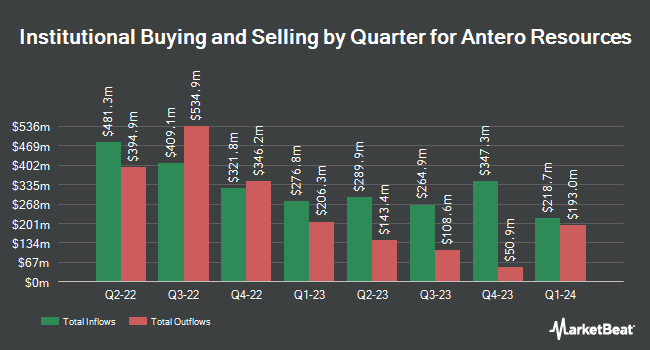

Banco BTG Pactual S.A. acquired a new stake in shares of Antero Resources Co. (NYSE:AR - Free Report) during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm acquired 6,400 shares of the oil and natural gas company's stock, valued at approximately $228,000.

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Pinnacle Bancorp Inc. purchased a new stake in Antero Resources during the fourth quarter valued at $28,000. Spire Wealth Management bought a new stake in shares of Antero Resources in the 4th quarter worth about $31,000. True Wealth Design LLC purchased a new position in shares of Antero Resources during the 3rd quarter worth about $30,000. Wilmington Savings Fund Society FSB grew its stake in shares of Antero Resources by 205.2% during the fourth quarter. Wilmington Savings Fund Society FSB now owns 1,358 shares of the oil and natural gas company's stock valued at $48,000 after buying an additional 913 shares during the last quarter. Finally, UMB Bank n.a. raised its holdings in shares of Antero Resources by 59.6% in the fourth quarter. UMB Bank n.a. now owns 1,401 shares of the oil and natural gas company's stock worth $49,000 after buying an additional 523 shares during the period. Institutional investors own 83.04% of the company's stock.

Insiders Place Their Bets

In other Antero Resources news, Director W Howard Keenan, Jr. sold 200,000 shares of Antero Resources stock in a transaction on Tuesday, February 18th. The stock was sold at an average price of $39.76, for a total value of $7,952,000.00. Following the sale, the director now owns 1,800,000 shares in the company, valued at $71,568,000. The trade was a 10.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 6.70% of the stock is owned by insiders.

Antero Resources Stock Performance

NYSE:AR opened at $40.50 on Tuesday. The company has a market cap of $12.60 billion, a P/E ratio of 126.55 and a beta of 3.38. The company has a current ratio of 0.35, a quick ratio of 0.35 and a debt-to-equity ratio of 0.21. Antero Resources Co. has a twelve month low of $24.53 and a twelve month high of $42.63. The company's 50-day moving average price is $38.47 and its 200-day moving average price is $33.72.

Antero Resources (NYSE:AR - Get Free Report) last released its quarterly earnings data on Wednesday, February 12th. The oil and natural gas company reported $0.54 earnings per share for the quarter, topping analysts' consensus estimates of $0.40 by $0.14. Antero Resources had a return on equity of 0.74% and a net margin of 2.31%. On average, sell-side analysts forecast that Antero Resources Co. will post 2.74 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of equities research analysts have weighed in on the company. Barclays lifted their target price on Antero Resources from $36.00 to $38.00 and gave the company an "equal weight" rating in a research report on Friday, February 14th. Morgan Stanley reissued an "overweight" rating and set a $58.00 target price on shares of Antero Resources in a research report on Wednesday, March 26th. Benchmark reiterated a "hold" rating on shares of Antero Resources in a research note on Friday, January 17th. Citigroup boosted their price target on Antero Resources from $29.00 to $35.00 and gave the stock a "neutral" rating in a research report on Friday, December 6th. Finally, Truist Financial lifted their target price on shares of Antero Resources from $28.00 to $38.00 and gave the stock a "hold" rating in a research note on Monday, January 13th. One investment analyst has rated the stock with a sell rating, eight have issued a hold rating, eight have given a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat.com, Antero Resources currently has a consensus rating of "Moderate Buy" and an average price target of $42.24.

Check Out Our Latest Research Report on AR

Antero Resources Profile

(

Free Report)

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Development; Marketing; and Equity Method Investment in Antero Midstream.

Featured Stories

Before you consider Antero Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Resources wasn't on the list.

While Antero Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.