Bain Capital Investors LLC purchased a new position in Nutanix, Inc. (NASDAQ:NTNX - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm purchased 16,854,032 shares of the technology company's stock, valued at approximately $998,601,000. Nutanix comprises 26.1% of Bain Capital Investors LLC's investment portfolio, making the stock its 2nd largest position. Bain Capital Investors LLC owned 6.35% of Nutanix at the end of the most recent reporting period.

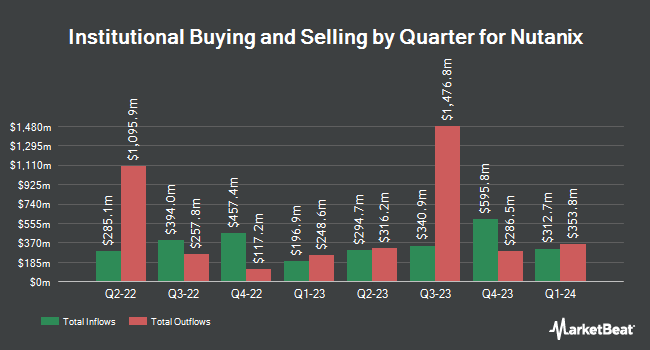

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Cetera Investment Advisers grew its stake in shares of Nutanix by 48.7% in the first quarter. Cetera Investment Advisers now owns 76,103 shares of the technology company's stock worth $4,697,000 after purchasing an additional 24,918 shares in the last quarter. Diversified Trust Co lifted its stake in shares of Nutanix by 46.7% in the 2nd quarter. Diversified Trust Co now owns 36,666 shares of the technology company's stock worth $2,084,000 after acquiring an additional 11,668 shares during the period. Versor Investments LP lifted its stake in shares of Nutanix by 211.7% in the 3rd quarter. Versor Investments LP now owns 33,352 shares of the technology company's stock worth $1,976,000 after acquiring an additional 22,652 shares during the period. Marshall Wace LLP raised its holdings in Nutanix by 47.5% during the second quarter. Marshall Wace LLP now owns 1,482,989 shares of the technology company's stock worth $84,308,000 after purchasing an additional 477,838 shares in the last quarter. Finally, Resolute Capital Asset Partners LLC acquired a new stake in Nutanix in the second quarter worth approximately $2,274,000. Institutional investors and hedge funds own 85.25% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently issued reports on the company. JPMorgan Chase & Co. lifted their price target on Nutanix from $65.00 to $75.00 and gave the company an "overweight" rating in a research report on Thursday, August 29th. Oppenheimer began coverage on shares of Nutanix in a research report on Wednesday, November 13th. They set an "outperform" rating and a $80.00 price objective for the company. Royal Bank of Canada boosted their target price on shares of Nutanix from $70.00 to $75.00 and gave the stock an "outperform" rating in a report on Thursday, August 29th. Piper Sandler raised their target price on shares of Nutanix from $77.00 to $83.00 and gave the stock an "overweight" rating in a report on Wednesday. Finally, Northland Securities reaffirmed a "market perform" rating and issued a $77.00 price target (up previously from $74.00) on shares of Nutanix in a report on Wednesday. Three research analysts have rated the stock with a hold rating and fourteen have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $78.86.

Read Our Latest Stock Report on NTNX

Nutanix Price Performance

NTNX traded down $5.65 on Thursday, reaching $66.70. 7,735,697 shares of the company traded hands, compared to its average volume of 2,582,859. The company has a market cap of $17.69 billion, a price-to-earnings ratio of -128.27, a PEG ratio of 12.05 and a beta of 1.17. The stock's 50 day moving average price is $64.64 and its 200-day moving average price is $59.40. Nutanix, Inc. has a 52-week low of $40.44 and a 52-week high of $75.80.

Nutanix (NASDAQ:NTNX - Get Free Report) last posted its quarterly earnings results on Wednesday, August 28th. The technology company reported ($0.06) EPS for the quarter, beating the consensus estimate of ($0.08) by $0.02. The business had revenue of $547.95 million for the quarter, compared to analysts' expectations of $537.12 million. Nutanix had a negative net margin of 5.81% and a negative return on equity of 7.57%. As a group, equities research analysts forecast that Nutanix, Inc. will post 0.31 earnings per share for the current fiscal year.

Insider Buying and Selling at Nutanix

In other news, CFO Rukmini Sivaraman sold 24,316 shares of the firm's stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of $58.85, for a total transaction of $1,430,996.60. Following the transaction, the chief financial officer now owns 192,169 shares in the company, valued at approximately $11,309,145.65. This trade represents a 11.23 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, COO David Sangster sold 11,950 shares of Nutanix stock in a transaction on Monday, September 16th. The shares were sold at an average price of $59.83, for a total transaction of $714,968.50. Following the completion of the sale, the chief operating officer now directly owns 123,868 shares of the company's stock, valued at approximately $7,411,022.44. The trade was a 8.80 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 6.80% of the company's stock.

Nutanix Profile

(

Free Report)

Nutanix, Inc provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa. The company offers hyperconverged infrastructure software stack that converges virtualization, storage, and networking services into a turnkey solution; Acropolis Hypervisor, an enterprise-grade virtualization solution; flow virtual networking and flow network security, which offers services to visualize the network, automate common network operations, and build virtual private networks; Nutanix Kubernetes Engine for automated deployment and management of Kubernetes clusters to simplify the provisioning, operations, and lifecycle management of cloud-native environments, applications, and microservices; and Nutanix Cloud Clusters.

See Also

Before you consider Nutanix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutanix wasn't on the list.

While Nutanix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.