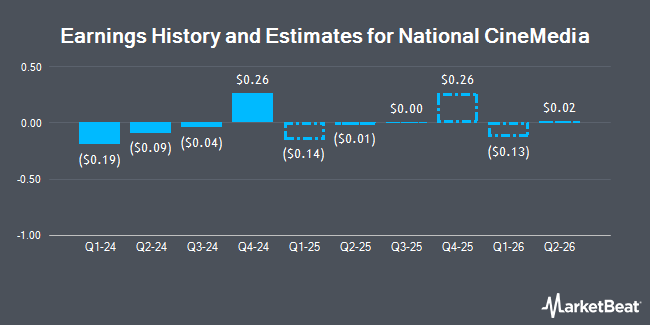

National CineMedia, Inc. (NASDAQ:NCMI - Free Report) - B. Riley decreased their Q4 2024 EPS estimates for National CineMedia in a report issued on Tuesday, November 5th. B. Riley analyst E. Wold now anticipates that the business services provider will post earnings per share of $0.14 for the quarter, down from their prior forecast of $0.19. B. Riley has a "Buy" rating and a $8.50 price objective on the stock. The consensus estimate for National CineMedia's current full-year earnings is ($0.05) per share. B. Riley also issued estimates for National CineMedia's Q2 2025 earnings at $0.05 EPS, Q4 2025 earnings at $0.28 EPS, FY2025 earnings at $0.21 EPS, Q1 2026 earnings at ($0.13) EPS, Q2 2026 earnings at $0.07 EPS, Q3 2026 earnings at $0.03 EPS and FY2026 earnings at $0.28 EPS.

A number of other research analysts have also recently weighed in on the stock. Wedbush reaffirmed a "neutral" rating and set a $7.50 price target (up from $6.00) on shares of National CineMedia in a research report on Monday. Benchmark reissued a "buy" rating and issued a $8.00 target price on shares of National CineMedia in a research note on Monday, September 23rd. Finally, Barrington Research upped their price target on shares of National CineMedia from $7.50 to $8.25 and gave the stock an "outperform" rating in a research report on Wednesday. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating and three have given a buy rating to the stock. According to MarketBeat, the stock has an average rating of "Hold" and an average target price of $8.06.

Check Out Our Latest Analysis on NCMI

National CineMedia Trading Up 1.1 %

Shares of NASDAQ NCMI traded up $0.08 during midday trading on Thursday, hitting $6.61. The stock had a trading volume of 589,870 shares, compared to its average volume of 612,489. The company has a quick ratio of 2.45, a current ratio of 2.45 and a debt-to-equity ratio of 0.03. National CineMedia has a 1-year low of $3.63 and a 1-year high of $7.39. The company has a market capitalization of $637.84 million, a price-to-earnings ratio of 2.44 and a beta of 2.07. The company has a fifty day moving average price of $6.88 and a 200 day moving average price of $5.78.

National CineMedia (NASDAQ:NCMI - Get Free Report) last issued its earnings results on Tuesday, November 5th. The business services provider reported ($0.04) earnings per share for the quarter, missing the consensus estimate of ($0.03) by ($0.01). The firm had revenue of $62.40 million during the quarter, compared to analysts' expectations of $58.20 million. National CineMedia had a return on equity of 3.50% and a net margin of 78.04%. During the same period last year, the business posted $0.33 earnings per share.

Institutional Trading of National CineMedia

Hedge funds and other institutional investors have recently bought and sold shares of the company. First Eagle Investment Management LLC increased its stake in National CineMedia by 37.6% during the first quarter. First Eagle Investment Management LLC now owns 1,966,355 shares of the business services provider's stock valued at $10,127,000 after purchasing an additional 537,822 shares during the last quarter. Harbor Capital Advisors Inc. boosted its holdings in shares of National CineMedia by 270.0% in the 2nd quarter. Harbor Capital Advisors Inc. now owns 208,649 shares of the business services provider's stock valued at $916,000 after buying an additional 152,251 shares during the period. Rhumbline Advisers bought a new stake in shares of National CineMedia during the 2nd quarter valued at about $427,000. Bank of New York Mellon Corp acquired a new stake in National CineMedia during the second quarter worth about $979,000. Finally, Oppenheimer Asset Management Inc. lifted its holdings in National CineMedia by 38.9% in the first quarter. Oppenheimer Asset Management Inc. now owns 23,897 shares of the business services provider's stock worth $123,000 after acquiring an additional 6,690 shares during the last quarter. 69.49% of the stock is owned by institutional investors.

National CineMedia Company Profile

(

Get Free Report)

National CineMedia, Inc, through its subsidiary, National CineMedia, LLC, operates cinema advertising network in North America. It engages in the sale of advertising to national, regional, and local businesses in Noovie, a cinema advertising and entertainment show seen on movie screens; and sells advertising on its Lobby Entertainment Network, a series of strategically-placed screens located in movie theater lobbies, as well as other forms of advertising and promotions in theatre lobbies.

Recommended Stories

Before you consider National CineMedia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National CineMedia wasn't on the list.

While National CineMedia currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.