Baillie Gifford & Co. raised its stake in Aurora Innovation, Inc. (NASDAQ:AUR - Free Report) by 17.2% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 84,904,647 shares of the company's stock after purchasing an additional 12,466,085 shares during the period. Baillie Gifford & Co. owned approximately 5.41% of Aurora Innovation worth $502,636,000 as of its most recent SEC filing.

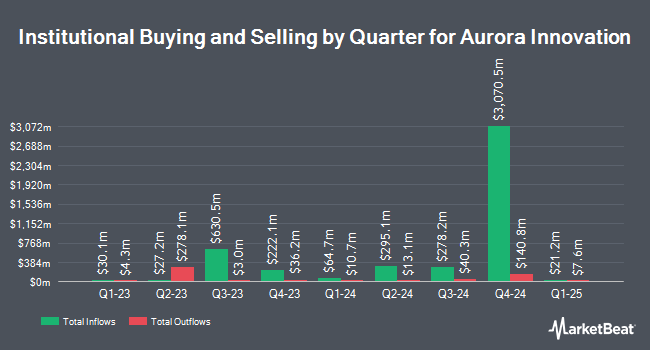

A number of other hedge funds have also recently bought and sold shares of AUR. Vanguard Group Inc. lifted its holdings in Aurora Innovation by 1.5% during the 1st quarter. Vanguard Group Inc. now owns 84,784,550 shares of the company's stock valued at $239,092,000 after purchasing an additional 1,267,962 shares during the last quarter. Dimensional Fund Advisors LP increased its position in Aurora Innovation by 23.1% in the 2nd quarter. Dimensional Fund Advisors LP now owns 13,337,429 shares of the company's stock valued at $36,941,000 after acquiring an additional 2,502,002 shares in the last quarter. Primecap Management Co. CA increased its position in Aurora Innovation by 1.0% in the 2nd quarter. Primecap Management Co. CA now owns 10,217,700 shares of the company's stock valued at $28,303,000 after acquiring an additional 102,800 shares in the last quarter. Bank of New York Mellon Corp increased its position in Aurora Innovation by 273.5% in the 2nd quarter. Bank of New York Mellon Corp now owns 5,190,426 shares of the company's stock valued at $14,377,000 after acquiring an additional 3,800,901 shares in the last quarter. Finally, ARK Investment Management LLC acquired a new stake in shares of Aurora Innovation during the 3rd quarter worth approximately $12,433,000. 44.71% of the stock is owned by institutional investors.

Aurora Innovation Stock Down 3.3 %

Aurora Innovation stock traded down $0.18 during mid-day trading on Tuesday, hitting $5.28. 5,370,390 shares of the stock were exchanged, compared to its average volume of 8,742,146. Aurora Innovation, Inc. has a 12 month low of $1.73 and a 12 month high of $7.01. The firm's fifty day simple moving average is $5.47 and its two-hundred day simple moving average is $4.01. The stock has a market capitalization of $9.07 billion, a price-to-earnings ratio of -11.14 and a beta of 2.82.

Analysts Set New Price Targets

Several equities research analysts have commented on the stock. The Goldman Sachs Group upped their target price on shares of Aurora Innovation from $2.00 to $2.50 and gave the company a "sell" rating in a research note on Monday, November 4th. Evercore ISI upped their price target on shares of Aurora Innovation from $3.00 to $5.00 and gave the stock an "in-line" rating in a research report on Monday, October 14th. TD Cowen increased their price objective on shares of Aurora Innovation from $3.00 to $4.00 and gave the company a "hold" rating in a research report on Thursday, October 31st. Finally, Canaccord Genuity Group reaffirmed a "buy" rating and set a $7.00 price target on shares of Aurora Innovation in a research report on Monday, September 30th.

Get Our Latest Stock Analysis on Aurora Innovation

Insiders Place Their Bets

In other news, Director Reid Hoffman sold 829,713 shares of Aurora Innovation stock in a transaction on Friday, November 8th. The shares were sold at an average price of $5.54, for a total value of $4,596,610.02. Following the completion of the sale, the director now owns 310,939 shares in the company, valued at $1,722,602.06. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. In the last 90 days, insiders sold 5,723,587 shares of company stock worth $31,723,223. 13.83% of the stock is currently owned by insiders.

Aurora Innovation Company Profile

(

Free Report)

Aurora Innovation, Inc operates as a self-driving technology company in the United States. It focuses on developing Aurora Driver, a platform that brings a suite of self-driving hardware, software, and data services together to adapt and interoperate vehicles. The company was founded in 2017 and is headquartered in Pittsburgh, Pennsylvania.

See Also

Before you consider Aurora Innovation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aurora Innovation wasn't on the list.

While Aurora Innovation currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.