Banco Santander S.A. reduced its stake in shares of The Walt Disney Company (NYSE:DIS - Free Report) by 25.6% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 132,926 shares of the entertainment giant's stock after selling 45,636 shares during the quarter. Banco Santander S.A.'s holdings in Walt Disney were worth $12,786,000 as of its most recent filing with the Securities and Exchange Commission.

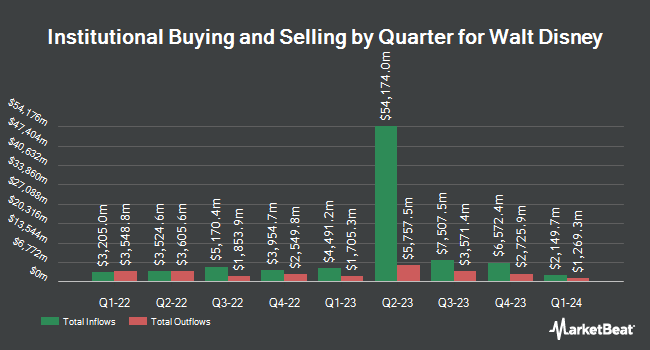

Several other institutional investors and hedge funds also recently added to or reduced their stakes in DIS. Smithfield Trust Co increased its stake in shares of Walt Disney by 0.5% during the 3rd quarter. Smithfield Trust Co now owns 18,869 shares of the entertainment giant's stock worth $1,809,000 after purchasing an additional 102 shares in the last quarter. Pacer Advisors Inc. increased its stake in shares of Walt Disney by 3.7% during the 3rd quarter. Pacer Advisors Inc. now owns 134,529 shares of the entertainment giant's stock worth $12,940,000 after purchasing an additional 4,842 shares in the last quarter. Integrated Investment Consultants LLC increased its stake in shares of Walt Disney by 1,045.6% during the 3rd quarter. Integrated Investment Consultants LLC now owns 63,293 shares of the entertainment giant's stock worth $6,088,000 after purchasing an additional 57,768 shares in the last quarter. John G Ullman & Associates Inc. increased its stake in shares of Walt Disney by 4.3% during the 3rd quarter. John G Ullman & Associates Inc. now owns 92,089 shares of the entertainment giant's stock worth $8,858,000 after purchasing an additional 3,800 shares in the last quarter. Finally, German American Bancorp Inc. increased its stake in shares of Walt Disney by 11.2% during the 3rd quarter. German American Bancorp Inc. now owns 37,921 shares of the entertainment giant's stock worth $3,648,000 after purchasing an additional 3,828 shares in the last quarter. 65.71% of the stock is currently owned by institutional investors and hedge funds.

Ad Stansberry Research

"This Could Be Worse Than the Great Depression, the Dot-Com Crash, and the 2008 Crisis Combined"

What Are These Billionaire Investors Afraid Of?

Billionaires Warren Buffett, Stanley Druckenmiller, George Soros, and David Tepper have all sold off massive U.S. stock positions, including shares of Nvidia, Apple, and Bank of America. Billionaire Ray Dalio, who runs one of the world’s most successful hedge funds, says, “Things are going to get worse for our economy.” What are these billionaires so worried about?

Click here to see why experts and insiders may be preparing for the biggest financial crisis of the

Wall Street Analyst Weigh In

A number of brokerages have recently weighed in on DIS. TD Cowen raised their price objective on shares of Walt Disney from $108.00 to $123.00 and gave the stock a "hold" rating in a research note on Friday, November 15th. Guggenheim lifted their target price on shares of Walt Disney from $110.00 to $130.00 and gave the stock a "buy" rating in a research note on Friday, November 15th. Sanford C. Bernstein lifted their target price on shares of Walt Disney from $115.00 to $120.00 and gave the stock an "outperform" rating in a research note on Friday, November 15th. Wells Fargo & Company lifted their target price on shares of Walt Disney from $116.00 to $138.00 and gave the stock an "overweight" rating in a research note on Friday, November 15th. Finally, Needham & Company LLC lifted their target price on shares of Walt Disney from $110.00 to $130.00 and gave the stock a "buy" rating in a research note on Friday, November 15th. Five equities research analysts have rated the stock with a hold rating, eighteen have issued a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $123.83.

Check Out Our Latest Research Report on DIS

Insiders Place Their Bets

In other news, EVP Brent Woodford sold 5,000 shares of the business's stock in a transaction dated Wednesday, November 20th. The shares were sold at an average price of $113.62, for a total value of $568,100.00. Following the completion of the sale, the executive vice president now owns 44,055 shares of the company's stock, valued at approximately $5,005,529.10. The trade was a 10.19 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 0.10% of the stock is currently owned by company insiders.

Walt Disney Stock Up 0.7 %

Shares of NYSE:DIS traded up $0.85 during midday trading on Thursday, hitting $115.11. 7,877,092 shares of the company's stock traded hands, compared to its average volume of 11,013,997. The company has a debt-to-equity ratio of 0.37, a quick ratio of 0.67 and a current ratio of 0.73. The company has a market cap of $208.46 billion, a PE ratio of 42.48, a P/E/G ratio of 2.09 and a beta of 1.40. The firm's fifty day moving average price is $97.59 and its two-hundred day moving average price is $96.85. The Walt Disney Company has a twelve month low of $83.91 and a twelve month high of $123.74.

About Walt Disney

(

Free Report)

The Walt Disney Company operates as an entertainment company worldwide. It operates through three segments: Entertainment, Sports, and Experiences. The company produces and distributes film and television video streaming content under the ABC Television Network, Disney, Freeform, FX, Fox, National Geographic, and Star brand television channels, as well as ABC television stations and A+E television networks; and produces original content under the ABC Signature, Disney Branded Television, FX Productions, Lucasfilm, Marvel, National Geographic Studios, Pixar, Searchlight Pictures, Twentieth Century Studios, 20th Television, and Walt Disney Pictures banners.

Recommended Stories

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.