Baillie Gifford & Co. lessened its position in shares of Markel Group Inc. (NYSE:MKL - Free Report) by 3.6% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 259,115 shares of the insurance provider's stock after selling 9,631 shares during the period. Baillie Gifford & Co. owned 2.01% of Markel Group worth $406,443,000 at the end of the most recent reporting period.

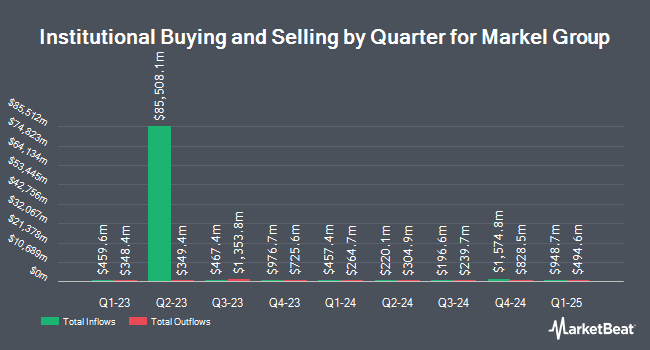

A number of other institutional investors have also recently made changes to their positions in the company. WealthPlan Investment Management LLC lifted its position in shares of Markel Group by 5.3% during the 3rd quarter. WealthPlan Investment Management LLC now owns 414 shares of the insurance provider's stock valued at $649,000 after buying an additional 21 shares during the last quarter. Entropy Technologies LP lifted its holdings in Markel Group by 114.9% during the 3rd quarter. Entropy Technologies LP now owns 374 shares of the insurance provider's stock worth $587,000 after purchasing an additional 200 shares in the last quarter. Versor Investments LP lifted its holdings in Markel Group by 72.4% during the 3rd quarter. Versor Investments LP now owns 381 shares of the insurance provider's stock worth $598,000 after purchasing an additional 160 shares in the last quarter. Venturi Wealth Management LLC lifted its holdings in Markel Group by 3.0% during the 3rd quarter. Venturi Wealth Management LLC now owns 343 shares of the insurance provider's stock worth $538,000 after purchasing an additional 10 shares in the last quarter. Finally, Weil Company Inc. lifted its holdings in Markel Group by 1.3% during the 3rd quarter. Weil Company Inc. now owns 3,088 shares of the insurance provider's stock worth $4,844,000 after purchasing an additional 39 shares in the last quarter. Hedge funds and other institutional investors own 77.12% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages recently issued reports on MKL. Royal Bank of Canada dropped their price objective on Markel Group from $1,700.00 to $1,675.00 and set a "sector perform" rating on the stock in a report on Friday, November 1st. Jefferies Financial Group upped their target price on Markel Group from $1,590.00 to $1,600.00 and gave the stock a "hold" rating in a research note on Wednesday, October 9th. StockNews.com upgraded Markel Group from a "hold" rating to a "buy" rating in a research note on Monday, November 4th. Finally, Citigroup upped their target price on Markel Group from $1,435.00 to $1,450.00 and gave the stock a "sell" rating in a research note on Tuesday, July 23rd. One equities research analyst has rated the stock with a sell rating, four have given a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $1,651.83.

View Our Latest Report on Markel Group

Markel Group Trading Up 0.5 %

NYSE MKL traded up $7.83 on Tuesday, hitting $1,659.52. The company's stock had a trading volume of 13,083 shares, compared to its average volume of 42,657. Markel Group Inc. has a 52-week low of $1,339.72 and a 52-week high of $1,676.56. The company has a current ratio of 0.60, a quick ratio of 0.60 and a debt-to-equity ratio of 0.26. The company's 50-day simple moving average is $1,571.01 and its 200 day simple moving average is $1,575.84. The firm has a market cap of $21.34 billion, a P/E ratio of 7.62 and a beta of 0.73.

Markel Group (NYSE:MKL - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The insurance provider reported $17.34 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $21.97 by ($4.63). The company had revenue of $3.69 billion for the quarter, compared to analysts' expectations of $3.74 billion. Markel Group had a net margin of 17.03% and a return on equity of 10.86%. Research analysts predict that Markel Group Inc. will post 89.27 EPS for the current fiscal year.

Markel Group Profile

(

Free Report)

Markel Group Inc, a diverse holding company, engages in marketing and underwriting specialty insurance products in the United States, Bermuda, the United Kingdom, and Germany. The company offers general and professional liability, personal lines, marine and energy, specialty programs, and workers' compensation insurance products; and property coverages that include fire, allied lines, and other specialized property coverages, including catastrophe-exposed property risks, such as earthquake and wind.

Further Reading

Before you consider Markel Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Markel Group wasn't on the list.

While Markel Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.