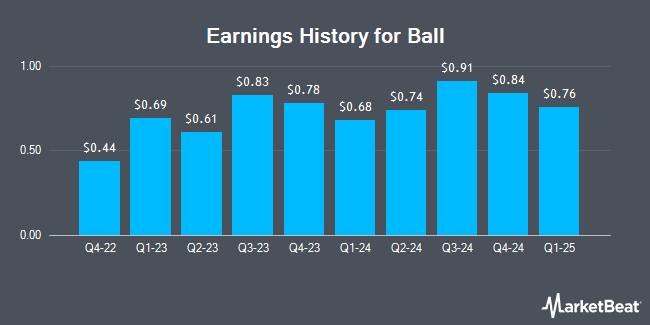

Ball (NYSE:BALL - Get Free Report) is projected to release its earnings data before the market opens on Tuesday, February 4th. Analysts expect Ball to post earnings of $0.81 per share and revenue of $2.91 billion for the quarter. Investors interested in registering for the company's conference call can do so using this link.

Ball (NYSE:BALL - Get Free Report) last announced its earnings results on Thursday, October 31st. The company reported $0.91 EPS for the quarter, topping the consensus estimate of $0.87 by $0.04. The company had revenue of $3.08 billion for the quarter, compared to analysts' expectations of $3.13 billion. Ball had a net margin of 34.05% and a return on equity of 17.46%. The business's revenue for the quarter was down .9% on a year-over-year basis. During the same period last year, the firm earned $0.83 earnings per share. On average, analysts expect Ball to post $3 EPS for the current fiscal year and $4 EPS for the next fiscal year.

Ball Price Performance

NYSE:BALL traded down $0.96 during trading hours on Tuesday, reaching $55.57. 1,854,946 shares of the company were exchanged, compared to its average volume of 2,343,085. The company has a market capitalization of $16.58 billion, a P/E ratio of 4.19, a P/E/G ratio of 1.35 and a beta of 0.93. The company has a debt-to-equity ratio of 0.79, a current ratio of 1.09 and a quick ratio of 0.82. The business has a 50 day moving average of $56.96 and a 200 day moving average of $61.41. Ball has a 1-year low of $51.96 and a 1-year high of $71.32.

Wall Street Analyst Weigh In

Several research analysts have commented on the company. Citigroup lowered their target price on Ball from $69.00 to $59.00 and set a "neutral" rating for the company in a research note on Monday, January 6th. Morgan Stanley lowered their price objective on shares of Ball from $78.00 to $75.00 and set an "overweight" rating for the company in a research report on Monday, January 13th. Wells Fargo & Company restated an "underweight" rating and issued a $49.00 target price (down previously from $56.00) on shares of Ball in a research report on Thursday, January 16th. Royal Bank of Canada reiterated an "outperform" rating and issued a $75.00 price target on shares of Ball in a research note on Monday, November 4th. Finally, UBS Group upgraded Ball from a "sell" rating to a "neutral" rating and reduced their price objective for the stock from $62.00 to $58.00 in a research report on Friday, January 10th. One research analyst has rated the stock with a sell rating, five have assigned a hold rating, seven have issued a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $68.17.

View Our Latest Analysis on Ball

Ball Company Profile

(

Get Free Report)

Ball Corporation supplies aluminum packaging products for the beverage, personal care, and household products industries in the United States, Brazil, and internationally. The company manufactures and sells aluminum beverage containers to fillers of carbonated soft drinks, beer, energy drinks, and other beverages.

Featured Stories

Before you consider Ball, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ball wasn't on the list.

While Ball currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.