Bailard Inc. lifted its stake in The Home Depot, Inc. (NYSE:HD - Free Report) by 1.6% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 83,551 shares of the home improvement retailer's stock after purchasing an additional 1,322 shares during the period. Home Depot comprises about 0.9% of Bailard Inc.'s investment portfolio, making the stock its 23rd largest position. Bailard Inc.'s holdings in Home Depot were worth $33,855,000 as of its most recent filing with the Securities and Exchange Commission.

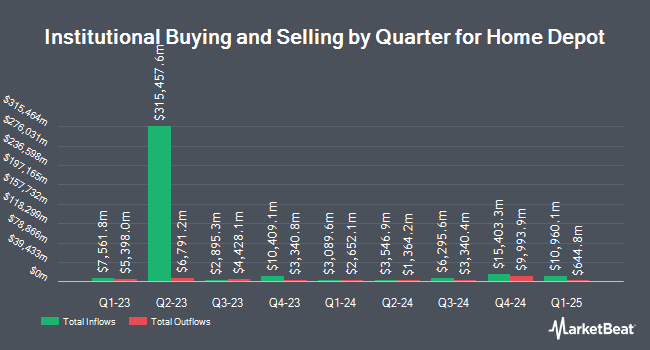

Other hedge funds have also added to or reduced their stakes in the company. Abacus Wealth Partners LLC raised its position in shares of Home Depot by 3.7% in the 3rd quarter. Abacus Wealth Partners LLC now owns 704 shares of the home improvement retailer's stock valued at $285,000 after buying an additional 25 shares in the last quarter. Redhawk Wealth Advisors Inc. raised its holdings in Home Depot by 0.7% in the 3rd quarter. Redhawk Wealth Advisors Inc. now owns 3,624 shares of the home improvement retailer's stock valued at $1,469,000 after buying an additional 25 shares during the last quarter. Ruedi Wealth Management Inc. increased its holdings in Home Depot by 1.2% in the second quarter. Ruedi Wealth Management Inc. now owns 2,372 shares of the home improvement retailer's stock valued at $817,000 after purchasing an additional 27 shares during the period. Acorn Creek Capital LLC raised its holdings in Home Depot by 3.4% during the 2nd quarter. Acorn Creek Capital LLC now owns 845 shares of the home improvement retailer's stock worth $291,000 after purchasing an additional 28 shares during the last quarter. Finally, Consolidated Portfolio Review Corp raised its position in shares of Home Depot by 1.9% in the 3rd quarter. Consolidated Portfolio Review Corp now owns 1,524 shares of the home improvement retailer's stock worth $617,000 after acquiring an additional 28 shares in the last quarter. 70.86% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

A number of brokerages have commented on HD. Barclays raised their price objective on Home Depot from $372.00 to $420.00 and gave the company an "overweight" rating in a research note on Tuesday. Sanford C. Bernstein began coverage on shares of Home Depot in a report on Tuesday, October 22nd. They set a "market perform" rating and a $451.00 price objective for the company. Royal Bank of Canada lowered their target price on Home Depot from $377.00 to $363.00 and set a "sector perform" rating on the stock in a research note on Wednesday, August 14th. Morgan Stanley upped their price target on shares of Home Depot from $380.00 to $450.00 and gave the company an "overweight" rating in a research note on Monday, October 21st. Finally, Evercore ISI cut their target price on Home Depot from $415.00 to $400.00 and set an "outperform" rating for the company in a research note on Wednesday, August 14th. One investment analyst has rated the stock with a sell rating, eight have given a hold rating and twenty-two have given a buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $416.37.

View Our Latest Stock Report on HD

Home Depot Trading Down 3.0 %

Shares of NYSE:HD traded down $11.90 during trading on Wednesday, hitting $388.19. The company had a trading volume of 7,129,534 shares, compared to its average volume of 3,364,879. The stock has a market cap of $385.59 billion, a price-to-earnings ratio of 26.12, a price-to-earnings-growth ratio of 2.72 and a beta of 1.01. The company has a debt-to-equity ratio of 11.74, a current ratio of 1.15 and a quick ratio of 0.33. The company has a fifty day simple moving average of $393.80 and a two-hundred day simple moving average of $363.10. The Home Depot, Inc. has a one year low of $286.79 and a one year high of $421.56.

Home Depot (NYSE:HD - Get Free Report) last issued its quarterly earnings results on Tuesday, August 13th. The home improvement retailer reported $4.67 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $4.59 by $0.08. Home Depot had a return on equity of 733.61% and a net margin of 9.71%. The company had revenue of $43.18 billion during the quarter, compared to the consensus estimate of $42.57 billion. During the same period last year, the company earned $4.65 earnings per share. Home Depot's revenue was up .6% on a year-over-year basis. As a group, equities analysts forecast that The Home Depot, Inc. will post 15.01 earnings per share for the current year.

Home Depot Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, September 12th. Investors of record on Thursday, August 29th were issued a $2.25 dividend. The ex-dividend date of this dividend was Thursday, August 29th. This represents a $9.00 annualized dividend and a dividend yield of 2.32%. Home Depot's payout ratio is currently 60.57%.

Home Depot Profile

(

Free Report)

The Home Depot, Inc operates as a home improvement retailer in the United States and internationally. It sells various building materials, home improvement products, lawn and garden products, and décor products, as well as facilities maintenance, repair, and operations products. The company also offers installation services for flooring, water heaters, bath, garage doors, cabinets, cabinet makeovers, countertops, sheds, furnaces and central air systems, and windows.

Recommended Stories

Before you consider Home Depot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Home Depot wasn't on the list.

While Home Depot currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.