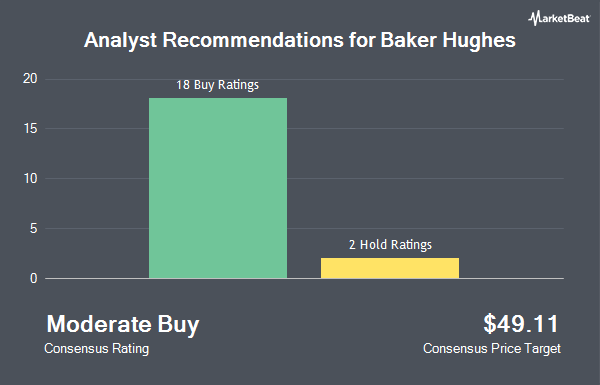

Shares of Baker Hughes (NASDAQ:BKR - Get Free Report) have earned a consensus rating of "Moderate Buy" from the nineteen research firms that are presently covering the stock, MarketBeat reports. Two investment analysts have rated the stock with a hold rating and seventeen have assigned a buy rating to the company. The average 1-year price objective among brokerages that have issued ratings on the stock in the last year is $50.65.

BKR has been the topic of a number of recent analyst reports. TD Cowen decreased their price target on Baker Hughes from $53.00 to $51.00 and set a "buy" rating on the stock in a report on Wednesday, January 8th. Royal Bank of Canada lifted their price target on shares of Baker Hughes from $49.00 to $53.00 and gave the company an "outperform" rating in a report on Monday, February 3rd. Wells Fargo & Company increased their price objective on shares of Baker Hughes from $49.00 to $54.00 and gave the company an "overweight" rating in a report on Monday, February 3rd. Jefferies Financial Group lifted their target price on Baker Hughes from $48.00 to $50.00 and gave the stock a "buy" rating in a report on Friday, January 3rd. Finally, Stifel Nicolaus dropped their price target on Baker Hughes from $54.00 to $52.00 and set a "buy" rating for the company in a research note on Tuesday.

View Our Latest Report on Baker Hughes

Insider Activity

In other news, EVP Maria C. Borras sold 8,000 shares of the stock in a transaction on Monday, January 27th. The stock was sold at an average price of $44.77, for a total transaction of $358,160.00. Following the transaction, the executive vice president now owns 173,302 shares of the company's stock, valued at approximately $7,758,730.54. This represents a 4.41 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Insiders own 0.27% of the company's stock.

Institutional Trading of Baker Hughes

Hedge funds have recently added to or reduced their stakes in the business. Dynasty Wealth Management LLC lifted its position in shares of Baker Hughes by 2.7% in the 4th quarter. Dynasty Wealth Management LLC now owns 7,904 shares of the company's stock worth $324,000 after purchasing an additional 207 shares during the period. Larson Financial Group LLC raised its stake in Baker Hughes by 41.2% in the fourth quarter. Larson Financial Group LLC now owns 740 shares of the company's stock worth $30,000 after buying an additional 216 shares in the last quarter. Alpine Woods Capital Investors LLC lifted its holdings in Baker Hughes by 0.7% during the fourth quarter. Alpine Woods Capital Investors LLC now owns 40,467 shares of the company's stock worth $1,660,000 after buying an additional 267 shares during the period. Cromwell Holdings LLC boosted its position in Baker Hughes by 9.3% during the 4th quarter. Cromwell Holdings LLC now owns 3,169 shares of the company's stock valued at $130,000 after acquiring an additional 269 shares in the last quarter. Finally, 180 Wealth Advisors LLC increased its holdings in shares of Baker Hughes by 1.3% in the 4th quarter. 180 Wealth Advisors LLC now owns 22,506 shares of the company's stock valued at $923,000 after acquiring an additional 295 shares during the period. 92.06% of the stock is owned by hedge funds and other institutional investors.

Baker Hughes Stock Performance

Shares of NASDAQ:BKR traded up $0.73 during mid-day trading on Wednesday, reaching $38.86. 5,548,880 shares of the company traded hands, compared to its average volume of 6,876,305. The company's 50 day moving average price is $42.50 and its 200-day moving average price is $42.05. The firm has a market cap of $38.47 billion, a PE ratio of 13.04, a PEG ratio of 2.00 and a beta of 1.08. Baker Hughes has a 52 week low of $30.93 and a 52 week high of $49.40. The company has a debt-to-equity ratio of 0.35, a current ratio of 1.32 and a quick ratio of 0.94.

Baker Hughes (NASDAQ:BKR - Get Free Report) last posted its quarterly earnings results on Thursday, January 30th. The company reported $0.70 earnings per share for the quarter, topping analysts' consensus estimates of $0.63 by $0.07. Baker Hughes had a net margin of 10.70% and a return on equity of 14.58%. On average, equities analysts expect that Baker Hughes will post 2.59 EPS for the current fiscal year.

Baker Hughes Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, February 21st. Shareholders of record on Tuesday, February 11th were paid a $0.23 dividend. This is an increase from Baker Hughes's previous quarterly dividend of $0.21. This represents a $0.92 dividend on an annualized basis and a yield of 2.37%. The ex-dividend date was Tuesday, February 11th. Baker Hughes's dividend payout ratio is currently 30.87%.

Baker Hughes Company Profile

(

Get Free ReportBaker Hughes Company provides a portfolio of technologies and services to energy and industrial value chain worldwide. The company operates through Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET) segments. The OFSE segment designs and manufactures products and provides related services, including exploration, appraisal, development, production, rejuvenation, and decommissioning for onshore and offshore oilfield operations.

Recommended Stories

Before you consider Baker Hughes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baker Hughes wasn't on the list.

While Baker Hughes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.