Bank of New York Mellon Corp lifted its position in Uniti Group Inc. (NASDAQ:UNIT - Free Report) by 5.8% in the 4th quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 1,764,803 shares of the real estate investment trust's stock after acquiring an additional 96,245 shares during the period. Bank of New York Mellon Corp owned 0.72% of Uniti Group worth $9,706,000 as of its most recent SEC filing.

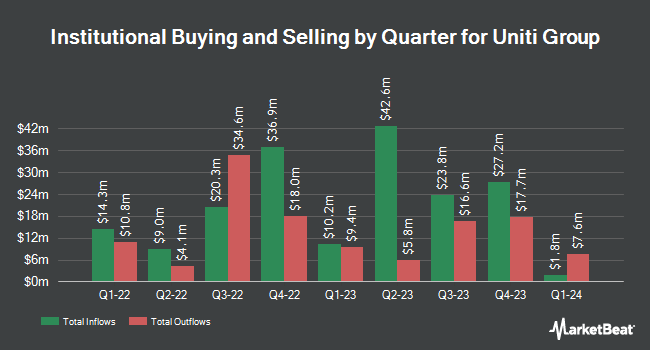

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Pitcairn Co. purchased a new stake in shares of Uniti Group in the 3rd quarter worth approximately $69,000. Virtu Financial LLC purchased a new stake in Uniti Group during the 3rd quarter valued at $70,000. Handelsbanken Fonder AB purchased a new stake in Uniti Group during the 4th quarter valued at $71,000. Y Intercept Hong Kong Ltd purchased a new stake in Uniti Group during the 3rd quarter valued at $74,000. Finally, Diversified Trust Co purchased a new stake in Uniti Group during the 4th quarter valued at $74,000. Hedge funds and other institutional investors own 87.51% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have commented on the company. Royal Bank of Canada increased their target price on Uniti Group from $5.50 to $6.00 and gave the company a "sector perform" rating in a research note on Monday, December 23rd. Raymond James upgraded Uniti Group from an "outperform" rating to a "strong-buy" rating and increased their target price for the company from $6.00 to $8.00 in a research note on Monday, February 24th.

Check Out Our Latest Report on UNIT

Uniti Group Stock Performance

Shares of UNIT stock traded down $0.17 on Tuesday, reaching $4.97. The stock had a trading volume of 1,789,443 shares, compared to its average volume of 2,106,613. The stock has a market cap of $1.21 billion, a P/E ratio of 12.12 and a beta of 1.70. Uniti Group Inc. has a 1 year low of $2.57 and a 1 year high of $6.39. The company has a 50 day simple moving average of $5.49 and a 200 day simple moving average of $5.53.

Uniti Group (NASDAQ:UNIT - Get Free Report) last released its quarterly earnings results on Friday, February 21st. The real estate investment trust reported $0.35 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.33 by $0.02. The firm had revenue of $293.32 million for the quarter, compared to the consensus estimate of $294.59 million. Uniti Group had a negative return on equity of 4.12% and a net margin of 8.82%. On average, equities research analysts anticipate that Uniti Group Inc. will post 1.28 earnings per share for the current fiscal year.

Uniti Group Profile

(

Free Report)

Uniti Group, Inc is a real estate investment trust company, which engages in the acquisition, construction, and leasing of properties. It operates through the following business segments: Uniti Leasing, Uniti Fiber, and Corporate. The Uniti Leasing segment involves mission-critical communications assets on exclusive or shared-tenant basis, and dark fiber network.

See Also

Before you consider Uniti Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uniti Group wasn't on the list.

While Uniti Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.