Baker BROS. Advisors LP increased its position in shares of CRISPR Therapeutics AG (NASDAQ:CRSP - Free Report) by 743.1% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 843,075 shares of the company's stock after purchasing an additional 743,075 shares during the quarter. CRISPR Therapeutics accounts for approximately 0.4% of Baker BROS. Advisors LP's investment portfolio, making the stock its 27th largest position. Baker BROS. Advisors LP owned 0.99% of CRISPR Therapeutics worth $39,608,000 at the end of the most recent reporting period.

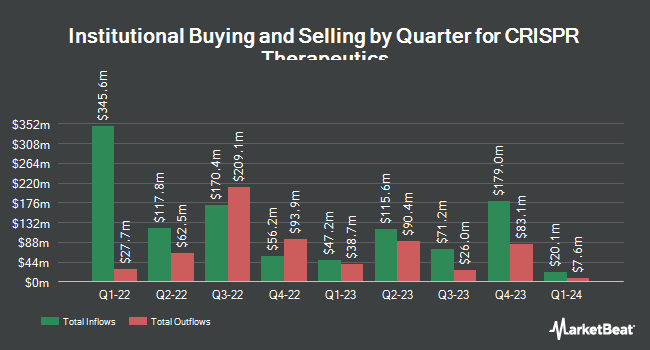

Other institutional investors and hedge funds have also bought and sold shares of the company. Global Trust Asset Management LLC lifted its holdings in shares of CRISPR Therapeutics by 150.0% in the second quarter. Global Trust Asset Management LLC now owns 500 shares of the company's stock worth $27,000 after acquiring an additional 300 shares during the last quarter. Larson Financial Group LLC lifted its holdings in shares of CRISPR Therapeutics by 95.5% in the second quarter. Larson Financial Group LLC now owns 565 shares of the company's stock worth $31,000 after acquiring an additional 276 shares during the last quarter. GPS Wealth Strategies Group LLC lifted its holdings in shares of CRISPR Therapeutics by 99.7% in the second quarter. GPS Wealth Strategies Group LLC now owns 615 shares of the company's stock worth $33,000 after acquiring an additional 307 shares during the last quarter. Itau Unibanco Holding S.A. bought a new position in shares of CRISPR Therapeutics in the second quarter worth about $35,000. Finally, Darwin Wealth Management LLC bought a new position in shares of CRISPR Therapeutics in the third quarter worth about $43,000. Institutional investors own 69.20% of the company's stock.

Insider Transactions at CRISPR Therapeutics

In other news, CEO Samarth Kulkarni sold 30,000 shares of CRISPR Therapeutics stock in a transaction on Monday, November 11th. The stock was sold at an average price of $55.62, for a total transaction of $1,668,600.00. Following the sale, the chief executive officer now directly owns 196,540 shares in the company, valued at $10,931,554.80. The trade was a 13.24 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, General Counsel James R. Kasinger sold 1,089 shares of CRISPR Therapeutics stock in a transaction dated Monday, October 14th. The stock was sold at an average price of $46.28, for a total value of $50,398.92. Following the completion of the sale, the general counsel now directly owns 62,597 shares of the company's stock, valued at approximately $2,896,989.16. This trade represents a 1.71 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 35,382 shares of company stock worth $1,917,679 in the last ninety days. Company insiders own 4.10% of the company's stock.

Analysts Set New Price Targets

CRSP has been the subject of a number of research reports. Chardan Capital dropped their price objective on shares of CRISPR Therapeutics from $112.00 to $94.00 and set a "buy" rating for the company in a report on Tuesday, August 6th. Needham & Company LLC reiterated a "buy" rating and issued a $84.00 price objective on shares of CRISPR Therapeutics in a report on Wednesday, November 6th. Royal Bank of Canada reiterated a "sector perform" rating and issued a $53.00 price objective on shares of CRISPR Therapeutics in a report on Wednesday, November 6th. StockNews.com raised shares of CRISPR Therapeutics to a "sell" rating in a research report on Thursday, November 7th. Finally, Stifel Nicolaus decreased their target price on shares of CRISPR Therapeutics from $60.00 to $59.00 and set a "hold" rating for the company in a research report on Tuesday, August 6th. Three research analysts have rated the stock with a sell rating, eight have assigned a hold rating and nine have issued a buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $74.94.

Check Out Our Latest Analysis on CRISPR Therapeutics

CRISPR Therapeutics Stock Up 7.6 %

NASDAQ:CRSP traded up $3.88 during trading hours on Monday, hitting $55.05. 3,257,177 shares of the company traded hands, compared to its average volume of 1,490,486. The firm's 50-day simple moving average is $48.13 and its 200-day simple moving average is $51.58. CRISPR Therapeutics AG has a one year low of $43.42 and a one year high of $91.10. The company has a market cap of $4.70 billion, a PE ratio of -18.08 and a beta of 1.67.

CRISPR Therapeutics (NASDAQ:CRSP - Get Free Report) last issued its quarterly earnings data on Tuesday, November 5th. The company reported ($1.01) earnings per share for the quarter, beating the consensus estimate of ($1.42) by $0.41. The business had revenue of $0.60 million for the quarter, compared to analysts' expectations of $6.65 million. CRISPR Therapeutics had a negative return on equity of 12.15% and a negative net margin of 118.13%. During the same period last year, the business earned ($1.41) EPS. As a group, equities research analysts expect that CRISPR Therapeutics AG will post -5.14 EPS for the current year.

About CRISPR Therapeutics

(

Free Report)

CRISPR Therapeutics is a gene-editing company focused on developing transformative gene-based medicines for serious diseases using its proprietary CRISPR/Cas9 platform. CRISPR/Cas9 is a revolutionary gene-editing technology that allows for precise, directed changes to genomic DNA. CRISPR Therapeutics has established a portfolio of therapeutic programs across a broad range of disease areas including hemoglobinopathies, oncology, regenerative medicine and rare diseases.

Featured Articles

Before you consider CRISPR Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CRISPR Therapeutics wasn't on the list.

While CRISPR Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.