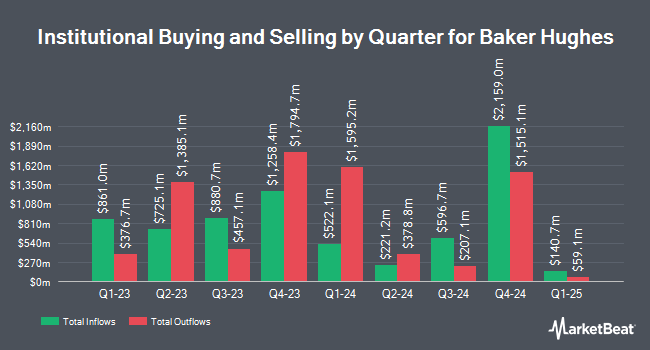

Hantz Financial Services Inc. lifted its stake in Baker Hughes (NASDAQ:BKR - Free Report) by 549.7% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 58,648 shares of the company's stock after acquiring an additional 49,621 shares during the quarter. Hantz Financial Services Inc.'s holdings in Baker Hughes were worth $2,406,000 as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds and other institutional investors have also modified their holdings of the company. National Pension Service increased its position in Baker Hughes by 6.4% in the 3rd quarter. National Pension Service now owns 1,362,973 shares of the company's stock worth $49,271,000 after purchasing an additional 81,625 shares during the last quarter. Burney Co. grew its stake in shares of Baker Hughes by 315.0% in the 4th quarter. Burney Co. now owns 138,788 shares of the company's stock valued at $5,693,000 after buying an additional 105,349 shares in the last quarter. Northstar Advisory Group LLC acquired a new position in Baker Hughes in the fourth quarter worth approximately $1,180,000. Artemis Investment Management LLP raised its position in Baker Hughes by 29.4% during the fourth quarter. Artemis Investment Management LLP now owns 1,053,947 shares of the company's stock valued at $43,233,000 after acquiring an additional 239,773 shares in the last quarter. Finally, Czech National Bank lifted its stake in Baker Hughes by 6.0% in the fourth quarter. Czech National Bank now owns 214,549 shares of the company's stock valued at $8,801,000 after acquiring an additional 12,178 shares during the last quarter. 92.06% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of research firms have recently weighed in on BKR. Argus upgraded shares of Baker Hughes from a "hold" rating to a "buy" rating in a report on Friday, October 25th. Benchmark reiterated a "buy" rating and set a $42.00 price target on shares of Baker Hughes in a research note on Thursday, October 24th. Stifel Nicolaus raised their price objective on Baker Hughes from $45.00 to $48.00 and gave the company a "buy" rating in a research note on Monday, November 25th. Wells Fargo & Company upped their target price on Baker Hughes from $42.00 to $49.00 and gave the stock an "overweight" rating in a research report on Tuesday, December 17th. Finally, Piper Sandler started coverage on shares of Baker Hughes in a research report on Thursday, December 19th. They issued an "overweight" rating and a $53.00 price target on the stock. Two equities research analysts have rated the stock with a hold rating and seventeen have given a buy rating to the company. According to MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $48.06.

Read Our Latest Stock Report on BKR

Insider Buying and Selling at Baker Hughes

In other news, EVP Maria C. Borras sold 8,000 shares of the business's stock in a transaction on Monday, January 27th. The shares were sold at an average price of $44.77, for a total value of $358,160.00. Following the sale, the executive vice president now owns 173,302 shares in the company, valued at approximately $7,758,730.54. The trade was a 4.41 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 0.25% of the company's stock.

Baker Hughes Price Performance

Shares of NASDAQ:BKR opened at $44.60 on Friday. The firm has a market capitalization of $44.13 billion, a PE ratio of 20.00, a PEG ratio of 0.88 and a beta of 1.39. The company has a current ratio of 1.30, a quick ratio of 0.88 and a debt-to-equity ratio of 0.37. Baker Hughes has a 1-year low of $28.32 and a 1-year high of $47.47. The business's 50 day moving average is $43.00 and its 200-day moving average is $38.96.

Baker Hughes (NASDAQ:BKR - Get Free Report) last announced its quarterly earnings results on Thursday, January 30th. The company reported $0.70 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.63 by $0.07. Baker Hughes had a net margin of 8.20% and a return on equity of 13.77%. Sell-side analysts predict that Baker Hughes will post 2.29 earnings per share for the current year.

Baker Hughes Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, February 21st. Shareholders of record on Tuesday, February 11th will be paid a dividend of $0.23 per share. This is a boost from Baker Hughes's previous quarterly dividend of $0.21. This represents a $0.92 dividend on an annualized basis and a yield of 2.06%. Baker Hughes's dividend payout ratio (DPR) is currently 37.67%.

Baker Hughes Profile

(

Free Report)

Baker Hughes Company provides a portfolio of technologies and services to energy and industrial value chain worldwide. The company operates through Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET) segments. The OFSE segment designs and manufactures products and provides related services, including exploration, appraisal, development, production, rejuvenation, and decommissioning for onshore and offshore oilfield operations.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Baker Hughes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baker Hughes wasn't on the list.

While Baker Hughes currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.