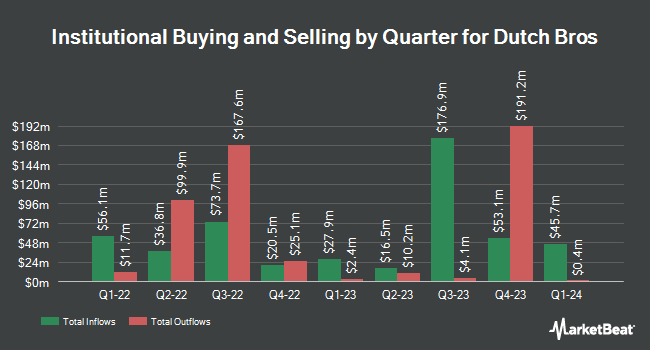

Baillie Gifford & Co. bought a new position in shares of Dutch Bros Inc. (NYSE:BROS - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 7,007,836 shares of the company's stock, valued at approximately $224,461,000. Baillie Gifford & Co. owned about 4.54% of Dutch Bros as of its most recent filing with the Securities & Exchange Commission.

Several other large investors also recently made changes to their positions in the business. Chartwell Investment Partners LLC grew its holdings in shares of Dutch Bros by 56.0% during the third quarter. Chartwell Investment Partners LLC now owns 14,742 shares of the company's stock worth $472,000 after purchasing an additional 5,293 shares during the last quarter. State of New Jersey Common Pension Fund D boosted its holdings in Dutch Bros by 23.3% in the third quarter. State of New Jersey Common Pension Fund D now owns 62,891 shares of the company's stock valued at $2,014,000 after acquiring an additional 11,880 shares during the last quarter. Covestor Ltd boosted its holdings in Dutch Bros by 355.6% in the third quarter. Covestor Ltd now owns 3,663 shares of the company's stock valued at $117,000 after acquiring an additional 2,859 shares during the last quarter. Hollencrest Capital Management boosted its holdings in Dutch Bros by 52.3% in the third quarter. Hollencrest Capital Management now owns 914 shares of the company's stock valued at $29,000 after acquiring an additional 314 shares during the last quarter. Finally, Keudell Morrison Wealth Management boosted its holdings in Dutch Bros by 4.6% in the third quarter. Keudell Morrison Wealth Management now owns 11,036 shares of the company's stock valued at $353,000 after acquiring an additional 490 shares during the last quarter. Institutional investors own 85.54% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts recently issued reports on BROS shares. JPMorgan Chase & Co. raised their price target on Dutch Bros from $44.00 to $48.00 and gave the company an "overweight" rating in a report on Thursday, November 7th. TD Cowen raised their price target on Dutch Bros from $47.00 to $53.00 and gave the company a "buy" rating in a report on Thursday, November 7th. UBS Group increased their target price on Dutch Bros from $39.00 to $44.00 and gave the company a "buy" rating in a research note on Thursday, November 7th. Stifel Nicolaus reduced their target price on Dutch Bros from $40.00 to $38.00 and set a "buy" rating on the stock in a report on Thursday, August 8th. Finally, Wedbush raised their target price on Dutch Bros from $45.00 to $55.00 and gave the stock an "outperform" rating in a report on Thursday, November 7th. Three equities research analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. Based on data from MarketBeat.com, Dutch Bros has an average rating of "Moderate Buy" and a consensus target price of $45.80.

Check Out Our Latest Stock Report on BROS

Insider Buying and Selling at Dutch Bros

In other Dutch Bros news, Chairman Travis Boersma sold 38,339 shares of the business's stock in a transaction that occurred on Monday, November 4th. The stock was sold at an average price of $33.48, for a total value of $1,283,589.72. Following the sale, the chairman now owns 15,610 shares in the company, valued at approximately $522,622.80. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. In other Dutch Bros news, Chairman Travis Boersma sold 38,339 shares of the business's stock in a transaction that occurred on Monday, November 4th. The stock was sold at an average price of $33.48, for a total value of $1,283,589.72. Following the sale, the chairman now owns 15,610 shares in the company, valued at approximately $522,622.80. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, major shareholder Dm Individual Aggregator, Llc sold 167,315 shares of the business's stock in a transaction that occurred on Monday, August 19th. The shares were sold at an average price of $31.60, for a total value of $5,287,154.00. Following the completion of the sale, the insider now owns 467,228 shares in the company, valued at $14,764,404.80. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 1,689,583 shares of company stock worth $55,164,707. Corporate insiders own 46.50% of the company's stock.

Dutch Bros Stock Down 0.0 %

Shares of NYSE:BROS traded down $0.01 during trading on Tuesday, hitting $48.43. 1,701,999 shares of the company's stock traded hands, compared to its average volume of 2,819,354. Dutch Bros Inc. has a 52 week low of $25.46 and a 52 week high of $50.24. The company has a current ratio of 2.19, a quick ratio of 1.88 and a debt-to-equity ratio of 0.82. The company has a market cap of $7.47 billion, a price-to-earnings ratio of 167.04, a price-to-earnings-growth ratio of 5.20 and a beta of 2.47. The company has a 50-day moving average price of $34.20 and a 200-day moving average price of $35.35.

Dutch Bros (NYSE:BROS - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The company reported $0.16 earnings per share for the quarter, beating the consensus estimate of $0.12 by $0.04. Dutch Bros had a return on equity of 5.58% and a net margin of 2.54%. The business had revenue of $338.20 million for the quarter, compared to analysts' expectations of $324.97 million. During the same quarter in the previous year, the business posted $0.08 EPS. Dutch Bros's revenue for the quarter was up 27.9% on a year-over-year basis. As a group, research analysts forecast that Dutch Bros Inc. will post 0.33 EPS for the current fiscal year.

Dutch Bros Profile

(

Free Report)

Dutch Bros Inc, together with its subsidiaries, operates and franchises drive-thru shops in the United States. The company operates through Company-Operated Shops and Franchising and Other segments. It serves through company-operated shops and online channels under Dutch Bros; Dutch Bros Coffee; Dutch Bros Rebel; Dutch Bros; and Blue Rebel brands.

Further Reading

Before you consider Dutch Bros, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dutch Bros wasn't on the list.

While Dutch Bros currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.