Bailard Inc. lifted its position in shares of Evergy, Inc. (NASDAQ:EVRG - Free Report) by 9.9% in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 45,842 shares of the company's stock after acquiring an additional 4,137 shares during the period. Bailard Inc.'s holdings in Evergy were worth $2,822,000 as of its most recent filing with the Securities & Exchange Commission.

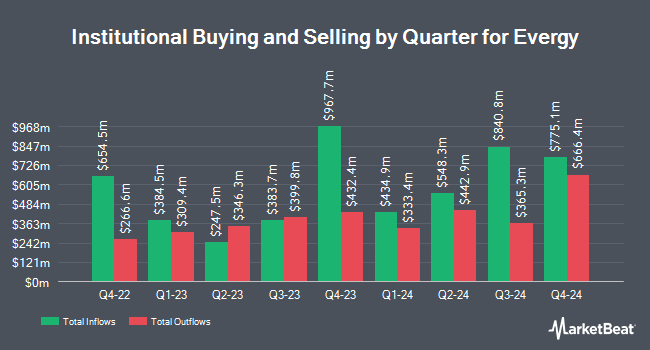

A number of other large investors have also added to or reduced their stakes in the stock. Franklin Resources Inc. grew its stake in Evergy by 5.5% in the 3rd quarter. Franklin Resources Inc. now owns 5,532,719 shares of the company's stock worth $330,469,000 after acquiring an additional 288,619 shares in the last quarter. Bank of New York Mellon Corp increased its stake in shares of Evergy by 9.1% during the fourth quarter. Bank of New York Mellon Corp now owns 3,085,401 shares of the company's stock worth $189,906,000 after purchasing an additional 256,978 shares in the last quarter. Point72 Asset Management L.P. boosted its position in Evergy by 25.8% during the third quarter. Point72 Asset Management L.P. now owns 2,848,735 shares of the company's stock worth $176,650,000 after acquiring an additional 583,923 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in Evergy by 42.3% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,135,011 shares of the company's stock valued at $132,392,000 after purchasing an additional 634,735 shares during the last quarter. Finally, FMR LLC lifted its holdings in shares of Evergy by 131.4% in the 3rd quarter. FMR LLC now owns 2,004,414 shares of the company's stock worth $124,294,000 after acquiring an additional 1,138,138 shares during the last quarter. Institutional investors own 87.24% of the company's stock.

Evergy Stock Down 1.1 %

EVRG traded down $0.75 during midday trading on Thursday, reaching $66.22. 1,942,446 shares of the company were exchanged, compared to its average volume of 1,798,621. Evergy, Inc. has a one year low of $49.55 and a one year high of $69.93. The company has a debt-to-equity ratio of 1.15, a quick ratio of 0.32 and a current ratio of 0.55. The company's fifty day moving average price is $64.29 and its 200 day moving average price is $62.38. The company has a market cap of $15.23 billion, a price-to-earnings ratio of 17.87, a price-to-earnings-growth ratio of 2.82 and a beta of 0.62.

Evergy (NASDAQ:EVRG - Get Free Report) last released its quarterly earnings data on Thursday, February 27th. The company reported $0.35 earnings per share for the quarter, missing analysts' consensus estimates of $0.46 by ($0.11). The firm had revenue of $1.26 billion for the quarter, compared to the consensus estimate of $1.24 billion. Evergy had a net margin of 14.77% and a return on equity of 8.77%. As a group, analysts expect that Evergy, Inc. will post 3.83 EPS for the current year.

Evergy Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, March 21st. Investors of record on Monday, March 10th will be issued a $0.6675 dividend. The ex-dividend date of this dividend is Monday, March 10th. This represents a $2.67 annualized dividend and a yield of 4.03%. Evergy's dividend payout ratio (DPR) is currently 70.45%.

Analyst Ratings Changes

Several equities research analysts have recently commented on the company. Guggenheim upgraded Evergy from a "neutral" rating to a "buy" rating in a research note on Thursday, January 23rd. Barclays lowered their price objective on shares of Evergy from $65.00 to $62.00 and set an "overweight" rating for the company in a research report on Monday, January 27th. Finally, LADENBURG THALM/SH SH upgraded Evergy from a "neutral" rating to a "buy" rating and raised their price objective for the stock from $59.00 to $68.50 in a research note on Thursday, January 2nd. One investment analyst has rated the stock with a hold rating and eight have given a buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $65.36.

Read Our Latest Research Report on Evergy

About Evergy

(

Free Report)

Evergy, Inc, together with its subsidiaries, engages in the generation, transmission, distribution, and sale of electricity in the United States. The company generates electricity through coal, landfill gas, uranium, and natural gas and oil sources, as well as solar, wind, other renewable sources. It serves residences, commercial firms, industrials, municipalities, and other electric utilities.

See Also

Before you consider Evergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evergy wasn't on the list.

While Evergy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.