Banco Macro (NYSE:BMA - Get Free Report) is anticipated to release its earnings data before the market opens on Wednesday, February 26th. Analysts expect Banco Macro to post earnings of $2.41 per share and revenue of $830.64 billion for the quarter. Individual interested in registering for the company's earnings conference call can do so using this link.

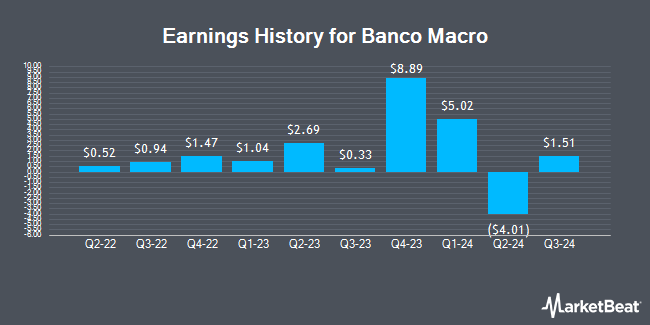

Banco Macro (NYSE:BMA - Get Free Report) last issued its earnings results on Wednesday, November 27th. The bank reported $1.51 earnings per share for the quarter, missing analysts' consensus estimates of $2.21 by ($0.70). Banco Macro had a return on equity of 26.55% and a net margin of 15.12%. On average, analysts expect Banco Macro to post $8 EPS for the current fiscal year and $10 EPS for the next fiscal year.

Banco Macro Stock Down 4.3 %

Shares of NYSE:BMA traded down $4.07 during trading on Friday, reaching $89.68. 315,435 shares of the stock were exchanged, compared to its average volume of 364,630. The company has a debt-to-equity ratio of 0.13, a current ratio of 1.02 and a quick ratio of 0.79. Banco Macro has a 1-year low of $33.74 and a 1-year high of $118.42. The stock has a fifty day moving average of $101.31 and a two-hundred day moving average of $81.07. The firm has a market cap of $5.73 billion, a price-to-earnings ratio of 7.86 and a beta of 1.67.

Analyst Ratings Changes

Separately, Morgan Stanley raised Banco Macro from an "underweight" rating to an "overweight" rating and set a $12.50 target price on the stock in a research report on Monday, December 16th.

View Our Latest Stock Report on Banco Macro

About Banco Macro

(

Get Free Report)

Banco Macro SA provides various banking products and services to retail and corporate customers in Argentina. It offers various retail banking products and services, such as savings and checking accounts, time deposits, credit and debit cards, consumer finance loans, mortgage loans, automobile loans, overdrafts, credit-related services, home and car insurance coverage, tax collection, utility payments, automated teller machines, and money transfers.

Further Reading

Before you consider Banco Macro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banco Macro wasn't on the list.

While Banco Macro currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.