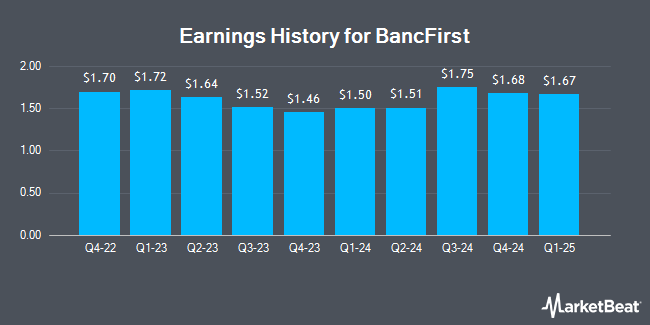

BancFirst (NASDAQ:BANF - Get Free Report) is expected to be issuing its quarterly earnings data before the market opens on Thursday, April 17th. Analysts expect the company to announce earnings of $1.57 per share and revenue of $161.72 million for the quarter.

BancFirst (NASDAQ:BANF - Get Free Report) last issued its quarterly earnings data on Thursday, January 23rd. The bank reported $1.68 EPS for the quarter, beating the consensus estimate of $1.61 by $0.07. BancFirst had a net margin of 23.52% and a return on equity of 14.21%. On average, analysts expect BancFirst to post $7 EPS for the current fiscal year and $6 EPS for the next fiscal year.

BancFirst Price Performance

NASDAQ:BANF traded up $1.93 during trading hours on Tuesday, hitting $106.00. The stock had a trading volume of 80,245 shares, compared to its average volume of 101,210. The company has a 50 day simple moving average of $112.10 and a two-hundred day simple moving average of $115.61. The firm has a market capitalization of $3.52 billion, a price-to-earnings ratio of 16.46 and a beta of 0.82. The company has a debt-to-equity ratio of 0.05, a current ratio of 0.98 and a quick ratio of 0.98. BancFirst has a one year low of $81.21 and a one year high of $132.29.

BancFirst Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, April 15th. Investors of record on Monday, March 31st will be given a dividend of $0.46 per share. This represents a $1.84 annualized dividend and a yield of 1.74%. The ex-dividend date of this dividend is Monday, March 31st. BancFirst's payout ratio is 28.57%.

Analyst Upgrades and Downgrades

Separately, StockNews.com raised BancFirst from a "sell" rating to a "hold" rating in a report on Monday.

Read Our Latest Stock Analysis on BANF

Insider Transactions at BancFirst

In other BancFirst news, Director William Scott Martin sold 10,000 shares of the firm's stock in a transaction dated Friday, February 28th. The stock was sold at an average price of $119.13, for a total transaction of $1,191,300.00. Following the sale, the director now owns 214,499 shares in the company, valued at $25,553,265.87. This trade represents a 4.45 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director F Ford Drummond sold 5,000 shares of the company's stock in a transaction dated Wednesday, February 5th. The stock was sold at an average price of $120.58, for a total value of $602,900.00. Following the completion of the transaction, the director now owns 6,000 shares of the company's stock, valued at $723,480. The trade was a 45.45 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 25,000 shares of company stock valued at $2,994,350. Insiders own 33.89% of the company's stock.

About BancFirst

(

Get Free Report)

BancFirst Corporation operates as the bank holding company for BancFirst that provides a range of commercial banking services to retail customers, and small to medium-sized businesses. The company operates through BancFirst Metropolitan Banks, BancFirst Community Banks, Pegasus, Worthington, and Other Financial Services segments.

Read More

Before you consider BancFirst, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BancFirst wasn't on the list.

While BancFirst currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.