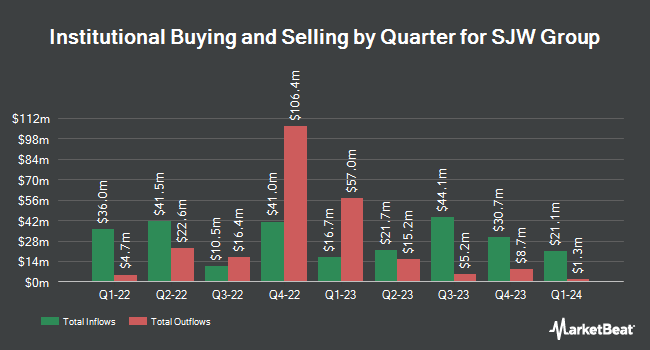

Bank of Montreal Can reduced its position in shares of SJW Group (NYSE:SJW - Free Report) by 30.3% in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 15,143 shares of the utilities provider's stock after selling 6,568 shares during the period. Bank of Montreal Can's holdings in SJW Group were worth $745,000 as of its most recent SEC filing.

Several other large investors also recently modified their holdings of SJW. Arizona State Retirement System grew its position in shares of SJW Group by 2.2% in the 4th quarter. Arizona State Retirement System now owns 9,015 shares of the utilities provider's stock worth $444,000 after buying an additional 197 shares during the last quarter. State of Alaska Department of Revenue lifted its stake in SJW Group by 1.2% in the fourth quarter. State of Alaska Department of Revenue now owns 17,198 shares of the utilities provider's stock worth $846,000 after acquiring an additional 210 shares during the period. HighTower Advisors LLC boosted its holdings in SJW Group by 5.6% in the fourth quarter. HighTower Advisors LLC now owns 4,430 shares of the utilities provider's stock valued at $218,000 after acquiring an additional 233 shares in the last quarter. Russell Investments Group Ltd. increased its position in SJW Group by 64.4% during the 4th quarter. Russell Investments Group Ltd. now owns 766 shares of the utilities provider's stock valued at $38,000 after purchasing an additional 300 shares during the period. Finally, Vontobel Holding Ltd. raised its holdings in SJW Group by 1.9% in the 4th quarter. Vontobel Holding Ltd. now owns 18,930 shares of the utilities provider's stock worth $932,000 after purchasing an additional 349 shares in the last quarter. 84.29% of the stock is owned by institutional investors.

SJW Group Stock Up 0.4 %

NYSE:SJW opened at $54.61 on Friday. The company has a debt-to-equity ratio of 1.25, a current ratio of 0.77 and a quick ratio of 0.77. The firm's 50-day moving average price is $53.19 and its 200-day moving average price is $53.00. The company has a market capitalization of $1.86 billion, a PE ratio of 19.79, a P/E/G ratio of 3.94 and a beta of 0.56. SJW Group has a 1-year low of $44.91 and a 1-year high of $62.18.

SJW Group Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, March 3rd. Shareholders of record on Monday, February 10th were issued a $0.42 dividend. This represents a $1.68 dividend on an annualized basis and a yield of 3.08%. The ex-dividend date was Monday, February 10th. This is a boost from SJW Group's previous quarterly dividend of $0.40. SJW Group's dividend payout ratio is 58.95%.

Wall Street Analyst Weigh In

A number of brokerages have recently weighed in on SJW. StockNews.com raised shares of SJW Group from a "sell" rating to a "hold" rating in a research note on Friday, February 28th. Wells Fargo & Company lifted their price objective on SJW Group from $53.00 to $57.00 and gave the company an "equal weight" rating in a research report on Friday, February 28th. Finally, Bank of America raised SJW Group from a "neutral" rating to a "buy" rating and decreased their target price for the stock from $59.00 to $55.00 in a research report on Monday, February 3rd.

Read Our Latest Research Report on SJW

SJW Group Profile

(

Free Report)

SJW Group, through its subsidiaries, provides water utility and other related services in the United States. It operates in Water Utility Services and Real Estate Services segments. The company engages in the production, purchase, storage, purification, distribution, wholesale, and retail sale of water and wastewater services; and supplies groundwater from wells, surface water from watershed run-off and diversion, reclaimed water, and imported water purchased from the Santa Clara Valley Water District.

Further Reading

Want to see what other hedge funds are holding SJW? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for SJW Group (NYSE:SJW - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SJW Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SJW Group wasn't on the list.

While SJW Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.