Bank of Montreal Can increased its stake in shares of Bausch Health Companies Inc. (NYSE:BHC - Free Report) by 234.0% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 3,833,179 shares of the company's stock after purchasing an additional 2,685,675 shares during the period. Bank of Montreal Can owned approximately 1.04% of Bausch Health Companies worth $31,598,000 as of its most recent filing with the Securities & Exchange Commission.

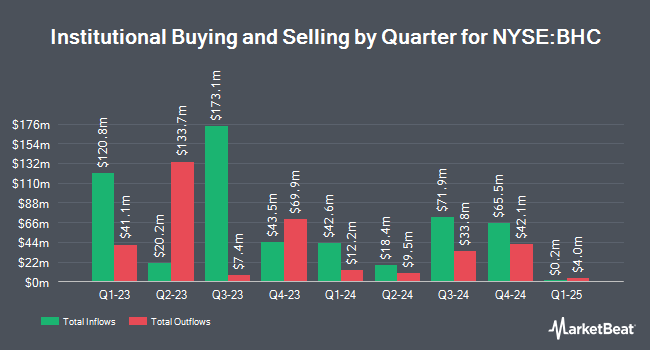

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Headlands Technologies LLC bought a new stake in shares of Bausch Health Companies during the 2nd quarter valued at about $35,000. MQS Management LLC bought a new stake in Bausch Health Companies during the second quarter valued at approximately $71,000. Certuity LLC bought a new stake in Bausch Health Companies during the second quarter valued at approximately $75,000. Bfsg LLC increased its holdings in Bausch Health Companies by 46.7% during the second quarter. Bfsg LLC now owns 11,450 shares of the company's stock valued at $80,000 after buying an additional 3,643 shares during the last quarter. Finally, Kendall Capital Management bought a new position in Bausch Health Companies in the second quarter worth approximately $87,000. Institutional investors own 78.65% of the company's stock.

Insiders Place Their Bets

In other Bausch Health Companies news, EVP Seana Carson sold 13,370 shares of Bausch Health Companies stock in a transaction on Friday, September 6th. The shares were sold at an average price of $6.21, for a total value of $83,027.70. Following the completion of the transaction, the executive vice president now directly owns 435,198 shares of the company's stock, valued at $2,702,579.58. This trade represents a 2.98 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. Corporate insiders own 8.12% of the company's stock.

Bausch Health Companies Trading Up 3.1 %

BHC traded up $0.25 on Friday, hitting $8.37. 579,215 shares of the company's stock traded hands, compared to its average volume of 2,837,413. Bausch Health Companies Inc. has a one year low of $3.96 and a one year high of $11.46. The firm has a market cap of $3.01 billion, a price-to-earnings ratio of -16.92 and a beta of 0.74. The company's 50 day simple moving average is $8.40 and its 200-day simple moving average is $7.13.

Bausch Health Companies (NYSE:BHC - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The company reported $1.12 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.02 by $0.10. The firm had revenue of $2.51 billion for the quarter, compared to analysts' expectations of $2.42 billion. Bausch Health Companies had a negative net margin of 1.88% and a negative return on equity of 755.86%. The company's revenue for the quarter was up 12.2% compared to the same quarter last year. During the same quarter last year, the business posted $1.03 earnings per share. As a group, equities analysts anticipate that Bausch Health Companies Inc. will post 3.74 EPS for the current fiscal year.

Analysts Set New Price Targets

BHC has been the subject of several analyst reports. Piper Sandler lowered Bausch Health Companies from a "neutral" rating to an "underweight" rating and reduced their price objective for the stock from $9.00 to $3.00 in a research note on Friday, August 2nd. Evercore ISI upgraded Bausch Health Companies to a "hold" rating in a research report on Tuesday, October 15th. Royal Bank of Canada lifted their price objective on Bausch Health Companies from $10.00 to $11.00 and gave the company a "sector perform" rating in a research report on Friday, November 1st. Scotiabank reduced their target price on shares of Bausch Health Companies from $10.00 to $8.50 and set a "sector perform" rating for the company in a report on Friday, August 2nd. Finally, StockNews.com raised shares of Bausch Health Companies from a "hold" rating to a "buy" rating in a report on Friday, October 25th. One research analyst has rated the stock with a sell rating, five have assigned a hold rating and two have issued a buy rating to the company's stock. Based on data from MarketBeat, Bausch Health Companies presently has an average rating of "Hold" and a consensus price target of $7.75.

Read Our Latest Report on Bausch Health Companies

Bausch Health Companies Company Profile

(

Free Report)

Bausch Health Companies Inc operates as a diversified specialty pharmaceutical and medical device company in the United States and internationally. It develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, international pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health.

Featured Articles

Before you consider Bausch Health Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bausch Health Companies wasn't on the list.

While Bausch Health Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.