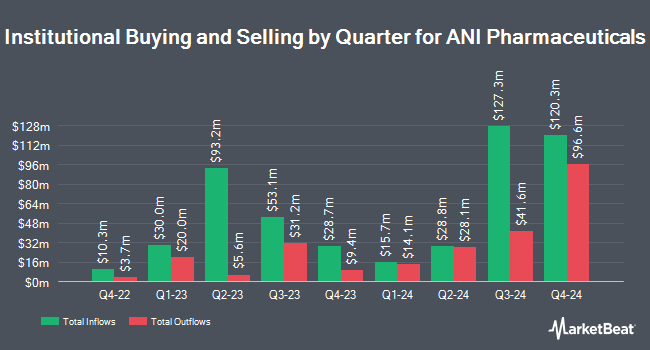

Bank of Montreal Can acquired a new stake in ANI Pharmaceuticals, Inc. (NASDAQ:ANIP - Free Report) in the 3rd quarter, according to its most recent disclosure with the SEC. The fund acquired 221,896 shares of the specialty pharmaceutical company's stock, valued at approximately $13,043,000. Bank of Montreal Can owned approximately 1.05% of ANI Pharmaceuticals at the end of the most recent reporting period.

Other institutional investors have also recently modified their holdings of the company. Innealta Capital LLC bought a new position in shares of ANI Pharmaceuticals in the second quarter worth $65,000. Ridgewood Investments LLC bought a new position in ANI Pharmaceuticals in the 2nd quarter valued at about $85,000. XTX Topco Ltd bought a new position in ANI Pharmaceuticals in the 2nd quarter valued at about $207,000. Profund Advisors LLC acquired a new position in shares of ANI Pharmaceuticals in the 2nd quarter valued at approximately $225,000. Finally, Susquehanna Fundamental Investments LLC bought a new stake in shares of ANI Pharmaceuticals during the 2nd quarter worth approximately $228,000. 76.05% of the stock is currently owned by institutional investors.

ANI Pharmaceuticals Trading Down 3.6 %

Shares of ANI Pharmaceuticals stock traded down $2.16 on Friday, hitting $57.23. The stock had a trading volume of 224,908 shares, compared to its average volume of 290,745. The stock has a 50 day moving average of $58.22 and a 200 day moving average of $60.64. The company has a debt-to-equity ratio of 1.52, a quick ratio of 1.97 and a current ratio of 2.74. ANI Pharmaceuticals, Inc. has a twelve month low of $48.20 and a twelve month high of $70.81. The firm has a market capitalization of $1.20 billion, a P/E ratio of -104.05 and a beta of 0.71.

ANI Pharmaceuticals (NASDAQ:ANIP - Get Free Report) last released its quarterly earnings results on Friday, November 8th. The specialty pharmaceutical company reported $1.34 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.09 by $0.25. The firm had revenue of $148.30 million during the quarter, compared to the consensus estimate of $144.37 million. ANI Pharmaceuticals had a negative net margin of 1.28% and a positive return on equity of 15.87%. The company's revenue for the quarter was up 12.5% on a year-over-year basis. During the same quarter last year, the firm earned $1.05 earnings per share. Sell-side analysts expect that ANI Pharmaceuticals, Inc. will post 3.87 earnings per share for the current fiscal year.

Insider Transactions at ANI Pharmaceuticals

In other news, CEO Nikhil Lalwani sold 33,481 shares of the stock in a transaction on Tuesday, November 26th. The shares were sold at an average price of $57.99, for a total transaction of $1,941,563.19. Following the completion of the sale, the chief executive officer now directly owns 370,378 shares in the company, valued at $21,478,220.22. This represents a 8.29 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Insiders sold 33,981 shares of company stock worth $1,970,066 over the last ninety days. 12.70% of the stock is owned by insiders.

Wall Street Analyst Weigh In

ANIP has been the subject of several recent analyst reports. StockNews.com cut ANI Pharmaceuticals from a "buy" rating to a "hold" rating in a research note on Saturday, September 7th. Truist Financial boosted their price target on ANI Pharmaceuticals from $60.00 to $62.00 and gave the stock a "hold" rating in a report on Tuesday, October 22nd. HC Wainwright reaffirmed a "buy" rating and issued a $94.00 price objective on shares of ANI Pharmaceuticals in a research note on Monday, November 11th. Raymond James increased their target price on shares of ANI Pharmaceuticals from $81.00 to $83.00 and gave the stock an "outperform" rating in a report on Wednesday, September 18th. Finally, Piper Sandler initiated coverage on shares of ANI Pharmaceuticals in a report on Friday, October 11th. They set an "overweight" rating and a $68.00 price target on the stock. Two investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $77.33.

Get Our Latest Report on ANIP

ANI Pharmaceuticals Profile

(

Free Report)

ANI Pharmaceuticals, Inc, a biopharmaceutical company, develops, manufactures, and markets branded and generic prescription pharmaceuticals in the United States and Canada. The company manufactures oral solid dose products; semi-solids, liquids, and topicals; controlled substances; and potent products, as well as performs contract development and manufacturing of pharmaceutical products.

Further Reading

Before you consider ANI Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ANI Pharmaceuticals wasn't on the list.

While ANI Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.