Bank of Montreal Can grew its stake in shares of Amdocs Limited (NASDAQ:DOX - Free Report) by 7.8% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 205,881 shares of the technology company's stock after buying an additional 14,858 shares during the period. Bank of Montreal Can owned 0.18% of Amdocs worth $18,083,000 as of its most recent SEC filing.

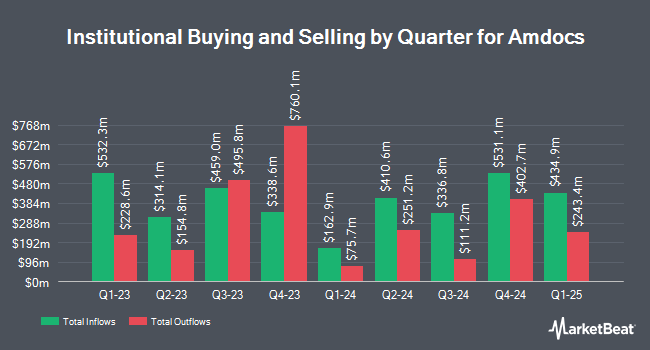

Several other large investors have also made changes to their positions in DOX. Boston Trust Walden Corp lifted its position in Amdocs by 17.0% during the second quarter. Boston Trust Walden Corp now owns 618,387 shares of the technology company's stock valued at $48,803,000 after buying an additional 89,726 shares in the last quarter. SG Americas Securities LLC boosted its position in Amdocs by 402.4% during the 2nd quarter. SG Americas Securities LLC now owns 154,968 shares of the technology company's stock worth $12,230,000 after purchasing an additional 124,122 shares during the period. Sargent Investment Group LLC acquired a new stake in Amdocs in the 2nd quarter valued at $289,000. BDF Gestion purchased a new position in Amdocs in the second quarter valued at about $833,000. Finally, Raymond James & Associates lifted its stake in shares of Amdocs by 15.8% during the second quarter. Raymond James & Associates now owns 457,477 shares of the technology company's stock worth $36,104,000 after purchasing an additional 62,460 shares in the last quarter. 92.02% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of research firms have recently issued reports on DOX. Barclays lowered their target price on Amdocs from $113.00 to $111.00 and set an "overweight" rating for the company in a research note on Thursday, November 14th. Oppenheimer boosted their target price on shares of Amdocs from $98.00 to $105.00 and gave the stock an "outperform" rating in a research report on Wednesday, November 13th. StockNews.com lowered shares of Amdocs from a "strong-buy" rating to a "buy" rating in a report on Thursday, November 14th. Finally, Stifel Nicolaus assumed coverage on shares of Amdocs in a report on Wednesday, October 2nd. They issued a "buy" rating and a $100.00 price objective on the stock. One research analyst has rated the stock with a hold rating and six have assigned a buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $101.83.

Read Our Latest Stock Report on Amdocs

Amdocs Stock Down 0.5 %

DOX traded down $0.46 during trading on Friday, hitting $86.72. The company had a trading volume of 500,218 shares, compared to its average volume of 753,368. The company has a market cap of $10.19 billion, a PE ratio of 20.45, a P/E/G ratio of 1.45 and a beta of 0.74. The company has a debt-to-equity ratio of 0.21, a current ratio of 1.20 and a quick ratio of 1.24. Amdocs Limited has a 1-year low of $74.41 and a 1-year high of $94.04. The business has a 50-day moving average of $88.08 and a 200-day moving average of $84.10.

Amdocs Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, January 31st. Stockholders of record on Tuesday, December 31st will be given a dividend of $0.479 per share. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $1.92 annualized dividend and a dividend yield of 2.21%. Amdocs's payout ratio is 45.28%.

About Amdocs

(

Free Report)

Amdocs Limited, through its subsidiaries, provides software and services worldwide. It designs, develops, operates, implements, supports, and markets open and modular cloud portfolio. The company provides CES23, a 5G and cloud-native microservices-based market-leading customer experience suite, that enables service providers to build, deliver, and monetize advanced services; Amdocs Subscription Marketplace, a software-as-a-service-based platform that includes an expansive network of pre-integrated digital services, such as media, gaming, eLearning, sports, and retail to security and business services; the monetization suite for charging, billing, policy, and revenue management; Intelligent networking suite with a set of modular, flexible, and open service lifecycle management capabilities for network automation journeys; amAIz, a telco GenAI framework; Amdocs Digital Brands Suite, a pre-integrated digital business suite; and Amdocs eSIM Cloud for service providers.

Featured Stories

Before you consider Amdocs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amdocs wasn't on the list.

While Amdocs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.