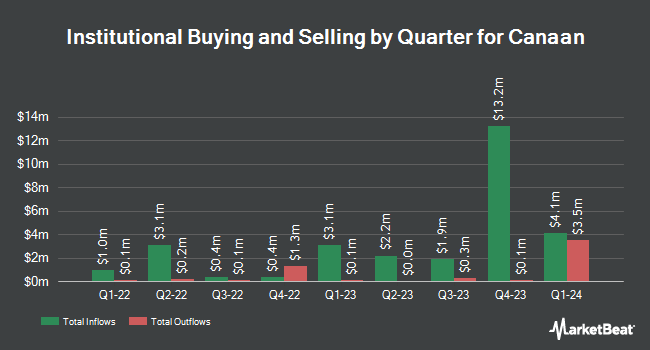

Baader Bank Aktiengesellschaft raised its position in shares of Canaan Inc. (NASDAQ:CAN - Free Report) by 287.0% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 1,305,724 shares of the company's stock after purchasing an additional 968,347 shares during the quarter. Baader Bank Aktiengesellschaft owned 0.46% of Canaan worth $2,677,000 at the end of the most recent reporting period.

Several other large investors have also added to or reduced their stakes in CAN. Exchange Traded Concepts LLC purchased a new stake in shares of Canaan in the fourth quarter worth about $2,807,000. Old Port Advisors purchased a new stake in shares of Canaan in the fourth quarter worth about $100,000. Virtu Financial LLC boosted its stake in shares of Canaan by 35.2% in the third quarter. Virtu Financial LLC now owns 103,394 shares of the company's stock worth $104,000 after buying an additional 26,920 shares during the last quarter. XTX Topco Ltd boosted its stake in shares of Canaan by 193.3% in the third quarter. XTX Topco Ltd now owns 232,525 shares of the company's stock worth $235,000 after buying an additional 153,255 shares during the last quarter. Finally, State Street Corp boosted its stake in shares of Canaan by 0.3% in the third quarter. State Street Corp now owns 9,111,069 shares of the company's stock worth $9,202,000 after buying an additional 23,759 shares during the last quarter. Hedge funds and other institutional investors own 70.14% of the company's stock.

Wall Street Analyst Weigh In

A number of equities analysts have issued reports on CAN shares. Rosenblatt Securities increased their price target on Canaan from $3.00 to $4.00 and gave the stock a "buy" rating in a research report on Friday, December 6th. HC Wainwright reiterated a "buy" rating and set a $3.00 price target on shares of Canaan in a research report on Wednesday, January 22nd.

View Our Latest Research Report on Canaan

Canaan Trading Up 15.3 %

CAN stock traded up $0.29 during midday trading on Thursday, hitting $2.15. 15,047,439 shares of the company's stock were exchanged, compared to its average volume of 17,537,109. The business has a 50-day simple moving average of $2.21 and a two-hundred day simple moving average of $1.47. The company has a current ratio of 2.03, a quick ratio of 1.45 and a debt-to-equity ratio of 0.08. The stock has a market capitalization of $603.99 million, a PE ratio of -1.58 and a beta of 3.27. Canaan Inc. has a 1-year low of $0.72 and a 1-year high of $3.27.

Canaan Profile

(

Free Report)

Canaan Inc engages in the research, design, and sale of integrated circuit (IC) final mining equipment products by integrating IC products for bitcoin mining and related components in the People's Republic of China. It is also involved in the assembly and distribution of mining equipment and spare parts.

Read More

Before you consider Canaan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canaan wasn't on the list.

While Canaan currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.