volume of 476,545. The business has a 50 day moving average of $7.93 and a 200 day moving average of $8.58. Hudson Technologies has a 1-year low of $5.35 and a 1-year high of $15.24. The company has a market capitalization of $267.66 million, a P/E ratio of 7.69, a P/E/G ratio of 0.42 and a beta of 1.22.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of the business. Swedbank AB bought a new stake in shares of Hudson Technologies during the 1st quarter valued at approximately $1,652,000. Russell Investments Group Ltd. boosted its position in Hudson Technologies by 240,800.0% in the first quarter. Russell Investments Group Ltd. now owns 57,816 shares of the industrial products company's stock valued at $637,000 after buying an additional 57,792 shares in the last quarter. Sixth Street Partners Management Company L.P. grew its stake in shares of Hudson Technologies by 30.0% during the second quarter. Sixth Street Partners Management Company L.P. now owns 1,300,000 shares of the industrial products company's stock worth $11,427,000 after buying an additional 300,000 shares during the last quarter. Commonwealth Equity Services LLC bought a new stake in shares of Hudson Technologies during the second quarter worth $687,000. Finally, Dimensional Fund Advisors LP increased its holdings in shares of Hudson Technologies by 22.0% during the second quarter. Dimensional Fund Advisors LP now owns 2,019,067 shares of the industrial products company's stock worth $17,747,000 after buying an additional 364,117 shares in the last quarter. Institutional investors own 71.34% of the company's stock.

About Hudson Technologies

(

Get Free Report)

Hudson Technologies, Inc, through its subsidiary, Hudson Technologies Company, engages in the provision of solutions to recurring problems within the refrigeration industry in the United States. The company engages in the sale of refrigerant and industrial gas; provision of refrigerant management services consisting primarily of reclamation of refrigerants, re-usable cylinder refurbishment, and hydrostatic testing services; and RefrigerantSide services comprising system decontamination and recovery to remove moisture, oils, and other contaminants.

See Also

Before you consider Hudson Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudson Technologies wasn't on the list.

While Hudson Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.