NIKE (NYSE:NKE - Get Free Report) had its target price lowered by equities research analysts at Bank of America from $95.00 to $90.00 in a report issued on Friday,Benzinga reports. The brokerage currently has a "buy" rating on the footwear maker's stock. Bank of America's target price points to a potential upside of 16.97% from the stock's current price.

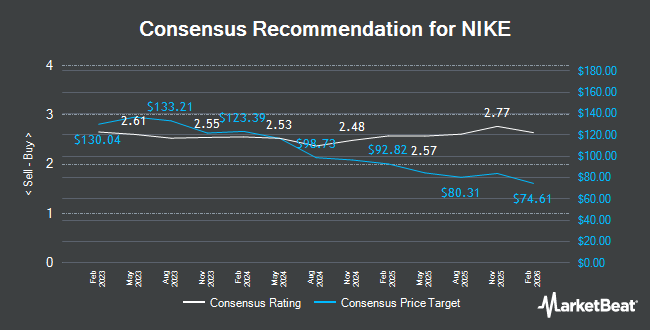

Several other brokerages have also commented on NKE. Sanford C. Bernstein lowered their price objective on shares of NIKE from $112.00 to $109.00 and set an "outperform" rating on the stock in a research report on Thursday, September 19th. Robert W. Baird lifted their price target on shares of NIKE from $100.00 to $110.00 and gave the stock an "outperform" rating in a report on Friday, September 20th. Truist Financial raised NIKE from a "hold" rating to a "buy" rating and raised their target price for the stock from $83.00 to $97.00 in a research report on Thursday, October 10th. Stifel Nicolaus dropped their price target on NIKE from $88.00 to $79.00 and set a "hold" rating on the stock in a research report on Monday, August 26th. Finally, Deutsche Bank Aktiengesellschaft decreased their price objective on NIKE from $92.00 to $82.00 and set a "buy" rating for the company in a report on Monday. Fifteen analysts have rated the stock with a hold rating and fifteen have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $89.77.

Check Out Our Latest Stock Report on NKE

NIKE Stock Performance

Shares of NKE traded down $0.16 on Friday, reaching $76.94. 49,808,547 shares of the company's stock traded hands, compared to its average volume of 11,716,173. The stock's 50 day simple moving average is $78.18 and its two-hundred day simple moving average is $80.77. The stock has a market cap of $115.36 billion, a PE ratio of 22.05, a PEG ratio of 1.89 and a beta of 1.02. NIKE has a 52-week low of $70.75 and a 52-week high of $123.30. The company has a current ratio of 2.36, a quick ratio of 1.58 and a debt-to-equity ratio of 0.57.

NIKE (NYSE:NKE - Get Free Report) last announced its earnings results on Thursday, December 19th. The footwear maker reported $0.78 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.63 by $0.15. The firm had revenue of $12.35 billion during the quarter, compared to analyst estimates of $12.11 billion. NIKE had a return on equity of 39.84% and a net margin of 10.60%. The business's revenue was down 7.7% compared to the same quarter last year. During the same period last year, the firm posted $1.03 EPS. On average, analysts forecast that NIKE will post 2.72 earnings per share for the current fiscal year.

Institutional Investors Weigh In On NIKE

Several hedge funds have recently added to or reduced their stakes in the company. Denver PWM LLC raised its holdings in shares of NIKE by 9.7% during the 3rd quarter. Denver PWM LLC now owns 2,574 shares of the footwear maker's stock valued at $228,000 after buying an additional 227 shares in the last quarter. Tidal Investments LLC grew its position in NIKE by 65.4% during the third quarter. Tidal Investments LLC now owns 105,571 shares of the footwear maker's stock valued at $9,332,000 after acquiring an additional 41,752 shares during the last quarter. Soltis Investment Advisors LLC raised its stake in shares of NIKE by 12.2% during the third quarter. Soltis Investment Advisors LLC now owns 36,010 shares of the footwear maker's stock worth $3,183,000 after acquiring an additional 3,918 shares in the last quarter. Teachers Retirement System of The State of Kentucky raised its stake in shares of NIKE by 8.2% during the third quarter. Teachers Retirement System of The State of Kentucky now owns 265,449 shares of the footwear maker's stock worth $23,466,000 after acquiring an additional 20,043 shares in the last quarter. Finally, Toronto Dominion Bank lifted its holdings in shares of NIKE by 59.9% in the 3rd quarter. Toronto Dominion Bank now owns 1,055,597 shares of the footwear maker's stock worth $93,315,000 after acquiring an additional 395,434 shares during the last quarter. Institutional investors own 64.25% of the company's stock.

NIKE Company Profile

(

Get Free Report)

NIKE, Inc, together with its subsidiaries, designs, develops, markets, and sells athletic footwear, apparel, equipment, accessories, and services worldwide. The company provides athletic and casual footwear, apparel, and accessories under the Jumpman trademark; and casual sneakers, apparel, and accessories under the Converse, Chuck Taylor, All Star, One Star, Star Chevron, and Jack Purcell trademarks.

Further Reading

Before you consider NIKE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NIKE wasn't on the list.

While NIKE currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.