Baillie Gifford & Co. cut its stake in Pinterest, Inc. (NYSE:PINS - Free Report) by 4.0% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 9,708,696 shares of the company's stock after selling 407,443 shares during the quarter. Baillie Gifford & Co. owned about 1.41% of Pinterest worth $314,270,000 at the end of the most recent quarter.

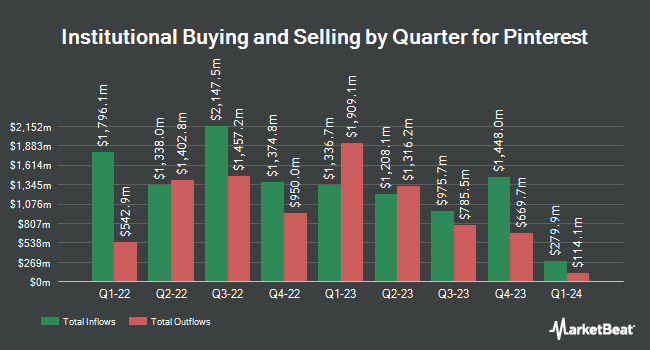

Several other hedge funds also recently made changes to their positions in PINS. Allspring Global Investments Holdings LLC grew its position in Pinterest by 195.1% during the first quarter. Allspring Global Investments Holdings LLC now owns 2,151 shares of the company's stock worth $75,000 after buying an additional 1,422 shares in the last quarter. Norden Group LLC purchased a new position in Pinterest during the first quarter worth about $214,000. Janney Montgomery Scott LLC grew its position in Pinterest by 7.6% during the first quarter. Janney Montgomery Scott LLC now owns 59,678 shares of the company's stock worth $2,069,000 after buying an additional 4,237 shares in the last quarter. Envestnet Portfolio Solutions Inc. grew its position in Pinterest by 19.8% during the first quarter. Envestnet Portfolio Solutions Inc. now owns 20,424 shares of the company's stock worth $708,000 after buying an additional 3,371 shares in the last quarter. Finally, Empowered Funds LLC grew its position in Pinterest by 25.5% during the first quarter. Empowered Funds LLC now owns 7,432 shares of the company's stock worth $258,000 after buying an additional 1,510 shares in the last quarter. 88.81% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Pinterest news, Director Gokul Rajaram sold 1,150 shares of the company's stock in a transaction that occurred on Wednesday, October 16th. The stock was sold at an average price of $33.52, for a total transaction of $38,548.00. Following the transaction, the director now owns 33,686 shares in the company, valued at approximately $1,129,154.72. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In related news, CFO Donnelly Julia Brau sold 30,280 shares of the company's stock in a transaction that occurred on Friday, September 27th. The stock was sold at an average price of $32.72, for a total value of $990,761.60. Following the transaction, the chief financial officer now directly owns 297,351 shares of the company's stock, valued at approximately $9,729,324.72. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, Director Gokul Rajaram sold 1,150 shares of the company's stock in a transaction that occurred on Wednesday, October 16th. The shares were sold at an average price of $33.52, for a total value of $38,548.00. Following the completion of the transaction, the director now directly owns 33,686 shares in the company, valued at $1,129,154.72. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 7.11% of the company's stock.

Wall Street Analyst Weigh In

PINS has been the subject of several recent analyst reports. Deutsche Bank Aktiengesellschaft initiated coverage on Pinterest in a research report on Monday, September 23rd. They set a "buy" rating and a $43.00 target price for the company. Morgan Stanley lifted their price target on Pinterest from $35.00 to $38.00 and gave the stock an "equal weight" rating in a research note on Tuesday, July 23rd. Rosenblatt Securities dropped their price target on Pinterest from $48.00 to $46.00 and set a "buy" rating for the company in a research note on Friday. Benchmark reaffirmed a "hold" rating on shares of Pinterest in a research note on Friday. Finally, JPMorgan Chase & Co. dropped their price target on Pinterest from $38.00 to $35.00 and set a "neutral" rating for the company in a research note on Friday. Seven research analysts have rated the stock with a hold rating, twenty-one have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $42.00.

Get Our Latest Research Report on PINS

Pinterest Trading Up 0.5 %

Shares of PINS stock traded up $0.16 during midday trading on Tuesday, reaching $30.55. 6,458,795 shares of the stock were exchanged, compared to its average volume of 9,552,428. Pinterest, Inc. has a 1 year low of $27.00 and a 1 year high of $45.19. The company's 50 day moving average is $31.79 and its two-hundred day moving average is $36.34. The firm has a market cap of $20.96 billion, a PE ratio of 102.24, a price-to-earnings-growth ratio of 2.25 and a beta of 1.02.

Pinterest Company Profile

(

Free Report)

Pinterest, Inc operates as a visual search and discovery platform in the United States and internationally. Its platform allows people to find ideas, such as recipes, home and style inspiration, and others; and to search, save, and shop the ideas. The company was formerly known as Cold Brew Labs Inc and changed its name to Pinterest, Inc in April 2012.

Recommended Stories

Before you consider Pinterest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinterest wasn't on the list.

While Pinterest currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.