Bank of Montreal Can lessened its position in shares of Novo Nordisk A/S (NYSE:NVO - Free Report) by 6.6% during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,121,092 shares of the company's stock after selling 79,215 shares during the quarter. Bank of Montreal Can's holdings in Novo Nordisk A/S were worth $135,383,000 at the end of the most recent quarter.

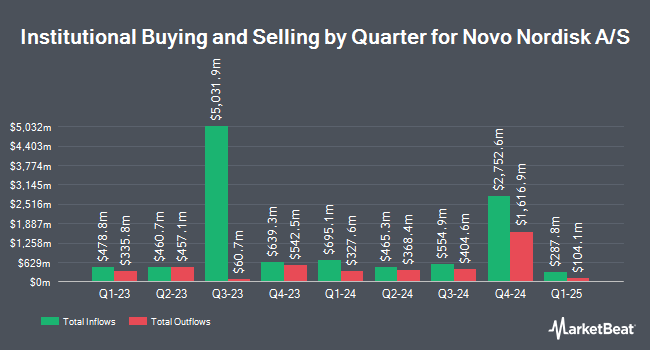

Other hedge funds have also recently added to or reduced their stakes in the company. 1620 Investment Advisors Inc. acquired a new position in Novo Nordisk A/S in the second quarter valued at about $25,000. Strategic Investment Solutions Inc. IL acquired a new position in Novo Nordisk A/S in the second quarter valued at about $25,000. Gilliland Jeter Wealth Management LLC lifted its stake in Novo Nordisk A/S by 200.0% in the second quarter. Gilliland Jeter Wealth Management LLC now owns 180 shares of the company's stock valued at $26,000 after buying an additional 120 shares during the period. Daiwa Securities Group Inc. acquired a new position in Novo Nordisk A/S in the third quarter valued at about $28,000. Finally, Halpern Financial Inc. lifted its stake in Novo Nordisk A/S by 113.0% in the second quarter. Halpern Financial Inc. now owns 213 shares of the company's stock valued at $30,000 after buying an additional 113 shares during the period. Institutional investors and hedge funds own 11.54% of the company's stock.

Novo Nordisk A/S Stock Up 1.5 %

Shares of NYSE:NVO traded up $1.59 during mid-day trading on Tuesday, reaching $106.15. 6,758,222 shares of the stock were exchanged, compared to its average volume of 4,519,703. The company has a quick ratio of 0.75, a current ratio of 0.94 and a debt-to-equity ratio of 0.43. The company has a market cap of $476.35 billion, a P/E ratio of 34.35, a P/E/G ratio of 1.35 and a beta of 0.42. Novo Nordisk A/S has a one year low of $94.73 and a one year high of $148.15. The stock's 50 day simple moving average is $114.32 and its 200-day simple moving average is $128.49.

Wall Street Analyst Weigh In

Several research firms have weighed in on NVO. Cantor Fitzgerald reissued an "overweight" rating and issued a $160.00 target price on shares of Novo Nordisk A/S in a research note on Wednesday, November 6th. StockNews.com raised Novo Nordisk A/S from a "buy" rating to a "strong-buy" rating in a research report on Friday, November 1st. Finally, BMO Capital Markets dropped their price target on Novo Nordisk A/S from $160.00 to $156.00 and set an "outperform" rating on the stock in a research report on Thursday, October 17th. One research analyst has rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Buy" and a consensus target price of $144.50.

Get Our Latest Stock Analysis on NVO

Novo Nordisk A/S Profile

(

Free Report)

Novo Nordisk A/S, together with its subsidiaries, engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally. It operates in two segments, Diabetes and Obesity Care, and Rare Disease.

Featured Stories

Before you consider Novo Nordisk A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novo Nordisk A/S wasn't on the list.

While Novo Nordisk A/S currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.