Enterprise Financial Services Corp grew its position in shares of Bank of America Co. (NYSE:BAC - Free Report) by 40.9% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 21,884 shares of the financial services provider's stock after purchasing an additional 6,357 shares during the period. Enterprise Financial Services Corp's holdings in Bank of America were worth $962,000 at the end of the most recent quarter.

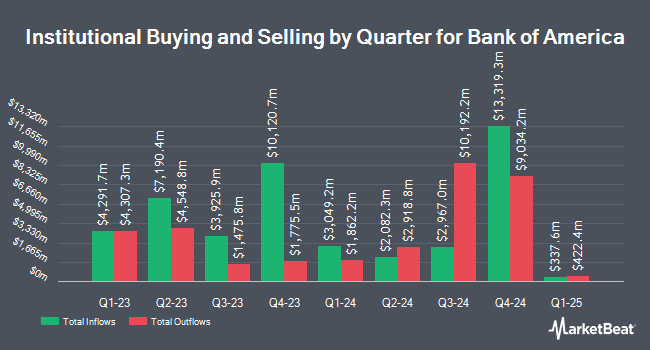

Other hedge funds have also recently made changes to their positions in the company. Amundi grew its position in Bank of America by 37.1% in the fourth quarter. Amundi now owns 37,819,980 shares of the financial services provider's stock worth $1,747,658,000 after acquiring an additional 10,231,001 shares in the last quarter. Two Sigma Advisers LP grew its position in Bank of America by 31,021.6% in the third quarter. Two Sigma Advisers LP now owns 10,207,900 shares of the financial services provider's stock worth $405,049,000 after acquiring an additional 10,175,100 shares in the last quarter. Swedbank AB grew its position in Bank of America by 81.4% in the fourth quarter. Swedbank AB now owns 12,776,184 shares of the financial services provider's stock worth $561,513,000 after acquiring an additional 5,733,810 shares in the last quarter. KBC Group NV grew its position in Bank of America by 130.9% in the fourth quarter. KBC Group NV now owns 9,692,279 shares of the financial services provider's stock worth $425,976,000 after acquiring an additional 5,493,817 shares in the last quarter. Finally, Caisse DE Depot ET Placement DU Quebec grew its position in Bank of America by 193.4% in the third quarter. Caisse DE Depot ET Placement DU Quebec now owns 7,608,305 shares of the financial services provider's stock worth $301,898,000 after acquiring an additional 5,015,378 shares in the last quarter. 70.71% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

BAC has been the subject of several research reports. Piper Sandler cut their target price on shares of Bank of America from $50.00 to $49.00 and set a "neutral" rating for the company in a research report on Friday, January 17th. Morgan Stanley upped their target price on shares of Bank of America from $54.00 to $56.00 and gave the stock an "equal weight" rating in a research report on Friday, January 17th. Barclays upped their price target on shares of Bank of America from $53.00 to $58.00 and gave the company an "overweight" rating in a research report on Monday, January 6th. Keefe, Bruyette & Woods upped their price target on shares of Bank of America from $50.00 to $57.00 and gave the company an "outperform" rating in a research report on Tuesday, December 3rd. Finally, Wells Fargo & Company upped their price target on shares of Bank of America from $52.00 to $56.00 and gave the company an "overweight" rating in a research report on Friday, November 15th. One research analyst has rated the stock with a sell rating, six have issued a hold rating, sixteen have assigned a buy rating and three have assigned a strong buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $48.64.

Check Out Our Latest Research Report on BAC

Bank of America Trading Down 1.1 %

Shares of NYSE:BAC traded down $0.43 during midday trading on Tuesday, hitting $39.41. 26,644,338 shares of the stock traded hands, compared to its average volume of 35,919,921. Bank of America Co. has a one year low of $34.15 and a one year high of $48.08. The stock has a market capitalization of $299.66 billion, a PE ratio of 12.26, a P/E/G ratio of 1.21 and a beta of 1.32. The business's 50 day moving average is $45.53 and its two-hundred day moving average is $43.76. The company has a quick ratio of 0.78, a current ratio of 0.78 and a debt-to-equity ratio of 1.04.

Bank of America (NYSE:BAC - Get Free Report) last released its quarterly earnings results on Thursday, January 16th. The financial services provider reported $0.82 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.77 by $0.05. Bank of America had a net margin of 14.10% and a return on equity of 10.29%. The company had revenue of $25.30 billion during the quarter, compared to the consensus estimate of $25.12 billion. During the same period in the prior year, the firm earned $0.70 earnings per share. Bank of America's revenue was up 15.0% on a year-over-year basis. As a group, research analysts forecast that Bank of America Co. will post 3.7 earnings per share for the current year.

Bank of America Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, March 28th. Investors of record on Friday, March 7th will be paid a $0.26 dividend. This represents a $1.04 dividend on an annualized basis and a yield of 2.64%. The ex-dividend date of this dividend is Friday, March 7th. Bank of America's payout ratio is currently 32.30%.

Bank of America Profile

(

Free Report)

Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. It operates in four segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets.

Recommended Stories

Before you consider Bank of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of America wasn't on the list.

While Bank of America currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.