Bank First (NASDAQ:BFC - Get Free Report) is anticipated to announce its earnings results before the market opens on Tuesday, January 21st. Analysts expect the company to announce earnings of $1.55 per share and revenue of $40,350.00 billion for the quarter.

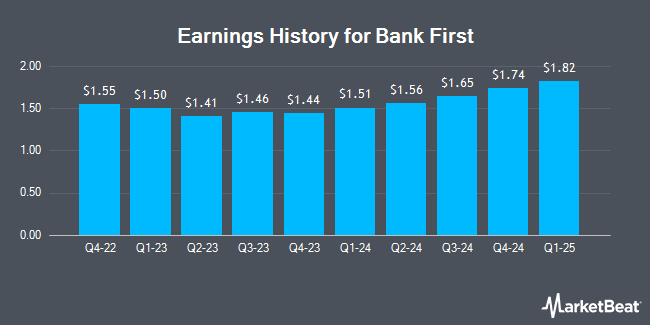

Bank First (NASDAQ:BFC - Get Free Report) last posted its earnings results on Tuesday, October 15th. The company reported $1.65 earnings per share for the quarter, beating the consensus estimate of $1.54 by $0.11. The company had revenue of $58.93 million for the quarter, compared to analyst estimates of $39.60 million. Bank First had a net margin of 32.02% and a return on equity of 10.10%. On average, analysts expect Bank First to post $6 EPS for the current fiscal year and $7 EPS for the next fiscal year.

Bank First Trading Up 1.0 %

NASDAQ:BFC traded up $0.95 on Wednesday, hitting $99.33. The stock had a trading volume of 16,140 shares, compared to its average volume of 19,071. The company has a quick ratio of 1.00, a current ratio of 1.00 and a debt-to-equity ratio of 0.02. The stock has a market cap of $994.49 million, a price-to-earnings ratio of 12.20 and a beta of 0.35. The company has a fifty day moving average price of $102.89 and a two-hundred day moving average price of $94.03. Bank First has a 1-year low of $74.90 and a 1-year high of $110.49.

Analyst Upgrades and Downgrades

Separately, Piper Sandler boosted their target price on shares of Bank First from $99.00 to $104.00 and gave the company a "neutral" rating in a report on Thursday, October 17th.

Check Out Our Latest Report on Bank First

About Bank First

(

Get Free Report)

Bank First Corporation operates as a holding company for Bank First, N.A. that provides consumer and commercial financial services to businesses, professionals, consumers, associations, individuals, and governmental authorities in Wisconsin. It offers checking, savings, money market, cash management, retirement, and health savings accounts; other time deposits; certificates of deposit; and residential mortgage products.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bank First, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank First wasn't on the list.

While Bank First currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.