Bank of Montreal Can lessened its position in shares of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM - Free Report) by 5.7% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 630,328 shares of the semiconductor company's stock after selling 37,787 shares during the period. Bank of Montreal Can's holdings in Taiwan Semiconductor Manufacturing were worth $112,179,000 at the end of the most recent reporting period.

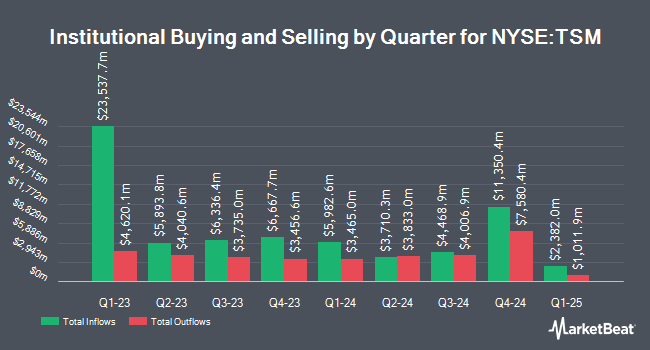

Several other large investors also recently added to or reduced their stakes in the company. Atlantic Edge Private Wealth Management LLC bought a new position in shares of Taiwan Semiconductor Manufacturing in the second quarter worth $25,000. Reston Wealth Management LLC bought a new stake in shares of Taiwan Semiconductor Manufacturing during the third quarter valued at about $25,000. Olistico Wealth LLC purchased a new stake in shares of Taiwan Semiconductor Manufacturing in the second quarter worth about $27,000. Valley Wealth Managers Inc. bought a new position in shares of Taiwan Semiconductor Manufacturing in the second quarter valued at approximately $27,000. Finally, NewSquare Capital LLC purchased a new position in Taiwan Semiconductor Manufacturing during the second quarter valued at approximately $29,000. Hedge funds and other institutional investors own 16.51% of the company's stock.

Taiwan Semiconductor Manufacturing Price Performance

TSM stock traded down $2.75 during mid-day trading on Wednesday, hitting $181.09. 605,954 shares of the stock were exchanged, compared to its average volume of 15,252,511. The business has a fifty day moving average price of $188.57 and a 200 day moving average price of $174.66. Taiwan Semiconductor Manufacturing Company Limited has a 12 month low of $95.25 and a 12 month high of $212.60. The company has a debt-to-equity ratio of 0.24, a current ratio of 2.57 and a quick ratio of 2.30. The stock has a market capitalization of $939.21 billion, a price-to-earnings ratio of 29.46, a PEG ratio of 0.85 and a beta of 1.12.

Taiwan Semiconductor Manufacturing (NYSE:TSM - Get Free Report) last issued its earnings results on Thursday, October 17th. The semiconductor company reported $1.94 EPS for the quarter, topping analysts' consensus estimates of $1.74 by $0.20. The company had revenue of $23.50 billion for the quarter, compared to analysts' expectations of $22.72 billion. Taiwan Semiconductor Manufacturing had a net margin of 39.10% and a return on equity of 27.44%. On average, sell-side analysts anticipate that Taiwan Semiconductor Manufacturing Company Limited will post 6.95 EPS for the current year.

Taiwan Semiconductor Manufacturing Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, April 10th. Investors of record on Tuesday, March 18th will be paid a $0.5484 dividend. This represents a $2.19 annualized dividend and a dividend yield of 1.21%. This is an increase from Taiwan Semiconductor Manufacturing's previous quarterly dividend of $0.49. The ex-dividend date is Tuesday, March 18th. Taiwan Semiconductor Manufacturing's payout ratio is presently 31.57%.

Analyst Upgrades and Downgrades

Several analysts have issued reports on the stock. Barclays increased their target price on shares of Taiwan Semiconductor Manufacturing from $215.00 to $240.00 and gave the stock an "overweight" rating in a research note on Monday, November 18th. Needham & Company LLC reissued a "buy" rating and set a $210.00 price objective on shares of Taiwan Semiconductor Manufacturing in a research note on Thursday, October 17th. StockNews.com cut Taiwan Semiconductor Manufacturing from a "buy" rating to a "hold" rating in a research report on Sunday, November 17th. Finally, Susquehanna reaffirmed a "buy" rating on shares of Taiwan Semiconductor Manufacturing in a report on Friday, October 18th. Two analysts have rated the stock with a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $214.00.

View Our Latest Stock Analysis on Taiwan Semiconductor Manufacturing

About Taiwan Semiconductor Manufacturing

(

Free Report)

Taiwan Semiconductor Manufacturing Company Limited, together with its subsidiaries, manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally. It provides a range of wafer fabrication processes, including processes to manufacture complementary metal- oxide-semiconductor (CMOS) logic, mixed-signal, radio frequency, embedded memory, bipolar CMOS mixed-signal, and others.

Recommended Stories

Before you consider Taiwan Semiconductor Manufacturing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taiwan Semiconductor Manufacturing wasn't on the list.

While Taiwan Semiconductor Manufacturing currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.