Banco Santander S.A. lessened its holdings in shares of Regency Centers Co. (NASDAQ:REG - Free Report) by 46.1% during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 9,299 shares of the company's stock after selling 7,951 shares during the quarter. Banco Santander S.A.'s holdings in Regency Centers were worth $687,000 at the end of the most recent quarter.

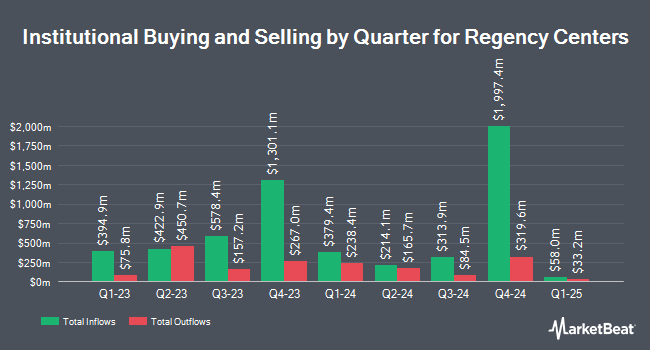

A number of other large investors also recently made changes to their positions in the business. Heck Capital Advisors LLC purchased a new position in shares of Regency Centers in the 4th quarter worth $26,000. National Pension Service purchased a new position in shares of Regency Centers in the 4th quarter worth $27,000. Catalyst Capital Advisors LLC purchased a new position in shares of Regency Centers in the 4th quarter worth $54,000. Venturi Wealth Management LLC raised its position in shares of Regency Centers by 4,400.0% in the 4th quarter. Venturi Wealth Management LLC now owns 855 shares of the company's stock worth $63,000 after buying an additional 836 shares during the period. Finally, Quest Partners LLC raised its position in shares of Regency Centers by 84.8% in the 3rd quarter. Quest Partners LLC now owns 937 shares of the company's stock worth $68,000 after buying an additional 430 shares during the period. Hedge funds and other institutional investors own 96.07% of the company's stock.

Regency Centers Stock Down 0.0 %

Shares of Regency Centers stock traded down $0.02 during trading hours on Monday, hitting $73.94. 1,048,546 shares of the company's stock traded hands, compared to its average volume of 1,010,784. The stock has a 50 day simple moving average of $72.93 and a 200-day simple moving average of $73.02. The company has a quick ratio of 0.95, a current ratio of 0.85 and a debt-to-equity ratio of 0.66. The company has a market cap of $13.41 billion, a PE ratio of 34.88, a PEG ratio of 3.75 and a beta of 1.23. Regency Centers Co. has a twelve month low of $51.88 and a twelve month high of $78.18.

Regency Centers (NASDAQ:REG - Get Free Report) last posted its quarterly earnings results on Thursday, February 6th. The company reported $1.09 EPS for the quarter, topping analysts' consensus estimates of $0.48 by $0.61. Regency Centers had a return on equity of 5.91% and a net margin of 27.54%. Equities research analysts anticipate that Regency Centers Co. will post 4.54 earnings per share for the current fiscal year.

Regency Centers Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, April 2nd. Investors of record on Wednesday, March 12th will be paid a $0.705 dividend. The ex-dividend date of this dividend is Wednesday, March 12th. This represents a $2.82 dividend on an annualized basis and a yield of 3.81%. Regency Centers's dividend payout ratio (DPR) is 133.02%.

Insider Buying and Selling

In other Regency Centers news, CEO Lisa Palmer sold 25,000 shares of Regency Centers stock in a transaction that occurred on Wednesday, February 19th. The stock was sold at an average price of $73.26, for a total value of $1,831,500.00. Following the completion of the transaction, the chief executive officer now directly owns 139,923 shares in the company, valued at $10,250,758.98. The trade was a 15.16 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CFO Michael J. Mas sold 20,000 shares of Regency Centers stock in a transaction that occurred on Wednesday, February 19th. The shares were sold at an average price of $73.60, for a total value of $1,472,000.00. Following the completion of the transaction, the chief financial officer now owns 54,020 shares of the company's stock, valued at approximately $3,975,872. The trade was a 27.02 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 1.00% of the company's stock.

Wall Street Analysts Forecast Growth

REG has been the topic of several research reports. Wells Fargo & Company cut their target price on Regency Centers from $81.00 to $80.00 and set an "overweight" rating on the stock in a research report on Wednesday, January 29th. Mizuho raised their price objective on Regency Centers from $78.00 to $80.00 and gave the company an "outperform" rating in a research report on Wednesday, January 8th. Evercore ISI cut their price objective on Regency Centers from $78.00 to $77.00 and set an "in-line" rating on the stock in a research report on Tuesday, December 24th. Finally, BTIG Research raised their price objective on Regency Centers from $72.00 to $79.00 and gave the company a "buy" rating in a research report on Wednesday, November 27th. Three research analysts have rated the stock with a hold rating, eight have issued a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $78.08.

Read Our Latest Analysis on REG

Regency Centers Profile

(

Free Report)

Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics. Our portfolio includes thriving properties merchandised with highly productive grocers, restaurants, service providers, and best-in-class retailers that connect to their neighborhoods, communities, and customers.

Featured Articles

Before you consider Regency Centers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regency Centers wasn't on the list.

While Regency Centers currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.