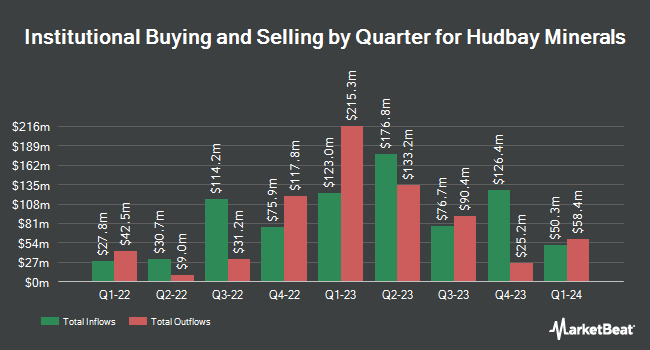

Bank of Montreal Can boosted its stake in shares of Hudbay Minerals Inc. (NYSE:HBM - Free Report) TSE: HBM by 23.1% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 7,691,519 shares of the mining company's stock after acquiring an additional 1,441,991 shares during the quarter. Bank of Montreal Can owned 1.95% of Hudbay Minerals worth $71,308,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors and hedge funds have also bought and sold shares of HBM. Vanguard Group Inc. boosted its stake in shares of Hudbay Minerals by 3.2% during the first quarter. Vanguard Group Inc. now owns 8,694,436 shares of the mining company's stock valued at $60,861,000 after purchasing an additional 272,635 shares during the period. Boston Partners boosted its position in Hudbay Minerals by 29.1% during the 1st quarter. Boston Partners now owns 552,226 shares of the mining company's stock valued at $3,866,000 after buying an additional 124,376 shares during the period. Artemis Investment Management LLP purchased a new stake in Hudbay Minerals during the 3rd quarter valued at $20,907,000. Driehaus Capital Management LLC bought a new stake in Hudbay Minerals in the 2nd quarter worth $14,718,000. Finally, Meritage Portfolio Management purchased a new position in shares of Hudbay Minerals in the third quarter valued at about $6,743,000. 57.82% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of analysts have recently weighed in on HBM shares. Jefferies Financial Group upgraded shares of Hudbay Minerals from a "hold" rating to a "buy" rating in a report on Wednesday, August 14th. StockNews.com upgraded Hudbay Minerals from a "hold" rating to a "buy" rating in a report on Friday, November 15th. Five research analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and an average target price of $11.17.

View Our Latest Analysis on HBM

Hudbay Minerals Trading Up 1.7 %

Shares of HBM traded up $0.15 during trading hours on Wednesday, reaching $8.85. 411,837 shares of the company traded hands, compared to its average volume of 3,085,220. Hudbay Minerals Inc. has a 12 month low of $4.34 and a 12 month high of $10.49. The company has a quick ratio of 1.47, a current ratio of 1.86 and a debt-to-equity ratio of 0.44. The company's fifty day moving average price is $9.03 and its two-hundred day moving average price is $8.70. The company has a market capitalization of $3.48 billion, a price-to-earnings ratio of 37.83 and a beta of 1.78.

Hudbay Minerals (NYSE:HBM - Get Free Report) TSE: HBM last posted its quarterly earnings data on Wednesday, November 13th. The mining company reported $0.13 earnings per share for the quarter, beating the consensus estimate of $0.04 by $0.09. Hudbay Minerals had a return on equity of 7.44% and a net margin of 4.23%. The business had revenue of $485.80 million for the quarter, compared to analysts' expectations of $454.47 million. During the same period in the previous year, the firm posted $0.07 EPS. The business's revenue was up 1.1% on a year-over-year basis. Equities research analysts predict that Hudbay Minerals Inc. will post 0.55 earnings per share for the current fiscal year.

Hudbay Minerals Profile

(

Free Report)

Hudbay Minerals Inc, a diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America. It produces copper concentrates containing gold, silver, and molybdenum; gold concentrates containing zinc; zinc concentrates; molybdenum concentrates; and silver/gold doré.

Read More

Before you consider Hudbay Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudbay Minerals wasn't on the list.

While Hudbay Minerals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.