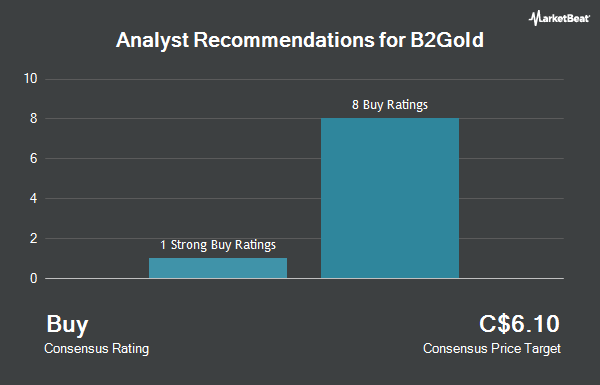

Shares of B2Gold Corp. (TSE:BTO - Get Free Report) NYSE: BTG have been given an average rating of "Moderate Buy" by the seven ratings firms that are presently covering the stock, Marketbeat reports. One research analyst has rated the stock with a sell rating, two have assigned a hold rating, three have given a buy rating and one has issued a strong buy rating on the company. The average 12-month price target among brokerages that have updated their coverage on the stock in the last year is C$5.93.

Several research analysts have issued reports on the company. Cormark upgraded B2Gold from a "hold" rating to a "moderate buy" rating in a research report on Tuesday. BMO Capital Markets decreased their price objective on shares of B2Gold from C$7.00 to C$6.50 in a report on Monday, March 31st. TD Securities lowered shares of B2Gold from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, February 4th. Bank of America downgraded shares of B2Gold from a "buy" rating to an "underperform" rating in a research report on Tuesday, January 14th. Finally, Stifel Nicolaus raised their price objective on B2Gold from C$6.50 to C$7.50 in a research note on Monday.

Read Our Latest Research Report on B2Gold

B2Gold Stock Performance

TSE BTO traded down C$0.03 during trading hours on Friday, hitting C$4.35. 554,978 shares of the stock were exchanged, compared to its average volume of 3,904,505. B2Gold has a 12-month low of C$3.16 and a 12-month high of C$4.88. The stock has a 50-day moving average of C$4.18 and a 200 day moving average of C$3.99. The company has a market cap of C$4.02 billion, a price-to-earnings ratio of -5.01, a price-to-earnings-growth ratio of -0.27 and a beta of 1.23. The company has a quick ratio of 3.33, a current ratio of 1.83 and a debt-to-equity ratio of 7.51.

B2Gold Cuts Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, March 20th. Shareholders of record on Thursday, March 20th were issued a $0.02 dividend. The ex-dividend date of this dividend was Friday, March 7th. This represents a $0.08 dividend on an annualized basis and a dividend yield of 1.84%. B2Gold's dividend payout ratio (DPR) is presently -25.32%.

Insider Buying and Selling

In other news, Senior Officer Randall Chatwin sold 30,150 shares of the stock in a transaction dated Wednesday, April 2nd. The stock was sold at an average price of C$4.17, for a total value of C$125,725.50. Also, Senior Officer Eduard Bartz sold 13,161 shares of the stock in a transaction that occurred on Tuesday, April 8th. The shares were sold at an average price of C$3.79, for a total transaction of C$49,880.19. Following the completion of the sale, the insider now directly owns 16 shares of the company's stock, valued at C$60.64. This trade represents a 99.88 % decrease in their position. In the last ninety days, insiders have sold 535,145 shares of company stock valued at $2,191,177. 0.66% of the stock is currently owned by company insiders.

About B2Gold

(

Get Free ReportB2Gold Corp. operates as a gold producer company. It operates the Fekola Mine in Mali, the Masbate Mine in the Philippines, and the Otjikoto Mine in Namibia. The company also has an 100% interest in the Gramalote gold project in Colombia; 24% interest in the Calibre Mining Corp.; and approximately 19% interest in BeMetals Corp.

Read More

Before you consider B2Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and B2Gold wasn't on the list.

While B2Gold currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.