Baillie Gifford & Co. reduced its position in shares of Schrödinger, Inc. (NASDAQ:SDGR - Free Report) by 6.8% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,980,992 shares of the company's stock after selling 143,976 shares during the period. Baillie Gifford & Co. owned approximately 2.72% of Schrödinger worth $36,747,000 as of its most recent filing with the Securities and Exchange Commission.

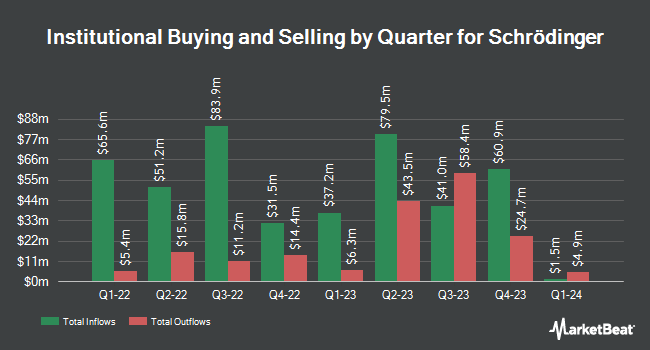

Several other hedge funds have also added to or reduced their stakes in the company. Vanguard Group Inc. lifted its holdings in shares of Schrödinger by 0.5% during the first quarter. Vanguard Group Inc. now owns 6,809,024 shares of the company's stock worth $183,844,000 after buying an additional 32,393 shares in the last quarter. Rubric Capital Management LP raised its stake in Schrödinger by 213.5% in the 2nd quarter. Rubric Capital Management LP now owns 3,130,000 shares of the company's stock worth $60,534,000 after purchasing an additional 2,131,724 shares in the last quarter. Stephens Investment Management Group LLC boosted its holdings in Schrödinger by 39.6% in the 3rd quarter. Stephens Investment Management Group LLC now owns 1,539,870 shares of the company's stock valued at $28,565,000 after purchasing an additional 436,789 shares during the period. Massachusetts Financial Services Co. MA boosted its holdings in Schrödinger by 53.4% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 1,228,123 shares of the company's stock valued at $23,752,000 after purchasing an additional 427,594 shares during the period. Finally, Tocqueville Asset Management L.P. grew its position in shares of Schrödinger by 35.5% during the 1st quarter. Tocqueville Asset Management L.P. now owns 899,750 shares of the company's stock worth $24,293,000 after purchasing an additional 235,785 shares in the last quarter. 79.05% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

SDGR has been the subject of several recent research reports. BMO Capital Markets boosted their price target on Schrödinger from $25.00 to $28.00 and gave the company an "outperform" rating in a research note on Wednesday. Morgan Stanley dropped their target price on shares of Schrödinger from $43.00 to $30.00 and set an "equal weight" rating for the company in a research report on Wednesday, August 21st. Three analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, Schrödinger presently has an average rating of "Moderate Buy" and a consensus price target of $32.90.

View Our Latest Research Report on Schrödinger

Insider Activity at Schrödinger

In related news, insider Margaret Dugan sold 1,531 shares of Schrödinger stock in a transaction that occurred on Tuesday, October 15th. The stock was sold at an average price of $17.78, for a total value of $27,221.18. Following the transaction, the insider now directly owns 13,469 shares of the company's stock, valued at $239,478.82. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. 8.60% of the stock is currently owned by company insiders.

Schrödinger Trading Down 0.7 %

SDGR stock traded down $0.16 during midday trading on Wednesday, reaching $22.09. 1,346,160 shares of the stock were exchanged, compared to its average volume of 755,359. Schrödinger, Inc. has a 52 week low of $16.67 and a 52 week high of $38.00. The company has a fifty day moving average price of $18.73 and a 200 day moving average price of $20.41.

Schrödinger (NASDAQ:SDGR - Get Free Report) last released its quarterly earnings results on Tuesday, November 12th. The company reported ($0.52) earnings per share for the quarter, missing the consensus estimate of ($0.40) by ($0.12). The firm had revenue of $35.30 million for the quarter, compared to the consensus estimate of $41.25 million. Schrödinger had a negative return on equity of 35.77% and a negative net margin of 91.84%. The business's revenue for the quarter was down 17.1% on a year-over-year basis. During the same quarter last year, the firm posted ($0.86) earnings per share. As a group, sell-side analysts predict that Schrödinger, Inc. will post -2.19 EPS for the current fiscal year.

Schrödinger Profile

(

Free Report)

Schrödinger, Inc, together with its subsidiaries, develops physics-based computational platform that enables discovery of novel molecules for drug development and materials applications. The company operates in two segments, Software and Drug Discovery. The Software segment is focused on licensing its software to transform molecular discovery for life sciences and materials science industries.

Read More

Before you consider Schrödinger, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Schrödinger wasn't on the list.

While Schrödinger currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.