Baillie Gifford & Co. decreased its position in Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX - Free Report) by 5.1% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 25,239,870 shares of the company's stock after selling 1,350,066 shares during the quarter. Baillie Gifford & Co. owned approximately 8.98% of Recursion Pharmaceuticals worth $166,331,000 as of its most recent SEC filing.

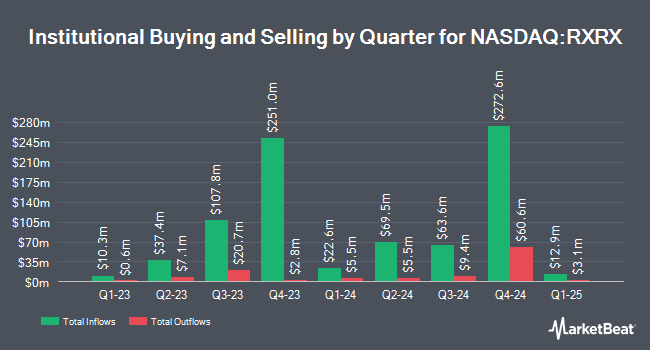

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Allspring Global Investments Holdings LLC bought a new stake in shares of Recursion Pharmaceuticals in the 3rd quarter valued at approximately $25,000. Farther Finance Advisors LLC raised its stake in shares of Recursion Pharmaceuticals by 176.9% in the third quarter. Farther Finance Advisors LLC now owns 6,404 shares of the company's stock worth $42,000 after acquiring an additional 4,091 shares during the last quarter. GAMMA Investing LLC increased its holdings in shares of Recursion Pharmaceuticals by 1,588.4% in the second quarter. GAMMA Investing LLC now owns 6,416 shares of the company's stock valued at $48,000 after purchasing an additional 6,036 shares in the last quarter. Amalgamated Bank raised its position in shares of Recursion Pharmaceuticals by 52.4% during the second quarter. Amalgamated Bank now owns 7,152 shares of the company's stock worth $54,000 after acquiring an additional 2,459 shares during the last quarter. Finally, San Luis Wealth Advisors LLC acquired a new position in Recursion Pharmaceuticals during the 3rd quarter valued at about $69,000. Institutional investors and hedge funds own 89.06% of the company's stock.

Insider Transactions at Recursion Pharmaceuticals

In other Recursion Pharmaceuticals news, CEO Christopher Gibson sold 20,000 shares of Recursion Pharmaceuticals stock in a transaction that occurred on Wednesday, September 4th. The stock was sold at an average price of $6.04, for a total value of $120,800.00. Following the completion of the sale, the chief executive officer now directly owns 762,656 shares in the company, valued at approximately $4,606,442.24. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In related news, COO Tina Marriott sold 6,000 shares of the company's stock in a transaction dated Thursday, August 29th. The shares were sold at an average price of $7.56, for a total value of $45,360.00. Following the sale, the chief operating officer now owns 521,138 shares in the company, valued at $3,939,803.28. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, CEO Christopher Gibson sold 20,000 shares of Recursion Pharmaceuticals stock in a transaction dated Wednesday, September 4th. The shares were sold at an average price of $6.04, for a total value of $120,800.00. Following the transaction, the chief executive officer now owns 762,656 shares of the company's stock, valued at $4,606,442.24. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 156,682 shares of company stock worth $1,012,618 over the last three months. 15.75% of the stock is owned by company insiders.

Analyst Ratings Changes

A number of analysts recently weighed in on RXRX shares. Needham & Company LLC reiterated a "buy" rating and issued a $11.00 price target on shares of Recursion Pharmaceuticals in a research report on Thursday, November 7th. Leerink Partners dropped their target price on Recursion Pharmaceuticals from $9.00 to $8.00 and set a "market perform" rating on the stock in a research report on Tuesday, September 3rd. Finally, Jefferies Financial Group cut their price objective on Recursion Pharmaceuticals from $8.00 to $6.00 and set a "hold" rating for the company in a report on Tuesday, September 3rd. Four research analysts have rated the stock with a hold rating and two have given a buy rating to the company. Based on data from MarketBeat.com, Recursion Pharmaceuticals currently has a consensus rating of "Hold" and an average target price of $9.40.

Check Out Our Latest Stock Report on Recursion Pharmaceuticals

Recursion Pharmaceuticals Price Performance

RXRX stock traded down $0.30 during trading on Tuesday, reaching $7.54. 4,424,500 shares of the company were exchanged, compared to its average volume of 5,711,893. The company has a 50-day moving average of $6.58 and a two-hundred day moving average of $7.62. The company has a market capitalization of $2.12 billion, a price-to-earnings ratio of -5.12 and a beta of 0.81. The company has a debt-to-equity ratio of 0.04, a current ratio of 4.35 and a quick ratio of 6.07. Recursion Pharmaceuticals, Inc. has a twelve month low of $5.22 and a twelve month high of $15.74.

Recursion Pharmaceuticals (NASDAQ:RXRX - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported ($0.34) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.33) by ($0.01). The business had revenue of $26.08 million for the quarter, compared to the consensus estimate of $12.62 million. Recursion Pharmaceuticals had a negative net margin of 579.52% and a negative return on equity of 76.56%. Recursion Pharmaceuticals's revenue was up 147.6% on a year-over-year basis. During the same period in the previous year, the business posted ($0.43) EPS. As a group, equities analysts predict that Recursion Pharmaceuticals, Inc. will post -1.54 earnings per share for the current fiscal year.

Recursion Pharmaceuticals Profile

(

Free Report)

Recursion Pharmaceuticals, Inc operates as a clinical-stage biotechnology company, engages in the decoding biology by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery. The company develops REC-994, which is in Phase 2 clinical trial to treat cerebral cavernous malformation; REC-2282, which is in Phase 2/3 clinical trial for the treatment of neurofibromatosis type 2; REC-4881, which is in Phase 1b/2 clinical trial to treat familial adenomatous polyposis; REC-3964, which is in Phase 1 clinical trial to treat Clostridioides difficile infection; and REC-4881, which is in Phase 2 clinical trial to treat AXIN1 or APC mutant cancers.

Featured Stories

Before you consider Recursion Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Recursion Pharmaceuticals wasn't on the list.

While Recursion Pharmaceuticals currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.