Bamco Inc. NY lowered its position in shares of Choice Hotels International, Inc. (NYSE:CHH - Free Report) by 1.1% during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 4,716,314 shares of the company's stock after selling 53,727 shares during the quarter. Choice Hotels International comprises 1.6% of Bamco Inc. NY's portfolio, making the stock its 12th largest position. Bamco Inc. NY owned approximately 10.05% of Choice Hotels International worth $614,536,000 at the end of the most recent quarter.

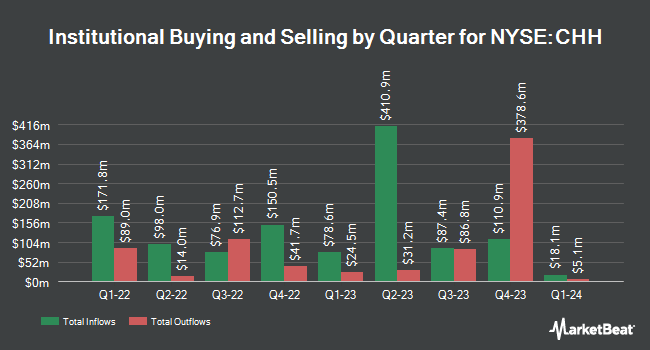

Several other institutional investors and hedge funds have also recently bought and sold shares of the business. Blue Trust Inc. raised its position in shares of Choice Hotels International by 307.4% during the 2nd quarter. Blue Trust Inc. now owns 220 shares of the company's stock worth $28,000 after buying an additional 166 shares in the last quarter. Tortoise Investment Management LLC boosted its position in shares of Choice Hotels International by 129.4% during the 2nd quarter. Tortoise Investment Management LLC now owns 250 shares of the company's stock valued at $30,000 after purchasing an additional 141 shares in the last quarter. Whittier Trust Co. of Nevada Inc. grew its stake in shares of Choice Hotels International by 1,146.9% in the 2nd quarter. Whittier Trust Co. of Nevada Inc. now owns 399 shares of the company's stock worth $47,000 after purchasing an additional 367 shares during the last quarter. Hantz Financial Services Inc. bought a new stake in shares of Choice Hotels International in the 2nd quarter worth approximately $56,000. Finally, Quest Partners LLC acquired a new stake in Choice Hotels International during the second quarter valued at approximately $69,000. Institutional investors and hedge funds own 65.57% of the company's stock.

Insider Buying and Selling at Choice Hotels International

In related news, SVP Simone Wu sold 7,840 shares of the stock in a transaction that occurred on Thursday, September 19th. The stock was sold at an average price of $130.08, for a total transaction of $1,019,827.20. Following the completion of the transaction, the senior vice president now directly owns 45,669 shares of the company's stock, valued at approximately $5,940,623.52. This represents a 14.65 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, EVP Dominic Dragisich sold 9,138 shares of the business's stock in a transaction that occurred on Friday, October 11th. The stock was sold at an average price of $134.88, for a total value of $1,232,533.44. Following the transaction, the executive vice president now directly owns 68,509 shares in the company, valued at $9,240,493.92. This trade represents a 11.77 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 71,437 shares of company stock valued at $9,788,980 in the last 90 days. 24.02% of the stock is currently owned by company insiders.

Choice Hotels International Trading Up 0.1 %

CHH traded up $0.10 during mid-day trading on Monday, reaching $151.34. The stock had a trading volume of 106,711 shares, compared to its average volume of 469,483. The firm's fifty day simple moving average is $139.24 and its two-hundred day simple moving average is $127.79. The stock has a market capitalization of $7.10 billion, a P/E ratio of 28.97, a P/E/G ratio of 2.39 and a beta of 1.24. Choice Hotels International, Inc. has a 52 week low of $108.91 and a 52 week high of $153.81. The company has a debt-to-equity ratio of 177.75, a quick ratio of 0.71 and a current ratio of 0.71.

Choice Hotels International (NYSE:CHH - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The company reported $2.23 earnings per share for the quarter, beating the consensus estimate of $1.92 by $0.31. Choice Hotels International had a net margin of 16.27% and a negative return on equity of 659.01%. The business had revenue of $428.00 million for the quarter, compared to analyst estimates of $432.62 million. During the same period in the prior year, the business posted $1.82 earnings per share. Choice Hotels International's revenue was up .6% compared to the same quarter last year. On average, equities analysts predict that Choice Hotels International, Inc. will post 6.84 EPS for the current year.

Choice Hotels International Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Wednesday, October 16th. Shareholders of record on Tuesday, October 1st were issued a dividend of $0.2875 per share. This represents a $1.15 dividend on an annualized basis and a yield of 0.76%. The ex-dividend date was Tuesday, October 1st. Choice Hotels International's dividend payout ratio (DPR) is presently 22.03%.

Wall Street Analyst Weigh In

A number of brokerages have recently commented on CHH. Robert W. Baird increased their price objective on Choice Hotels International from $138.00 to $145.00 and gave the company an "outperform" rating in a research report on Wednesday, November 6th. Deutsche Bank Aktiengesellschaft lifted their price target on Choice Hotels International from $113.00 to $114.00 and gave the stock a "hold" rating in a research note on Tuesday, November 5th. UBS Group reduced their price objective on shares of Choice Hotels International from $126.00 to $125.00 and set a "neutral" rating for the company in a research note on Friday, August 9th. Barclays boosted their price target on shares of Choice Hotels International from $112.00 to $123.00 and gave the company an "underweight" rating in a report on Tuesday, November 5th. Finally, Susquehanna raised their price target on shares of Choice Hotels International from $125.00 to $130.00 and gave the stock a "neutral" rating in a report on Thursday, November 7th. Three investment analysts have rated the stock with a sell rating, seven have issued a hold rating and one has assigned a buy rating to the stock. According to MarketBeat.com, Choice Hotels International presently has a consensus rating of "Hold" and a consensus target price of $130.00.

Get Our Latest Stock Analysis on Choice Hotels International

Choice Hotels International Profile

(

Free Report)

Choice Hotels International, Inc, together with its subsidiaries, operates as a hotel franchisor in the United States and internationally. It operates through Hotel Franchising & Management and Corporate & Other segments. The company franchises lodging properties under the brand names of Comfort Inn, Comfort Suites, Quality, Clarion, Clarion Pointe, Sleep Inn, Ascend Hotel Collection, Econo Lodge, Rodeway Inn, MainStay Suites, Suburban Studios, WoodSpring Suites, Everhome Suites, Cambria Hotels, Radisson Blu, Radisson RED, Radisson, Park Plaza, Country Inn & Suites by Radisson, Radisson Inn & Suites, Park Inn by Radisson, Radisson Individuals, and Radisson Collection.

Featured Stories

Before you consider Choice Hotels International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Choice Hotels International wasn't on the list.

While Choice Hotels International currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report