Bank of Montreal Can lowered its holdings in shares of Stellantis (NYSE:STLA - Free Report) by 53.3% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 795,575 shares of the company's stock after selling 909,421 shares during the period. Bank of Montreal Can's holdings in Stellantis were worth $10,382,000 at the end of the most recent reporting period.

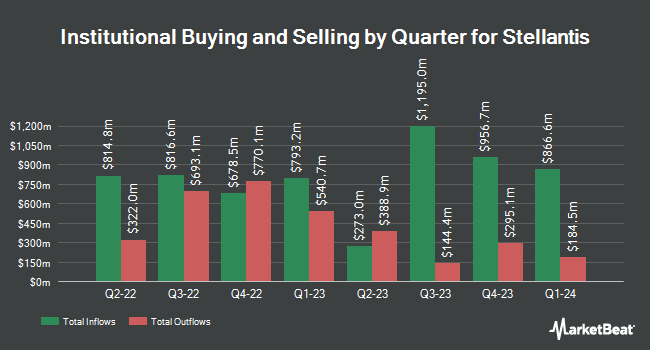

Other hedge funds and other institutional investors have also bought and sold shares of the company. Norges Bank purchased a new stake in shares of Stellantis during the fourth quarter valued at $609,076,000. Korea Investment CORP boosted its holdings in shares of Stellantis by 32.1% during the 4th quarter. Korea Investment CORP now owns 1,305,558 shares of the company's stock valued at $17,020,000 after acquiring an additional 317,091 shares during the last quarter. Grantham Mayo Van Otterloo & Co. LLC grew its stake in shares of Stellantis by 3.7% in the fourth quarter. Grantham Mayo Van Otterloo & Co. LLC now owns 4,529,083 shares of the company's stock worth $59,045,000 after acquiring an additional 162,201 shares during the period. Raymond James Financial Inc. purchased a new position in shares of Stellantis during the fourth quarter valued at approximately $1,151,000. Finally, Four Tree Island Advisory LLC purchased a new position in shares of Stellantis during the fourth quarter valued at approximately $2,019,000. Hedge funds and other institutional investors own 59.48% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on the company. Piper Sandler cut Stellantis from an "overweight" rating to a "neutral" rating and lowered their price target for the company from $23.00 to $13.00 in a report on Thursday, March 20th. Cowen began coverage on Stellantis in a research report on Thursday, March 6th. They issued a "hold" rating on the stock. UBS Group lowered shares of Stellantis from a "buy" rating to a "neutral" rating in a research report on Monday. Finally, TD Cowen began coverage on shares of Stellantis in a report on Friday, March 7th. They issued a "hold" rating and a $13.00 price objective on the stock. Ten analysts have rated the stock with a hold rating, one has given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, Stellantis currently has a consensus rating of "Hold" and a consensus price target of $16.49.

View Our Latest Research Report on Stellantis

Stellantis Stock Performance

NYSE STLA traded up $0.19 on Friday, reaching $9.42. 18,247,825 shares of the stock were exchanged, compared to its average volume of 10,567,434. The company has a current ratio of 1.14, a quick ratio of 0.85 and a debt-to-equity ratio of 0.26. Stellantis has a one year low of $8.39 and a one year high of $25.97. The firm has a market capitalization of $28.46 billion, a PE ratio of 2.76 and a beta of 1.44. The company's 50-day simple moving average is $11.85 and its two-hundred day simple moving average is $12.71.

Stellantis Dividend Announcement

The company also recently disclosed a dividend, which will be paid on Monday, May 5th. Stockholders of record on Thursday, April 24th will be given a dividend of $0.5032 per share. The ex-dividend date of this dividend is Wednesday, April 23rd. This represents a dividend yield of 6.07%. Stellantis's payout ratio is 20.82%.

Stellantis Profile

(

Free Report)

Stellantis N.V. engages in the design, engineering, manufacturing, distribution, and sale of automobiles and light commercial vehicles, engines, transmission systems, metallurgical products, mobility services, and production systems worldwide. It provides luxury and premium vehicles; sport utility vehicles; American and European brand vehicles; and parts and services, as well as retail and dealer financing, leasing, and rental services.

Further Reading

Before you consider Stellantis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stellantis wasn't on the list.

While Stellantis currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.