Urban Outfitters (NASDAQ:URBN - Get Free Report) had its price target boosted by equities researchers at Bank of America from $46.00 to $53.00 in a report issued on Wednesday,Benzinga reports. The brokerage presently has a "buy" rating on the apparel retailer's stock. Bank of America's price objective points to a potential upside of 11.60% from the stock's previous close.

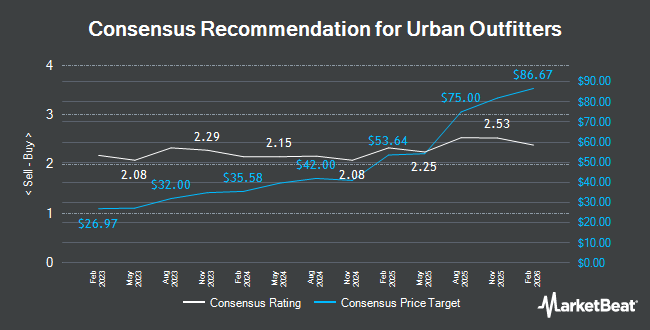

Other equities analysts have also issued research reports about the stock. Morgan Stanley dropped their target price on shares of Urban Outfitters from $40.00 to $38.00 and set an "equal weight" rating on the stock in a research report on Thursday, August 22nd. Citigroup upgraded shares of Urban Outfitters from a "neutral" rating to a "buy" rating and increased their target price for the company from $42.00 to $59.00 in a research note on Wednesday. Wells Fargo & Company lowered their price target on Urban Outfitters from $48.00 to $40.00 and set an "equal weight" rating on the stock in a research note on Thursday, August 22nd. Barclays reduced their price objective on Urban Outfitters from $52.00 to $43.00 and set an "overweight" rating for the company in a research report on Thursday, August 22nd. Finally, Jefferies Financial Group lowered their price objective on Urban Outfitters from $35.00 to $34.00 and set an "underperform" rating on the stock in a research report on Thursday, August 22nd. One analyst has rated the stock with a sell rating, eight have issued a hold rating and three have assigned a buy rating to the stock. Based on data from MarketBeat, Urban Outfitters presently has a consensus rating of "Hold" and an average price target of $46.27.

Get Our Latest Research Report on URBN

Urban Outfitters Stock Up 18.3 %

URBN stock traded up $7.35 during mid-day trading on Wednesday, reaching $47.49. 8,112,380 shares of the stock traded hands, compared to its average volume of 1,709,596. The firm has a market capitalization of $4.38 billion, a PE ratio of 14.20, a P/E/G ratio of 0.95 and a beta of 1.50. The business has a 50-day moving average of $37.24 and a two-hundred day moving average of $40.06. Urban Outfitters has a 52 week low of $33.17 and a 52 week high of $48.90.

Urban Outfitters (NASDAQ:URBN - Get Free Report) last announced its earnings results on Tuesday, November 26th. The apparel retailer reported $1.10 earnings per share for the quarter, beating the consensus estimate of $0.82 by $0.28. The firm had revenue of $1.36 billion during the quarter, compared to the consensus estimate of $1.34 billion. Urban Outfitters had a return on equity of 15.49% and a net margin of 5.83%. The firm's revenue for the quarter was up 6.3% compared to the same quarter last year. During the same quarter in the prior year, the company earned $0.88 EPS. On average, equities research analysts anticipate that Urban Outfitters will post 3.65 EPS for the current fiscal year.

Insider Activity

In related news, CEO Tricia D. Smith sold 11,730 shares of the firm's stock in a transaction on Friday, September 6th. The stock was sold at an average price of $35.29, for a total transaction of $413,951.70. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link. 31.80% of the stock is owned by corporate insiders.

Institutional Trading of Urban Outfitters

A number of hedge funds and other institutional investors have recently made changes to their positions in the business. Blue Trust Inc. grew its holdings in Urban Outfitters by 138.8% during the 3rd quarter. Blue Trust Inc. now owns 609 shares of the apparel retailer's stock worth $25,000 after acquiring an additional 354 shares during the last quarter. Quarry LP raised its stake in shares of Urban Outfitters by 1,825.0% in the second quarter. Quarry LP now owns 924 shares of the apparel retailer's stock worth $38,000 after acquiring an additional 876 shares during the last quarter. Northwestern Mutual Wealth Management Co. acquired a new position in shares of Urban Outfitters during the second quarter worth approximately $42,000. Asset Management One Co. Ltd. bought a new stake in shares of Urban Outfitters during the third quarter valued at approximately $47,000. Finally, Meeder Asset Management Inc. acquired a new stake in shares of Urban Outfitters in the second quarter valued at approximately $48,000. 77.61% of the stock is currently owned by institutional investors and hedge funds.

About Urban Outfitters

(

Get Free Report)

Urban Outfitters, Inc engages in the retail and wholesale of general consumer products. The company operates through three segments: Retail, Wholesale, and Nuuly. It operates Urban Outfitters stores, which offer women's and men's fashion apparel, activewear, intimates, footwear, accessories, home goods, electronics, and beauty products for young adults aged 18 to 28; and Anthropologie stores that provide women's apparel, accessories, intimates, shoes, and home furnishings, as well as gifts, decorative items, and beauty and wellness products for women aged 28 to 45.

Further Reading

Before you consider Urban Outfitters, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Urban Outfitters wasn't on the list.

While Urban Outfitters currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.