Baillie Gifford & Co. cut its holdings in Golub Capital BDC, Inc. (NASDAQ:GBDC - Free Report) by 50.3% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 251,639 shares of the investment management company's stock after selling 254,320 shares during the quarter. Baillie Gifford & Co. owned about 0.15% of Golub Capital BDC worth $3,802,000 as of its most recent SEC filing.

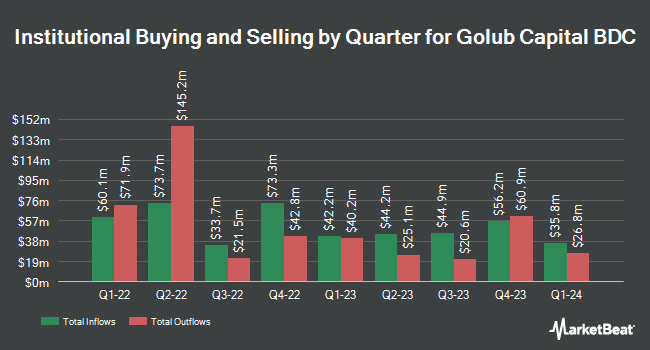

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. BNP Paribas Financial Markets boosted its stake in Golub Capital BDC by 39.1% during the 1st quarter. BNP Paribas Financial Markets now owns 6,898 shares of the investment management company's stock worth $115,000 after acquiring an additional 1,940 shares during the last quarter. SG Americas Securities LLC bought a new stake in shares of Golub Capital BDC in the first quarter worth about $878,000. ProShare Advisors LLC raised its position in shares of Golub Capital BDC by 13.6% during the first quarter. ProShare Advisors LLC now owns 23,948 shares of the investment management company's stock worth $398,000 after purchasing an additional 2,867 shares during the period. Entropy Technologies LP bought a new position in shares of Golub Capital BDC during the 1st quarter valued at about $213,000. Finally, Prevail Innovative Wealth Advisors LLC grew its position in shares of Golub Capital BDC by 68.4% in the 1st quarter. Prevail Innovative Wealth Advisors LLC now owns 39,942 shares of the investment management company's stock valued at $664,000 after purchasing an additional 16,230 shares during the period. Institutional investors own 42.38% of the company's stock.

Golub Capital BDC Price Performance

NASDAQ GBDC traded up $0.07 on Thursday, hitting $15.43. 625,969 shares of the company's stock were exchanged, compared to its average volume of 1,157,797. Golub Capital BDC, Inc. has a 52 week low of $14.05 and a 52 week high of $17.72. The stock has a 50-day moving average of $15.12 and a 200-day moving average of $15.50. The company has a current ratio of 5.01, a quick ratio of 5.01 and a debt-to-equity ratio of 1.06. The stock has a market cap of $2.65 billion, a price-to-earnings ratio of 9.35 and a beta of 0.54.

Wall Street Analyst Weigh In

GBDC has been the subject of a number of research analyst reports. Keefe, Bruyette & Woods reduced their target price on shares of Golub Capital BDC from $17.50 to $16.50 and set an "outperform" rating for the company in a research note on Wednesday, August 7th. Wells Fargo & Company boosted their target price on Golub Capital BDC from $15.00 to $15.50 and gave the stock an "equal weight" rating in a report on Tuesday, October 29th. Oppenheimer restated an "outperform" rating and set a $17.00 price objective on shares of Golub Capital BDC in a report on Wednesday, August 7th. Finally, StockNews.com upgraded Golub Capital BDC from a "sell" rating to a "hold" rating in a research note on Thursday, October 10th. Three investment analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat, Golub Capital BDC has an average rating of "Moderate Buy" and an average price target of $16.50.

View Our Latest Report on Golub Capital BDC

Insider Activity at Golub Capital BDC

In related news, CEO David Golub bought 20,000 shares of the company's stock in a transaction dated Monday, August 19th. The stock was purchased at an average price of $14.70 per share, with a total value of $294,000.00. Following the completion of the acquisition, the chief executive officer now owns 1,758,880 shares of the company's stock, valued at $25,855,536. The trade was a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Insiders have acquired 120,000 shares of company stock valued at $1,785,000 over the last ninety days. 2.70% of the stock is owned by corporate insiders.

Golub Capital BDC Profile

(

Free Report)

Golub Capital BDC, Inc (GBDC) is a business development company and operates as an externally managed closed-end non-diversified management investment company. It invests in debt and minority equity investments in middle-market companies that are, in most cases, sponsored by private equity investors.

Recommended Stories

Before you consider Golub Capital BDC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Golub Capital BDC wasn't on the list.

While Golub Capital BDC currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.