Balboa Wealth Partners lowered its position in shares of Cameco Co. (NYSE:CCJ - Free Report) TSE: CCO by 69.8% during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 4,650 shares of the basic materials company's stock after selling 10,726 shares during the quarter. Balboa Wealth Partners' holdings in Cameco were worth $222,000 at the end of the most recent quarter.

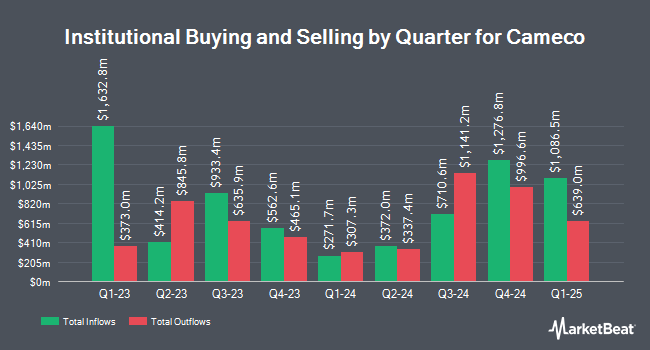

Other large investors also recently bought and sold shares of the company. Vanguard Group Inc. boosted its holdings in shares of Cameco by 1.3% in the 1st quarter. Vanguard Group Inc. now owns 15,911,954 shares of the basic materials company's stock valued at $689,306,000 after buying an additional 200,871 shares during the period. Capital World Investors boosted its stake in Cameco by 1.6% in the first quarter. Capital World Investors now owns 13,708,235 shares of the basic materials company's stock valued at $593,524,000 after acquiring an additional 215,741 shares during the period. Price T Rowe Associates Inc. MD grew its holdings in shares of Cameco by 3.2% during the first quarter. Price T Rowe Associates Inc. MD now owns 6,514,500 shares of the basic materials company's stock valued at $282,210,000 after purchasing an additional 202,157 shares during the last quarter. William Blair Investment Management LLC raised its position in shares of Cameco by 6.8% during the 2nd quarter. William Blair Investment Management LLC now owns 4,160,009 shares of the basic materials company's stock worth $204,672,000 after purchasing an additional 265,196 shares during the period. Finally, Driehaus Capital Management LLC lifted its holdings in shares of Cameco by 4.7% in the 2nd quarter. Driehaus Capital Management LLC now owns 3,915,086 shares of the basic materials company's stock worth $192,622,000 after purchasing an additional 176,183 shares during the last quarter. Institutional investors own 70.21% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities research analysts have weighed in on the company. Glj Research reaffirmed a "buy" rating and issued a $63.73 target price on shares of Cameco in a research report on Wednesday, August 14th. National Bank Financial raised shares of Cameco to a "strong-buy" rating in a research note on Tuesday, September 3rd. Cantor Fitzgerald upgraded shares of Cameco from a "neutral" rating to an "overweight" rating in a research note on Wednesday, July 31st. Scotiabank reduced their price objective on Cameco from $81.00 to $80.00 and set an "outperform" rating for the company in a research report on Monday, August 19th. Finally, Janney Montgomery Scott upgraded Cameco to a "strong-buy" rating in a research report on Friday, October 4th. One investment analyst has rated the stock with a sell rating, five have given a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Buy" and a consensus price target of $66.56.

View Our Latest Report on CCJ

Cameco Trading Up 0.9 %

Shares of Cameco stock traded up $0.48 on Friday, reaching $53.59. 10,937,847 shares of the company were exchanged, compared to its average volume of 4,443,106. The company has a current ratio of 2.88, a quick ratio of 1.26 and a debt-to-equity ratio of 0.20. Cameco Co. has a fifty-two week low of $35.43 and a fifty-two week high of $58.72. The firm has a market capitalization of $23.32 billion, a price-to-earnings ratio of 281.95 and a beta of 0.89. The stock has a fifty day moving average price of $49.73 and a 200-day moving average price of $48.33.

Cameco (NYSE:CCJ - Get Free Report) TSE: CCO last released its earnings results on Thursday, November 7th. The basic materials company reported ($0.01) earnings per share for the quarter, missing the consensus estimate of $0.39 by ($0.40). Cameco had a return on equity of 3.33% and a net margin of 4.15%. The firm had revenue of $721.00 million during the quarter, compared to analysts' expectations of $646.83 million. During the same period last year, the business earned $0.24 earnings per share. The business's revenue was up 25.4% on a year-over-year basis. On average, analysts expect that Cameco Co. will post 0.69 EPS for the current year.

Cameco Increases Dividend

The firm also recently announced an annual dividend, which will be paid on Friday, December 13th. Stockholders of record on Wednesday, November 27th will be issued a $0.118 dividend. This is an increase from Cameco's previous annual dividend of $0.09. The ex-dividend date of this dividend is Wednesday, November 27th. This represents a dividend yield of 0.22%. Cameco's dividend payout ratio is currently 57.89%.

About Cameco

(

Free Report)

Cameco Corporation provides uranium for the generation of electricity. It operates through Uranium, Fuel Services, Westinghouse segments. The Uranium segment is involved in the exploration for, mining, and milling, purchase, and sale of uranium concentrate. The Fuel Services segment engages in the refining, conversion, and fabrication of uranium concentrate, as well as the purchase and sale of conversion services.

Featured Articles

Before you consider Cameco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cameco wasn't on the list.

While Cameco currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.