Bank of Montreal Can acquired a new position in shares of CommScope Holding Company, Inc. (NASDAQ:COMM - Free Report) in the third quarter, according to its most recent disclosure with the SEC. The firm acquired 1,149,502 shares of the communications equipment provider's stock, valued at approximately $7,023,000. Bank of Montreal Can owned 0.53% of CommScope at the end of the most recent quarter.

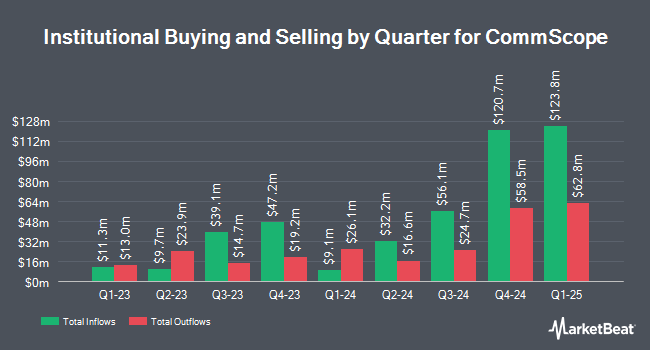

Several other hedge funds and other institutional investors also recently modified their holdings of the stock. Assenagon Asset Management S.A. acquired a new position in shares of CommScope during the third quarter worth about $11,023,000. Acadian Asset Management LLC raised its stake in shares of CommScope by 319.3% during the 2nd quarter. Acadian Asset Management LLC now owns 1,251,705 shares of the communications equipment provider's stock worth $1,537,000 after buying an additional 953,171 shares in the last quarter. Millennium Management LLC lifted its holdings in shares of CommScope by 19.9% in the 2nd quarter. Millennium Management LLC now owns 5,074,507 shares of the communications equipment provider's stock valued at $6,242,000 after buying an additional 840,742 shares during the period. Marathon Asset Management LP boosted its stake in shares of CommScope by 75.0% in the second quarter. Marathon Asset Management LP now owns 1,750,000 shares of the communications equipment provider's stock valued at $2,152,000 after buying an additional 750,000 shares in the last quarter. Finally, P Schoenfeld Asset Management LP boosted its stake in shares of CommScope by 233.3% in the second quarter. P Schoenfeld Asset Management LP now owns 1,000,000 shares of the communications equipment provider's stock valued at $1,230,000 after buying an additional 700,000 shares in the last quarter. 88.04% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of equities research analysts have commented on the company. StockNews.com raised CommScope from a "sell" rating to a "hold" rating in a report on Thursday, August 15th. Northland Securities raised their price objective on shares of CommScope from $1.25 to $2.00 and gave the company a "market perform" rating in a research note on Monday, August 12th. Finally, Morgan Stanley upped their target price on shares of CommScope from $2.70 to $5.00 and gave the stock an "equal weight" rating in a research report on Monday, November 4th. Two research analysts have rated the stock with a sell rating and four have assigned a hold rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of $2.50.

Get Our Latest Research Report on COMM

CommScope Trading Down 1.4 %

Shares of NASDAQ:COMM traded down $0.07 during midday trading on Tuesday, hitting $4.79. 4,107,102 shares of the stock were exchanged, compared to its average volume of 4,173,803. The stock has a market cap of $1.03 billion, a P/E ratio of -1.08 and a beta of 1.95. CommScope Holding Company, Inc. has a twelve month low of $0.86 and a twelve month high of $7.19. The company has a 50 day moving average price of $5.64 and a 200-day moving average price of $3.67.

CommScope (NASDAQ:COMM - Get Free Report) last announced its earnings results on Thursday, November 7th. The communications equipment provider reported ($0.05) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.33 by ($0.38). CommScope had a negative return on equity of 1.01% and a negative net margin of 18.10%. The business had revenue of $1.08 billion for the quarter, compared to analyst estimates of $1.42 billion. During the same quarter in the previous year, the firm posted $0.10 EPS. The business's revenue was up 2.7% on a year-over-year basis. On average, equities research analysts expect that CommScope Holding Company, Inc. will post -0.77 earnings per share for the current year.

About CommScope

(

Free Report)

CommScope Holding Company, Inc provides infrastructure solutions for communications, data center, and entertainment networks worldwide. The company operates through Connectivity and Cable Solutions (CCS); Outdoor Wireless Networks (OWN); Networking, Intelligent Cellular and Security Solutions (NICS), and Access Network Solutions (ANS) segments.

Further Reading

Before you consider CommScope, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CommScope wasn't on the list.

While CommScope currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.