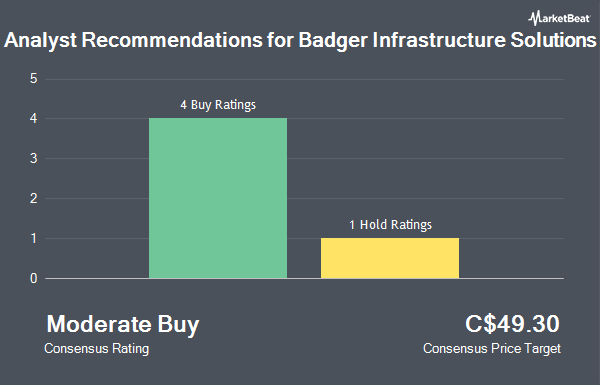

Badger Infrastructure Solutions Ltd. (TSE:BDGI - Get Free Report) has received an average rating of "Moderate Buy" from the seven analysts that are covering the stock, MarketBeat reports. Two equities research analysts have rated the stock with a hold rating and five have issued a buy rating on the company. The average 1-year price target among brokerages that have updated their coverage on the stock in the last year is C$49.21.

Several equities analysts recently weighed in on the company. Stifel Nicolaus cut their price target on Badger Infrastructure Solutions from C$56.00 to C$51.00 and set a "buy" rating for the company in a research note on Friday, November 1st. Raymond James cut their price objective on Badger Infrastructure Solutions from C$50.00 to C$46.00 and set an "outperform" rating for the company in a research report on Friday, November 1st. Finally, CIBC decreased their target price on Badger Infrastructure Solutions from C$50.00 to C$49.00 and set an "outperform" rating on the stock in a research report on Friday, November 1st.

Get Our Latest Stock Report on BDGI

Insider Buying and Selling at Badger Infrastructure Solutions

In other news, Senior Officer Julie Lee purchased 751 shares of the firm's stock in a transaction that occurred on Wednesday, September 11th. The stock was bought at an average price of C$35.51 per share, for a total transaction of C$26,667.71. Also, Director Robert George Blackadar purchased 1,000 shares of the stock in a transaction on Monday, November 4th. The shares were purchased at an average price of C$36.08 per share, with a total value of C$36,084.40. Insiders acquired 2,751 shares of company stock valued at $101,723 in the last 90 days. Company insiders own 0.33% of the company's stock.

Badger Infrastructure Solutions Stock Performance

BDGI stock traded down C$0.06 during midday trading on Tuesday, hitting C$38.07. 41,913 shares of the stock traded hands, compared to its average volume of 73,044. Badger Infrastructure Solutions has a 1-year low of C$34.85 and a 1-year high of C$51.50. The company has a debt-to-equity ratio of 97.25, a current ratio of 1.65 and a quick ratio of 1.49. The stock's fifty day simple moving average is C$38.89 and its 200-day simple moving average is C$38.73. The firm has a market cap of C$1.31 billion, a P/E ratio of 23.20 and a beta of 1.14.

Badger Infrastructure Solutions Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, October 15th. Shareholders of record on Tuesday, October 15th were issued a dividend of $0.18 per share. The ex-dividend date was Friday, September 27th. This represents a $0.72 dividend on an annualized basis and a yield of 1.89%. Badger Infrastructure Solutions's dividend payout ratio (DPR) is presently 43.90%.

About Badger Infrastructure Solutions

(

Get Free ReportBadger Infrastructure Solutions Ltd. provides non-destructive excavating and related services in Canada and the United States. Its Badger Hydrovac technology uses a pressurized water stream to liquefy the soil cover, which is then removed with a vacuum system and deposited into a storage tank. The company offers daylighting services for visual confirmation of buried lines, directional drilling test holes, sacrificial anode installation, pipeline and utility crossings, and subsurface utility engineering test holes applications; and debris removal services for frac tank clean-outs, road and box culvert clean-outs, pipe-rammed casing clean-outs, ballast and filter media removal, and inside structures and buildings material removal.

Featured Articles

Before you consider Badger Infrastructure Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Badger Infrastructure Solutions wasn't on the list.

While Badger Infrastructure Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.